Transportation Peer Group Discusses Increased Freight Volumes

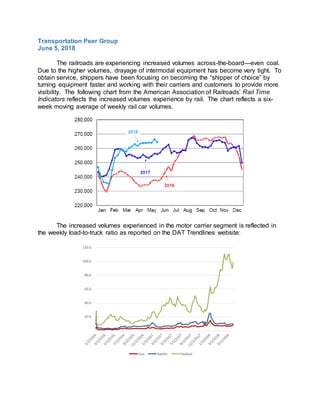

- 1. Transportation Peer Group June 5, 2018 The railroads are experiencing increased volumes across-the-board—even coal. Due to the higher volumes, drayage of intermodal equipment has become very tight. To obtain service, shippers have been focusing on becoming the “shipper of choice” by turning equipment faster and working with their carriers and customers to provide more visibility. The following chart from the American Association of Railroads’ Rail Time Indicators reflects the increased volumes experience by rail. The chart reflects a six- week moving average of weekly rail car volumes. The increased volumes experienced in the motor carrier segment is reflected in the weekly load-to-truck ratio as reported on the DAT Trendlines website: - 20.0 40.0 60.0 80.0 100.0 120.0 Van Reefer Flatbed

- 2. The ATA truck tonnage index also reflects a strong increase in freight demand: Increased visibility in the supply chain was a consistent comment. The focus has shifted from pricing to planning and managing drivers and equipment. Customers are seeking more visibility in their upstream supply chain. The ELD mandate has put a “spotlight” on equipment utilization to keep costs down and meet customer service objectives. A key problem facing many companies is the lack of integration. One participant indicated that they were working now to connect 72 systems. The company has 446 applications (not including the transportation). Increased freight volumes have produced the situation of a perfect storm. Comments were that it is rare that everything [freight and commodities] goes up at the same time (rail, trucking, air, expedited, international). Tight capacity is resulting in increased rates. As a result, shippers are seeking to work more closely with their carriers to determine how to best manage costs. The inventory drawdown has been compounding the problem (see below). The reduction in inventory levels has resulted in smaller, more frequent shipments for replenishment generating additional parcel, LTL, and expedited shipments. 85.0 90.0 95.0 100.0 105.0 110.0 115.0 Jan-14 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 May-15 Jul-15 Sep-15 Nov-15 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 Apr 2018 ATA: 112.5 +9.5% YOY

- 3. Source: US Census Bureau Increased freight volumes have accentuated the underlying driver shortage problem. Several individuals commented that they interview several hundred candidates to obtain only a very small proportion of qualified drivers or applicants for driving schools. The driver shortage is reflected in the driver turnover rate reported by the American Trucking Association: 1 1.1 1.2 1.3 1.4 1.5 1.6 1.7 Jan-2006 Jun-2006 Nov-2006 Apr-2007 Sep-2007 Feb-2008 Jul-2008 Dec-2008 May-2009 Oct-2009 Mar-2010 Aug-2010 Jan-2011 Jun-2011 Nov-2011 Apr-2012 Sep-2012 Feb-2013 Jul-2013 Dec-2013 May-2014 Oct-2014 Mar-2015 Aug-2015 Jan-2016 Jun-2016 Nov-2016 Apr-2017 Sep-2017 Feb-2018 Retail Ratio Manufacturer Ratio Wholesale Ratio 0% 20% 40% 60% 80% 100% 120% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 2012 2012 2012 2012 2013 2013 2013 2013 2014 2014 2014 2014 2015 2015 2015 2015 2016 2016 2016 2016 2017 2017 2017 2017 2018 Percent Large TL Fleets Small TL Feets LTL Fleets

- 4. Several strategies were mentioned as possible solutions to the driver shortage problem. These included truck platooning, getting drivers home at night, better treatment for drivers, reducing the age for a CDL to 18 years, using longer combination vehicles, and one individual mentioned that they were actively converting warehouse personnel to become truck drivers. Others were using “couriers for hire” for local deliveries. The opening of internal driving schools was another option identified. Areas for potential improvement include determining how to incentivize drivers to enter the industry earlier—30 year olds are the average entry; and identifying opportunities to partner/share loads across multiple transportation modes. Uber/Lyft not viewed as a viable option. Reliability is essential in most operations, and an operation cannot just hope somebody will show up to make a delivery. Despite the tight capacity, one estimate indicated that up to 20% of the trucking capacity is moving empty, usually on backhauls. Backhaul opportunities are greatly limited by a constantly changing network. The use of technology can lead to greater efficiencies; however, a large number of small carriers (94% of trucking companies operate six or fewer tractors) and lack the ability to make the investment in information technology. One participant mentioned that the LTL industry did not traditionally invest in technology which has affected the ability to track these shipments. However, the increased need for visibility may force some changes. One point raised as an obstacle to increasing capacity utilization is that most shippers do not want to share their data. The lack of sharing precludes carriers from effectively pooling their equipment across customers or lanes. Strategies for addressing peak season were discussed. These included: Ensure locations are “carrier friendly: Focus on change management to make operations more efficient Adopt a service management approach—some carriers are scoring pickup and delivery locations and factoring into their evaluation of loads Move away from a transactional approach to moving freight Carriers are seeing greater interest in dedicated as shippers want to ensure equipment availability. The rail industry has taken several actions to increase its capacity to handle additional freight volumes. These include: Investment in infrastructure—parallel tracks Information technology enabling the railroads to have closer, “drafting,” trains Purchasing additional locomotives Building longer trains, some up to three miles long

