PIMM overview whitepaper

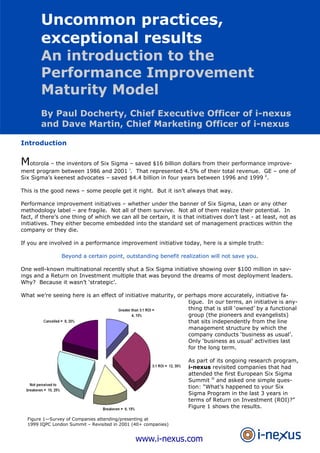

- 1. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model Uncommon practices, exceptional results An introduction to the Performance Improvement Maturity Model By Paul Docherty, Chief Executive Officer of i-nexus and Dave Martin, Chief Marketing Officer of i-nexus Introduction Motorola – the inventors of Six Sigma – saved $16 billion dollars from their performance improvement program between 1986 and 2001 i. That represented 4.5% of their total revenue. GE – one of Six Sigma’s keenest advocates – saved $4.4 billion in four years between 1996 and 1999 ii. This is the good news – some people get it right. But it isn’t always that way. Performance improvement initiatives – whether under the banner of Six Sigma, Lean or any other methodology label – are fragile. Not all of them survive. Not all of them realize their potential. In fact, if there’s one thing of which we can all be certain, it is that initiatives don’t last - at least, not as initiatives. They either become embedded into the standard set of management practices within the company or they die. If you are involved in a performance improvement initiative today, here is a simple truth: Beyond a certain point, outstanding benefit realization will not save you. One well-known multinational recently shut a Six Sigma initiative showing over $100 million in savings and a Return on Investment multiple that was beyond the dreams of most deployment leaders. Why? Because it wasn’t ‘strategic’. What we’re seeing here is an effect of initiative maturity, or perhaps more accurately, initiative fatigue. In our terms, an initiative is anything that is still ‘owned’ by a functional group (the pioneers and evangelists) that sits independently from the line management structure by which the company conducts ‘business as usual’. Only ‘business as usual’ activities last for the long term. As part of its ongoing research program, i-nexus revisited companies that had attended the first European Six Sigma Summit iii and asked one simple question: “What’s happened to your Six Sigma Program in the last 3 years in terms of Return on Investment (ROI)?” Figure 1 shows the results. Figure 1—Survey of Companies attending/presenting at 1999 IQPC London Summit – Revisited in 2001 (40+ companies) www.i-nexus.com

- 2. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model What is striking here is not just that some programs do better than others. It’s the scale of the variation. In fact, the results range from spectacular financial and strategic successes to outright loss and cancellation. Why is this? In pursuit of an answer, i-nexus sponsored a second piece of MBA research that focused on the practices of the companies considered by i-nexus’ consultancy partners to be examples of ‘success’. In other words, these are the companies making striking returns from their investments in Lean Six Sigma. Apart from a long list of common and uncommon practices (i.e. things that most people recommend for Six Sigma programs vs. things that only these successful few did), a single clear message emerged: After a while, all successful performance improvement programs are no longer ‘initiatives’. They have gone through a journey – from pilot, through a scaling phase and internalization phase to – finally – full maturity. Critically, in each phase, program success was defined by a different measure (the Big Y) and program failure was threatened by a different set of common pitfalls. These findings led to the definition of the i-nexus Performance Improvement Maturity Model, which was first unveiled at the London IQPC Six Sigma Summit in 2004. It has been refined and enhanced by further research. Today, it can be succinctly illustrated in the following diagram: Figure 2—The ‘Performance Improvement Maturity Model’. The characteristics, challenges and traps of the four main phases – Prove, Scale & Replicate, Internalize, and Align & Integrate – are discussed below. www.i-nexus.com

