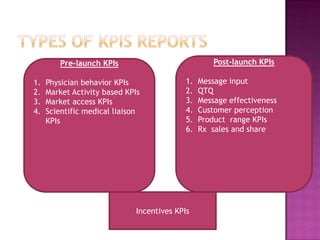

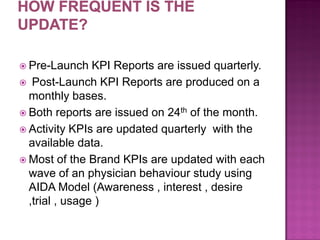

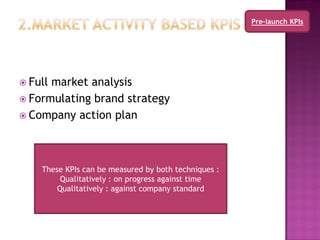

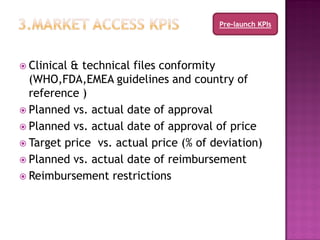

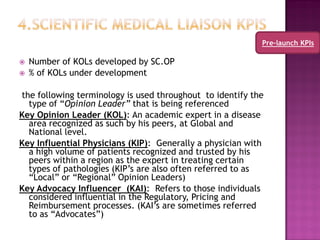

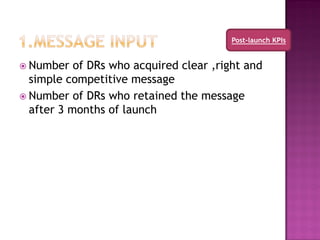

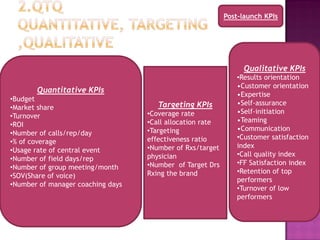

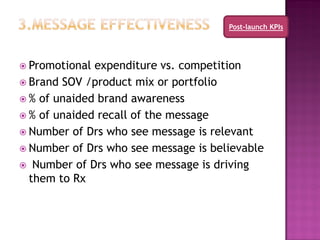

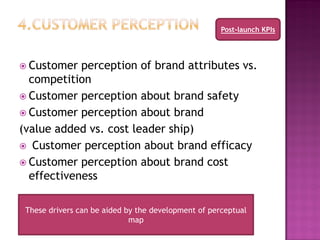

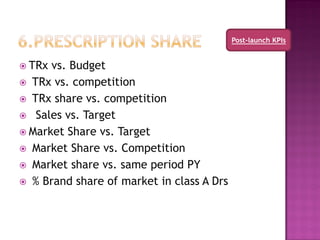

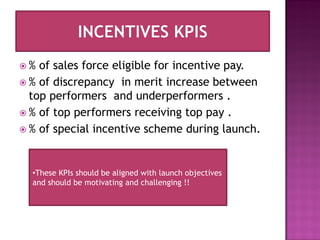

This document discusses key performance indicators (KPIs) for pharmaceutical sales forces. It provides examples of pre-launch and post-launch KPIs that can be used to track sales performance. Pre-launch KPIs include measures of physician awareness, market analysis, and regulatory approval progress. Post-launch KPIs include prescription sales, market share, message recall, customer perception, and incentives-related metrics. The document emphasizes that KPIs should provide a comprehensive picture of performance and be aligned with launch objectives.