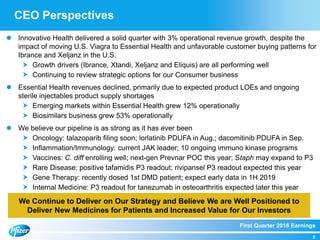

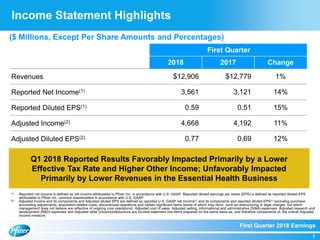

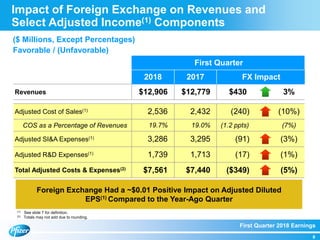

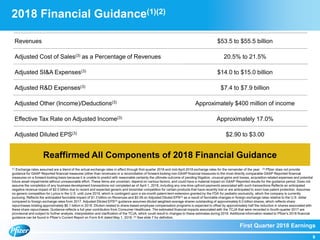

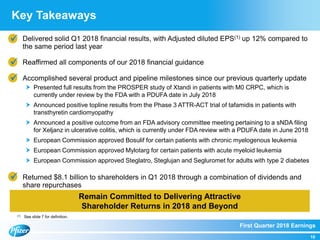

The document summarizes Pfizer's first quarter 2018 earnings teleconference. It discusses Pfizer's solid first quarter financial results, with adjusted diluted EPS up 12% compared to the previous year. Pfizer reaffirmed its full-year 2018 financial guidance. The document also provides an overview of recent product and pipeline milestones, including positive clinical trial results for drugs such as Xtandi and tafamidis and regulatory filing updates.