- 3. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model 1. Prove Phase Having made the decision to start a performance improvement program, companies generally begin with a ‘Prove’ Phase. This is assigned to some energetic individual or individuals to execute (in other words, it’s launched as an initiative). Now, all organizations have war stories about company initiatives that failed, and any new initiative is treated with knowing skepticism by most employees. If ‘the next great initiative’ is going to succeed, it has to show early success to silence the doubters and convert the non-believers. Thus, when you start a new performance improvement initiative, the main goal is to ‘prove’ – to demonstrate success. If – in a pilot wave – you can’t show financial benefit in a reasonable time frame (i.e. that a particular improvement methodology actually produces results) then the initiative will die before it’s out of its infancy. The key success measure (the Big ‘Y’) in this phase is about demonstrating to the company’s senior management that this is something worth investing in. Speed is essential, because – in general – senior management have a very short attention span. On a personal note, in the first initiative run by one of this paper’s co-authors, he was told he had 180 days to show the first returns. That sounded like a long time. But, in fact, it took over a year to show the first dollar of return. He was very lucky. Few deployment leaders would have survived; few initiatives would have survived. Typically, the ‘Prove’ Phase is over in 6-8 months. That’s how long you have to prove there is value in the initiative. To us, the message is clear. As a leader in any performance improvement initiative, your early stage objectives need to be the following: • Buy as much time as you can. Manage expectations so no-one expects the world to change overnight (because it won’t); • Then, show tangible benefit fast and make sure you can prove it (money you can’t point to doesn’t count); • Then, push for commitment to broader investment. And to achieve this, there are some key challenges to be met: • Pick good projects. Don’t pick projects that will take a long time to do. • Don’t pick project sponsors whose diaries will slow down the project. Surveys consistently show that the single biggest time element of all improvement projects is ‘waiting for someone’s input’. • Ensure effective application of the right tools. Performance improvement isn’t confined to one methodology. Too many initiatives rush straight towards DMAIC, applying Six Sigma to broken wasteful processes. Six Sigma is about process optimization. In the broken scenario, where processes are poorly defined and data is lacking, Lean is a much more appropriate methodology. • Maintain a pragmatic and balanced perspective. Make enough promises to maintain interest, but cultivate enough caution to avoid making the initial benefits achieved look like a failure. • Get and maintain the engagement of executives/sponsors and – critically – the financial community. www.i-nexus.com

- 4. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model A word or two on the last point: most commentators highlight the need for the continued engagement and commitment of executives and sponsors. This is true. No organization puts a lot of effort into things that senior people don’t care about, and it’s equally important that those key executives and sponsors are ‘engaged’ in playing the proper role. Most senior managers have got to where they are by being ‘Mr Fix-it’ or – indeed - ‘Mrs Fix-it’. They are used to making quick intuitive decisions on gut instinct. This is the complete antithesis of what makes for good practice in the application of modern performance improvement methodologies. As most good texts on Lean and Six Sigma will tell you, you need to factor this into your plans and take account of it. However, in our view, few commentators put sufficient emphasis on involving the financial community at this early stage. The best advice to deployment leaders is ‘always make the Chief Financial Officer (CFO) your friend’. In the end, the ‘Prove’ phase not only has to create benefit, it has to demonstrate that the benefit is affecting the financial results. In this regard, the CFO is the only scorekeeper that counts. In that first deployment of ours which we discussed earlier, one annual benefits presentation was a sobering experience. The senior management of the corporation had gathered to listen. By then, the results were good. We’d made real progress; we could show tangible benefits. But the Finance Director pointed to the figures one slide and said, ‘I don’t agree with that number’. The message sent in those six words destroyed 12 months of work. If you can’t get the CFO to believe the numbers (indeed if you can’t get him/her to present the results), the performance improvement initiative will always be seen as some intellectual exercise disconnected from business reality. Surviving and gaining commitment to the investment to move to the next level will always be a struggle. Scale & Replicate Phase 2. Once through Phase One- the ‘Prove’ phase – the challenges that face the ‘initiative’ and the deployment leader begin to change. Now, the initiative has to repeat the initial success on a bigger scale. Cynics within the organization will be saying, ‘Hey, all we did was pick the low hanging fruit. This thing will not produce returns when its scaled up.’ Control of the initiative is usually still under the control of a central resource – commonly called ‘the program office’ - headed by the deployment leader. The deployment leader’s key objective is now to show that the enlarged program is self-funding and profitable, or, in other words, a good ongoing investment. Typically, apart from the issues of scaling, a couple of new challenges now face the initiative: • In roll out, the promise of ‘putting the best people on the program’ gets diluted and training courses get populated with the ‘most easily spared person’. • Projects that would have been run by full-time resource during the Prove phase are now being run by part-time resources. These new resources (usually Green Belts) have ‘day jobs’ which puts short term pressure on them and they develop real problems balancing ‘urgent’ demands against ‘important’ demands. Performance improvement usually falls into the ‘Important, Not Urgent’ box and gets neglected because managers in most companies concentrate on the ‘Urgent’ items. In most companies, addressing short-term problems is behavior that reaps individuals the biggest personal rewards. Common practices begin to emerge: • Implementation of formal project hopper/selection processes • Coaching of Green Belts by Black Belts www.i-nexus.com