- 5. Better yard management—working with major shippers and trucking companies to better allocate/stage freight Maintaining flexibility—comments made that industry prefers “open gates” as opposed to appointments The LTL industry is moving away from the classification system to dimensional pricing. The traditional system based pricing too much on assumptions regarding the mix of freight which often change. Closing discussion focused on the point that relationship management is just as important today as information technology. Several carrier representatives remarked “Shippers want to partner when rates go up,” but when rates go down, much less focus on collaboration when rates go down. One shipper indicated that they do attempt to work with their carriers. In some instances, the carriers share the operating ratio on their business; however, others have significant distrust. During quarterly business reviews between shippers and carriers, the focus needs to be on how to jointly drive continuous improvement. Information sharing across the entire supply chain is needed to enable carrier/shipper partnerships to drive optimization and increase capacity. Prices are going up, rates are going up, partnerships are key. Feedback is a key limitation which affects the sharing of data. Need the industry to be more open and trusting. A suggestion offered was to get involved in quarterly business reviews with customers. Build 3 case studies of what works. Transportation Peer Group June 6, 2018 The opening discussion focused on sustainability and changes in trucking technology. Focus on sustainability based more on core values than as a specific strategy or key business driver to obtain customers or drive down costs. One of the railroads mentioned that they provide sustainability information regarding their train movements through the use of a “carbon calculator.” One carrier indicated that CNG has not worked due to weight and fill time. They are exploring LNG and have seen a reduction in fuel costs. The focus on using natural gas has been a part of their core values to become more sustainable. Electronic logging devices have assisted with reducing fuel consumption. Telematics has enabled the tracking of idle time. They have seen average idle time reduced from one hour to less than 15 minutes.

- 6. Autonomous vehicles still perceived as being several years away. However, as they become deployed they will be justified based on increasing safety and labor productivity. Electric vehicles seen as likely increasing in number as the range increases and vehicle weight decreases. Last mile discussion: A key challenge that last mile shippers are confronting is the management of client/customer expectations. Some carriers are addressing through technology alerts, call ahead, and delivery windows. Shippers are also addressing through short delivery times, focus on speed, and placing facilities and inventory closer to where customers live. Last mile delivery firms do not confront as significant issue with capacity due to the driver shortage. Drivers go home almost every night and usually are well compensated due to expectations. Independent contractors are used to leverage their networks. To make this work effectively, relationship required to treat them like partners, ensure consistent work, invest in technology to help with routing, and maintain communications throughout the day to take proactive action when potential problems emerge. Carriers/3PLs providing last mile delivery expected to provide same tracking capability and delivery timeframes as small parcel Seeing a shift away from white glove delivery to lower cost alternatives such as curbside delivery Carriers being evaluated on customer scores Productivity has changed for last mile carriers—white glove deliveries and ELD implementation have reduced productivity Communication required to address packaging issues—much work remains to be done to eliminate waste and to avoid damage. Need middle mile integration and other supply chain steps to communicate and invest in technology. Visibility is key! Blockchain discussion: Question raised as to how to exchange information—transportation supports different industries often using multiple modes and carriers—information exchanged and needed in a variety of formats. Data needs to be “stitched” together to obtain the needed information and make decisions. Blockchain may be an answer; however, much greater understanding is needed as to what it is, how it will work, and the types of information that can be exchanged. The platform does allow financial transactions in a secure environment, and it does change the game. One individual referred to it, and the

- 7. development of other IT capabilities as “an arms race.” Many customers are asking about Blockchain but don’t know what it is. Block chain does provide information availability, integrity and security. Several key questions emerged regarding blockchain: o How are the other members of the peer group using/exploring the use of Blockchain? o What have been your experiences to date? o How do we use the information available through Blockchain to optimize transportation and freight across modes? o What is the future of Blockchain and are companies considering this yet in their future supply chain strategy? o How are you using other forms of IT integration to bring all the information together? o What other options, besides Blockchain, are other others exploring? o What visibility will [does] Blockchain provide for freight in transit?