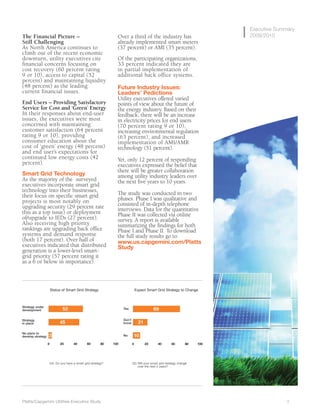

The survey of over 100 North American utility executives found that 80% were dissatisfied with President Obama's energy policy performance in the last year. The top issues facing the industry were identified as regulation, the environment, technology, finance, and customer demand. Executives expect to see increased regulation and electricity prices in the coming years. Nearly half have smart grid strategies in place or under development.