- 5. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model • Formalization of benefit claim/validation (even if that wasn’t done during the ‘Prove’ phase) • Introduction of tools for tracking of project progress and financial results. We are not going to examine the details here but we will point to the last of these bullet points, which holds the key to the continuing journey (i.e. jumping the next hurdle). In the end, getting seen as a profit centre rather than a cost centre or ‘investment in the future’ is a key milestone in program maturity. Our experience suggests the ‘Scale and Replicate’ phase has a life of 2-3 years. If you are a deployment leader, our advice is: focus on the ultimate measure in this phase, which is always ROI (Return on Investment). Of course, a number of factors, practices and barriers affect this measure, but these are at the ‘x’ level. Return on Investment is always the big ‘Y’. Actually, it’s a pretty simple measure. We can express the factors involved like this: Figure 3—Factors affecting Return on Investment. And we can even express this as a hard mathematical formula: Return on Investment = [x2 . x3 . x4] / [ x1 . x5 ] Note: Assumes average cycle time (x1) and program cost (x5) use same units of time. There are two things to note here: • Unusually for cause-effect functions, we know this one exactly. We normally struggle to know if we are really capturing the proper root causes of Y measures, but here we know for certain. If something is not affecting one of these X’s, it cannot make a jot of difference to the Y. • The weightings of all the X terms are the same, and they are all directly proportional or inversely proportional to the Y measure. In other words, a 10% change in any of the X terms produces a 10% change in the Y. Therefore, a close examination of these Xs tells us everything we need to know about success. www.i-nexus.com

- 6. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model Cutting Project Cycle Time Most DMAIC projects could be done in weeks if not days if all the data was lined up and all the people were available. It takes months because all the other time is spent getting sponsors to act, or getting data collected. The best companies complete projects in 4 - 5 months, and even they admit that they could do better. In a company running 30 projects, delivering an average of $250k per project, shortening the average cycle time by one month from, say, 6 to 5 months delivers an extra $6 million of benefit in two years. One company we have worked with set their gates so that all projects finish in 3 months. If they do not reach the Define gate in the first month, they kill the project, irrespective of its potential benefits. It’s a harsh policy, but one that illustrates that it isn’t just ‘benefits accumulated’, but rather ‘benefits accumulated per unit time’ that is the underlying ‘x’ that has a direct bearing on ROI. If we take ‘time wasted by sponsors’ and ‘time to get data’ collected as the key barriers, a number of uncommon practices we have seen really address these points: 1) Instigate brutally transparent reporting, driven by a system that provides exception-based personalized reports to the stakeholders on a regular (metronomic) cycle. An example is shown in the figure below. The report shows all projects that are the responsibility of a sponsor, and allows the report recipient to drill down to project detail level. Predefined progress reports can be delivered by email on a scheduled basis to a hierarchy of project leaders, sponsors and more senior managers. Figure 4— Personalized reporting offers ‘brutal transparency’. 2) Require not just a ‘Project Charter’ but a ‘CEO Sponsor Charter’ or a ‘Sponsor Benefit Contract’. The CEO Sponsor Charter/ Sponsor Benefit Contract is a commitment from the sponsor to deliver the benefits of the project. He or she is being allocated valuable ‘improvement’ resources; they ought to commit to the result. In best practice cases, the comparison of result vs. contract will be part of the sponsor’s personal appraisal. 3) Veto projects where the required data can’t be obtained or where the data frequency is so low that meaningful data will take a long time to accumulate. www.i-nexus.com

