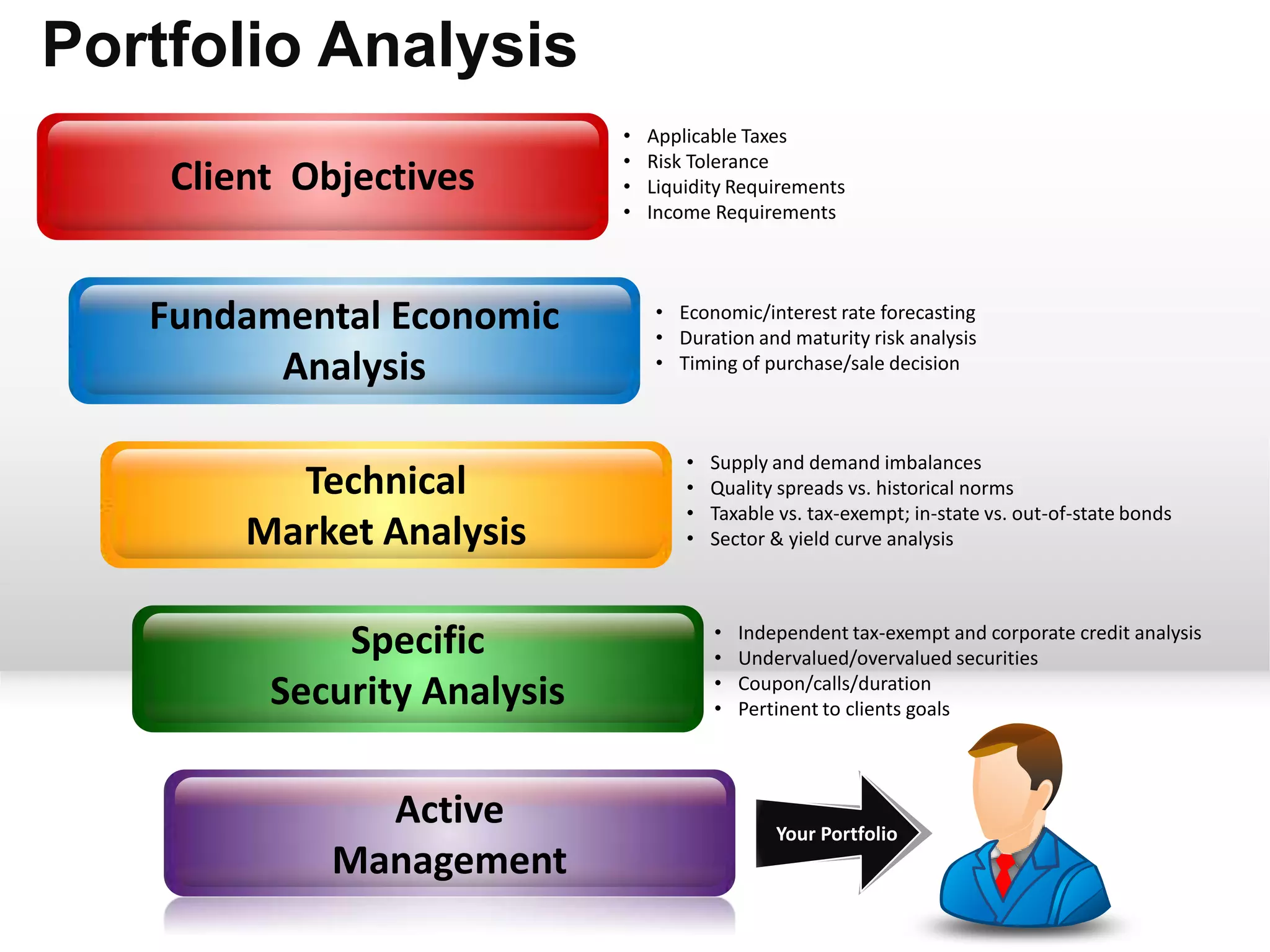

The document outlines a portfolio analysis process that includes four key sections:

1) Analyzing client objectives such as taxes, risk tolerance, liquidity needs, and income requirements.

2) Conducting fundamental economic analysis including economic forecasting, duration and maturity risk analysis, and timing of investment decisions.

3) Performing technical market analysis of supply and demand, historical spreads, tax implications, sectors, and yield curves.

4) Doing specific security analysis including independent credit reviews, identifying undervalued/overvalued securities, and ensuring investments align with client goals.