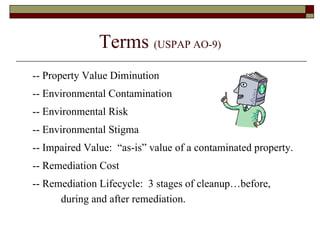

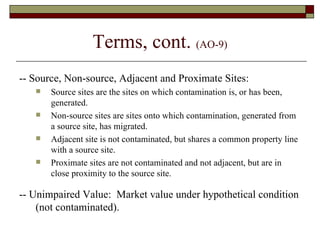

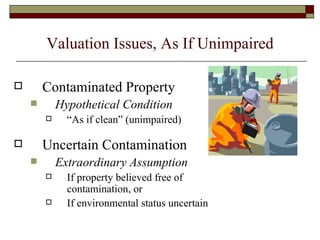

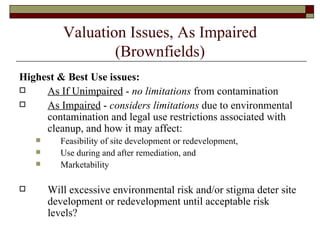

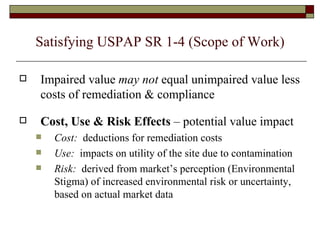

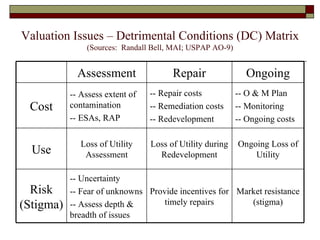

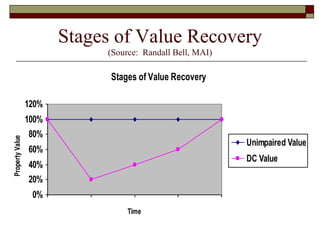

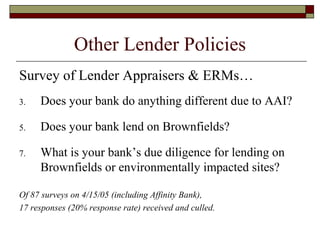

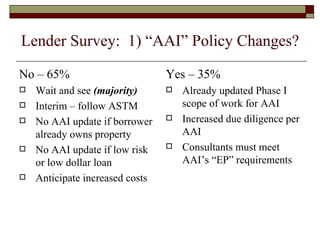

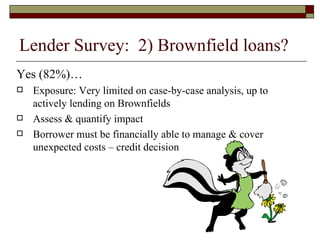

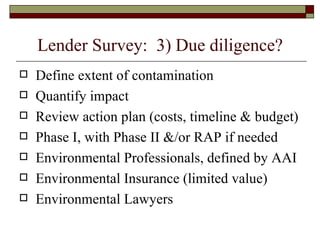

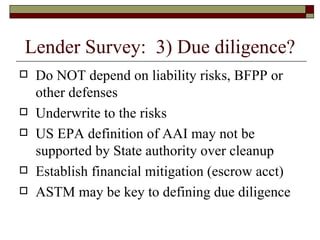

The document discusses perspectives from appraisers and lenders on appraising properties impacted by environmental contamination. It provides an overview of regulatory compliance standards, terminology used in appraising contaminated properties, and valuation issues to consider for contaminated properties. It also summarizes the results of a survey of lenders on their policies for lending on contaminated brownfield sites, finding that most conduct additional due diligence including environmental site assessments and insurance.

![AAI: Appraiser & Lender Perspectives Mitch Kreeger, MAI, SRA Chief Appraiser, Affinity Bank [email_address]](https://image.slidesharecdn.com/phoenixbrownfieldsuniversity2005-12513237978113-phpapp01/75/Phoenix-Brownfields-University-2005-1-2048.jpg)