- 7. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model Increasing Net Saving Per Project Apart from obvious practices (i.e. picking the projects with the biggest savings), there are two common issues that can affect the real net savings from a ‘successful’ project: There is a gulf between a theoretical process improvement and real net savings (i.e. putting the money in the bank). Usually management activity is required at a sponsor/operational level to realize the benefit that a process improvement offers (for example, freeing capacity only creates a tangible benefit if someone steps up to use the extra capacity). Too often apparent ‘improvements’ slip away when the improvement team moves out, because no-one takes ‘ownership’. 1) Figure 5 - Benefits are delivered by the Project Sponsor. Occasionally remember your old friend, the CFO, and look at what’s happening through his/her eyes. A recurring benefit only recurs if improvement is embedded and sustained. Make sure your project sponsors understand their responsibility in this regard. Note: this is another compelling argument for the use of a ‘CEO Sponsor Charter’ or a ‘Sponsor Benefit Contract’ as discussed in the previous section concerning project cycle times. 2) Once the project is finished, replication is the best way to drive up Net Savings per Project. Make projects work for you more than once. We believe that most projects can be worth up to 10 times their original savings if the experience and learning is shared effectively across the organization. There are several ways of doing this: • Create an internal market for project solutions – like licensing intellectual property. Some companies have created incentive schemes (reward and recognition systems for replication) for the group that has done a project in its own division to ‘sell’ the solution to other divisions. This is not a natural process and needs the push. Black Belt and Master Black Belt (MBB) resources are gold dust – one division will not send resource to another division to replicate a project. The informal internal MBB network is usually not strong enough to make this happen. www.i-nexus.com

- 8. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model • Some organizations have explicitly added a ‘Transfer’ Phase to their methodologies (DMAICT). This is not necessarily ideal as it creates a ‘push’ rather than ‘pull’ process. It does, however, set a cultural expectation that the IP in projects will be transferred between divisions. • The best infrastructure tools on the market will allow managers to ‘subscribe’ to internal news feeds, so that results of – for example – a project targeting customer service improvement will be sent automatically as a news item to all line managers with customer service as one of their key concerns. Improving % Success Rate Again, there are some common project management best practices that are covered in many, many publications. However, our own experience suggests that most project failures are predictable well in advance. Too many companies start projects that are doomed to failure. These companies have what we would call a weak ‘define’ gate, where simply completing the definition of a project is enough to allow the project to go forward. This allows projects to commence that are too big, not finely scoped enough to be implementable, or where the defect is not possible to identify in a meaningful way, or where the project is defined as a solution seeking a problem. Our advice: make sure that the go/no-go gate is tough, one that ensures the project goes through proper pre-scoping. Don’t be afraid to kill projects at this stage. Increasing Number of Concurrent Projects Simple arithmetic comes into play on this point. Given a fixed performance improvement resource, you cannot put up the number of projects being run at any one time unless you can make the people resource (Green and Black Belts) more productive. If you try to increase project numbers, you will severely impact cycle times and – in our experience – increasing workload by giving people ‘more stuff to do’ usually creates a more than pro-rata increase in the time they take to complete each task. However, a recent i-nexus survey found that the single largest consumer of time for Black Belts was ‘explaining to other people what they were doing’. In other words- ‘reporting’. Less than 5 % of their time was spent actually applying the tool skills of a Six Sigma Black Belt. 95% of their time was on activities that are not up to their pay grade. The biggest single impact you can have on this measure is to implement an infrastructure that enables effective and automatic reporting from project data. Project leaders should not need to create Project Charters, Progress Reports or Storyboard Presentations. Modern project management systems can be set to produce one or all of these from the live project data, and hold them for viewing within the system or deliver them directly to the appropriate recipients. In a best practice infrastructure, reporting is a by-product of working on the project, not something that needs to be created separately. Controlling Program Cost Here’s another area that has been examined in minute detail by any number of other authors. In our view, controlling program costs hinges around eliminating non-value adding activities and balancing resources. Infrastructure tools have a big part to play in cutting down on administration and giving you the information you need to make good control decisions: • Scheduling and managing training www.i-nexus.com

