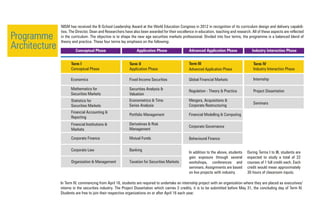

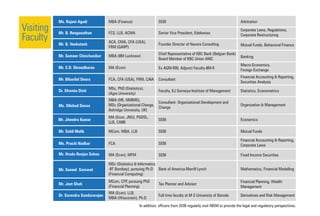

The Post Graduate Programme in Securities Markets (PGPSM) is a rigorous one-year course designed to train high-quality professionals for the securities industry, benefiting from an extensive curriculum and experienced faculty. Graduates are well-equipped for various roles in financial organizations, supported by hands-on internships and a strong theoretical foundation. NISM, established by SEBI, serves as a key institution for securities education and aims to enhance the skill set of securities professionals in India and beyond.