- 9. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model • Enabling gate reviews and other collaboration • Automating reporting A good deployment scorecard/dashboard is a vital tool to make sure that all the activity you are paying for is driving you in the right direction, but remember: you get what you measure. We have seen a number of companies who measured success by the number of belts trained without really knowing what came next. This is a good way of driving up cost for no return. 3. Internalize Phase Why does the ‘Scale and Replicate’ phase come to an end? If done correctly, the program is showing a reasonable, even spectacular, Return on Investment by now. Why isn’t everyone happy to just let it carry on? Our research would show that there are four reasons: 1. The reported benefits don’t sit comfortably in the line management structure of the business. Therefore, no one in a line management position feels ‘ownership’, the financial community have increasing difficultly finding them in the management accounts, and the company is still divided into ‘believers’ and ‘non-believers’ when it comes to the reality of the benefit. 2. More importantly, in modern management, operational and line managers are increasingly targeting their efforts at underlying enablers and strategic performance indicators (usually expressed in some kind of scorecard). They understand that apparent financial benefit doesn’t necessarily mean long term gains if the improvement doesn’t also serve the strategic objectives of the company. 3. ‘Initiatives’ usually don’t survive a change in top management. CEOs in the Fortune 500 have an average tenure under three years. The one thing experience tells us unequivocally is that a new CEO means a new strategy and a complete overhaul of all initiatives. Whilst the Performance improvement program is still ‘owned’ by a specialist central resource, it is still an initiative, and vulnerable to the ‘fresh way of looking at things’. Only embedded ‘business as usual’ survives such revolutions. 4. In a budget squeeze, when line managers are doing everything to hold onto their departmental budgets simply so they can run the business, who is going to fight to keep the initiative going? But, we know there are companies who are running long-lived and successful performance improvement programs. So the question is: what happened next in those cases? Let’s look at the biggest and best publicized success. If you read the annual reports of GE in the 90’s, it was all about Six Sigma, the wonderful new initiative that was changing the company. If you read it today, it’s about the business fundamentals and – by the way – ‘Six Sigma is part of the management system we use to achieve the company’s results’. That’s a shift! In order to survive, the performance improvement initiative must mature. It must become embedded in the way the company does business; it must become part of management review at a line management level. We call this process ‘internalization’. By this, we do not mean ‘internalize’ in the sense of simply removing dependency on the training consultancy and taking over the training and management of the program. We assume that most programs do this within the first two years. www.i-nexus.com

- 10. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model The transition into the Internalize phase is marked by a recognition that operational managers have to incorporate the principles of performance improvement methodologies into the process of management itself. It becomes part of the management review cycle. Review Performance Identify Actions Review Actions Do Actions Figure 6— Simple Management Review Cycle In many companies, there is an existing management review cycle, but - often - it doesn’t work well as a process. Typically, its focal point is a monthly meeting that tries to drive the cycle. The meeting spends 95% of time arguing about measurement of the past and only a few minutes at the end deciding what to do. They have little if any tool set that allows them to break the performance measures (big Ys) into underlying causes. Therefore, no valid or testable conclusion on how to close performance gaps is possible. Between meetings, no one does anything until it’s nearly time for the next month’s meeting, at which point there is a scramble of activity and collation of data, but no improvement. At its core this dysfunctional situation is a result of two things: • Lack of cause-effect thinking among the participants • Lack of a tool set to drive the cause-effect thinking towards action. Further, in such organization, any performance improvement initiative will eventually fail. Let us make one unequivocal statement: Every company that has embedded performance improvement into their management thinking (culture) and made it stick in the long term has taken this kind of cause-effect thinking into their management review cycle. They have to. Not that it is easy to accomplish! With most management teams, this transition – at the beginning – seems very hard. You might as well ask them to write the works of Shakespeare. They simply don’t think that way! Remember, these are the guys we had trouble with before, the ones used to making quick intuitive decisions on gut instinct. The key to enabling transition is two-fold: 1. Give them cause-effect training. 2. Give them a tool that helps them. www.i-nexus.com

- 11. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model There are a number of variants of the toolset, but the one we have found most effective is called a MAAR chart. It is – by comparison to other tools – simple to understand and sets everything you need onto one page. MAAR stands for Measure, Analyze, Action and Review. In effect, it is Plan-Do-Check-Act (PDCA) thinking compressed onto a two-by-two matrix. A typical MAAR chart might look like this: Figure 7—MAAR Chart In this example, we assume that ‘On Time Delivery’ performance is one of the identified operational KPIs (i.e. a metric that would be monitored by the Management Review Cycle). The first – upper left square – of the MAAR holds a control chart for the primary metric (OnTime Delivery). This allows management to see the impact of any improvements (i.e. changes in process) they have instigated. The second – lower left square- holds an analysis of root causes (i.e. an attempt to identify the critical factors that drive the defects in the ‘On Time Delivery Performance’) The third – upper right square – shows the list of projects/actions that are targeted at the root causes, their progress and the person responsible. The fourth – lower right square – shows the occurrence over time of defects created by each factor. The MAAR chart allows you to clearly ask the key questions and get answers: Questions: • How am I performing against my KPI? • What are the root causes of any gaps in performance? • Are the projects I’ve launched targeted at those root causes? • Are those projects progressing satisfactorily? • Are they having an impact on the occurrence of the root causes? www.i-nexus.com

- 12. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model Interpreting Answers: • If I’m running projects that aren’t targeting the root causes then my improvement projects aren’t improving anything important, even if my project benefit forecast says I’m saving money. • If I’m reducing the occurrence of root causes but my primary metric measure isn’t getting better, then I must have picked the wrong root cause. • If my primary metric is improving but my project hasn’t had any impact on the root cause, then this performance improvement probably had nothing to do with my project effort. We are not suggesting that MAAR charts are easy to implement. Measurement systems are often difficult to put in place, and the effort in generating the MAAR chart has to be low vs. benefit of using it before managers will adopt it. Success also depends on managers learning how to stratify data meaningfully, but we have experienced some gratifying successes. Line managers who come to their first management review with barely enough data to populate the Measure square in the top left hand corner, soon learn that they can only close the targeted gaps in their operational KPIs by sucking in performance improvement resource. Three things now emerge: • Robust linkage between measurements, decisions to act, and the result of actions. • The results of performance management are ‘owned by’ and ‘sought after by’ line managers. • Performance improvement becomes embedded as the way the company does business. When this happens, the company has reached Level 3 in the maturity model. The company’s management review cycle has become a robust process. The need to improve Operational KPIs (as expressed on process scorecards) lead to MAAR charts that suggest actions/projects. Actions/projects are prioritized and selected, run to uniform and proven methodologies, improvements properly documented and embedded in process documentation, creating process controls that feedback into improved performance on the process scorecards. Figure 8—Robust Management Review Cycle www.i-nexus.com

- 13. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model 4. Align & Integrate Phase In Level Three, we have seen that performance improvement methodologies become part of the methodology of company management at the operational level. You might think that this represents the end of the journey, and it is certainly true that the program has become sustainable at this point. But it isn’t delivering all it can. It is informative to look at the most popular topics in recent performance improvement conferences: • Sustainability • Alignment • Innovation And whilst it is true that, in Level Three, we went a long way to creating sustainability, we did little to address either of the other two key issues. The problem in Level Three is that it is about efficiency. It is taking the current snapshot of the business and trying to reshape its processes to deliver better outputs. It is not trying to redesign the business to deliver the corporate strategy. In a sense, it is optimizing today, rather than delivering tomorrow. To put it another way, the management review cycle we have created is not allowing for either innovation or alignment with corporate strategy. The missing link lies above the operational level. It lies at the levels where strategy is created and then cascaded as objectives down to the lower levels. The process by which this is accomplished in most companies is broken, and certainly not designed to allow business units to pick up those objectives and effectively execute against them. To put it simply, it is not that most corporate strategies discourage innovation; it is that they are so poorly aligned with the objectives set for business units that ‘innovation’ – along with a bunch of other important stuff about preparing for the future – gets lost along the way. Let us examine that through the most popular of modern strategy tools, the Kaplan and Norton Strategy Map that leads to a Balanced Scorecard. The Balanced Scorecard axiom, roughly stated, is as follows: “Capable, motivated, empowered, and aligned individuals executing flawless processes will arrive at superiorly delighted customers, which will lead to superior financial results.” If you want to turn top level strategy into something that means something to every level of your business, effective cascade is critical. The cascade needs to create meaningful definitions of the improvements/changes needed to achieve the strategy. But from our work as improvement deployers at previous levels, we know what this means. It means that the major objectives have to be expressed in terms of the gaps between current and target performance (the Big Y measures), the data has to be stratified to find the root causes, and then action needs to be initiated to address those root causes. In order to make this work, the cause-effect thinking that we struggled to force on Operational Managers in Level Three, has to be worked up to the ‘C’ level in Level Four. Not only that but the causal chain you’re working with is now much longer, so the precision of causal thinking process has to be refined to a much higher degree, otherwise the objectives set for units/divisions three or four levels down from the top will have lost all connection to the reality of the top level corporate strategy. www.i-nexus.com

- 14. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model We see the best practice companies involved in this struggle right now. Several things are clear: • Effective cascade is not about ‘mirror management’. Dividing up the sales pie or the cost pie and passing that down to the next level as a target is not the object here. This is about each level, thinking about what they have to achieve and thinking about what causes those results. • Success requires large scale integration of strategy formation, objective cascade, performance measurement, performance improvement and process management. An effective underlying infrastructure will be required. Old style management accounts systems with their financial basis will not be adequate. In fact, they will be destructive. • Alignment means aligning actions and objectives down to the personal level. Managers having personal scorecards linked to their appraisals and remuneration is a good idea, but only if the system setting those personal objectives has a robust linkage to the corporate objectives. Our experience is that asking all the executives in a business team to put their personal appraisal objectives on the wall in a ‘Post-It’ note exercise has never led to anything that looks like a match to a coherent corporate strategy. • The alignment needs to be dynamic and reviewable. What we mean here is that being aligned three years ago on that day when the CEO said, ‘Wouldn’t it be a good idea if we started a Six Sigma program?’ is not enough. Strategies change quickly and even the best of them must be adapted to overcome the circumstances and roadblocks that arise. Therefore, having everything aligned in a cascade this month is no guarantee that you will still be aligned after the next review. We are not claiming to have all the answers for Level Four, because we see it as an emerging challenge. However, we can offer a few pieces of advice: 1) Don’t allow management to indulge in sloppy causal thinking. It often helps to make the problem as pictorial as possible. Draw them a diagram that shows how the flow down of a particular objective is connected to a particular process and how that can be linked to the cause-effect type project thinking we discussed earlier. Figure 9—A process approach that links objectives to project selection and execution, and to the metrics that measure performance and improvement. www.i-nexus.com

- 15. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model 2) Make sure the infrastructure system ‘pushes’ the right information to the right people. For example, in the figure below, we show the breakdown of cause-effect on improving a Big ‘Y’ measure (Increase Margin by 15%). We also show how we would suggest reporting to each management level a limited but digestible slice of the cause-effect cascade. In this case, the CEO sees the Big Y (Margin) measure and the x measures one level below (sales growth, COPQ –cost of poor quality, and price erosion). Figure 10—A cascade of reporting, creating dashboard data for executives at the appropriate levels. 3) Make it personal. In the end, creating enough WIIFM (What’s In It For Me?’) drives all change in large corporate structures. Figure 11—An example of cascading strategy down to personal scorecards. www.i-nexus.com

- 16. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model Conclusion The maturity model shows that Performance improvement is a journey. The road conditions change along the way. What is really happening is a slow transformation of the company. First, we introduce cause-effect tools at a project level, then we use those same tools to manage and boost the returns on a project portfolio as we move to Level 2. In the latter two phases (Levels 3 and 4), we introduce cause-effect thinking to the higher processes of management, eventually attaining a Nirvana where the strategy formation and execution process of the whole company is enabled by that cause-effect thinking. As a deployment leader, you need to recognize the transitions and act accordingly. Apart from not achieving the Big Y’s in each phase, the other big danger to the future is not recognizing the need to move on. Most initiative/program failures happen at the end of phases, as shown in this, our last and concluding, figure: Figure 12— The Performance Improvement Maturity Model seen as a journey. i Motorola Six Sigma Services. Motorola University, July 2002 <http://mu.motorola.com/sigmasplash.htm>. ii GE Investor Relations Annual Reports. General Electric Company, 2002 <http://www.ge.com/company/investor/annreports.htm>. iii IQPC Six Sigma Summit, London 1999. www.i-nexus.com

- 17. Uncommon Practices, Exceptional Results— An Introduction To The Performance Improvement Maturity Model About Paul Docherty Paul is the CEO of i-nexus, the leading provider of enterprise software to enable strategy execution. Paul started his career in Marconi, the telecoms equipment provider, where he held a wide range of management roles covering manufacturing, IT, sales, product development, project management, Six Sigma and corporate strategy as well as having P&L responsibility for the growth of a regional services business. Paul holds a MEng in Computer Systems and Software Engineering from the University of York and an MBA from the University of Warwick. His understanding of the challenges of embedding Six Sigma and other performance improvement methodologies into the fabric of organizations comes from his experience coaching senior management teams in many Global 500 companies and from leading the deployment of Six Sigma at Marconi. Paul was a co-founder of i-solutions Global in 2001, and has spearheaded its rapid expansion into the preferred global deployment partner for Lean Six Sigma and Strategy Execution programs. He can be contacted on paul.docherty@i-nexus.com or by telephone on +44 (0)7985 117784 (mobile), +44 (0)24 7660 8865 (desk). About Dave Martin Dave is CMO of i-nexus. He is an experienced business and corporate development manager, specializing in strategy and technology marketing. Dave has been involved in continuous improvement projects for over fifteen years, both as a line manager, operations director and chief executive. He can be contacted on dave.martin@i-nexus.com or by telephone on +44 (0) 7903081434. About i-nexus i-nexus is the leading provider of web-based software for formulating, aligning and executing performance improvement in Global 500 leaders worldwide. Client companies include organizations such as Pfizer, BT, Royal Bank of Scotland, ALSTOM, AREVA, Staples, Hager, Vodafone, Carl Zeiss, CIBA Vision, Network Rail and Xchanging. i-nexus provides a tailored range of solutions. Beginning with simple deployment and training support, and expanding out beyond the project tracking needs of Lean and Six Sigma improvement programs, i-nexus can provide the infrastructure that enables strategy mapping, cascaded scorecards, corporate objective alignment and strategy execution. i-nexus solutions are underpinned by powerful business intelligence capabilities which deliver executive and senior management reports on demand, in real-time or on a scheduled basis. i-nexus is headquartered in Coventry, UK, with regional offices in Europe, North America and Asia. To find out more about how i-nexus can help you to reduce project cycle times, increase project success rates and cut the cost of managing your portfolio: • Email: sales@i-nexus.com • Call European office: +44 (0)845 607 0063 • Call Americas office: +1 (617) 267 9595 • Call Asia office: +86 (0) 215 836 2701 • Visit: www.i-nexus.com www.i-nexus.com