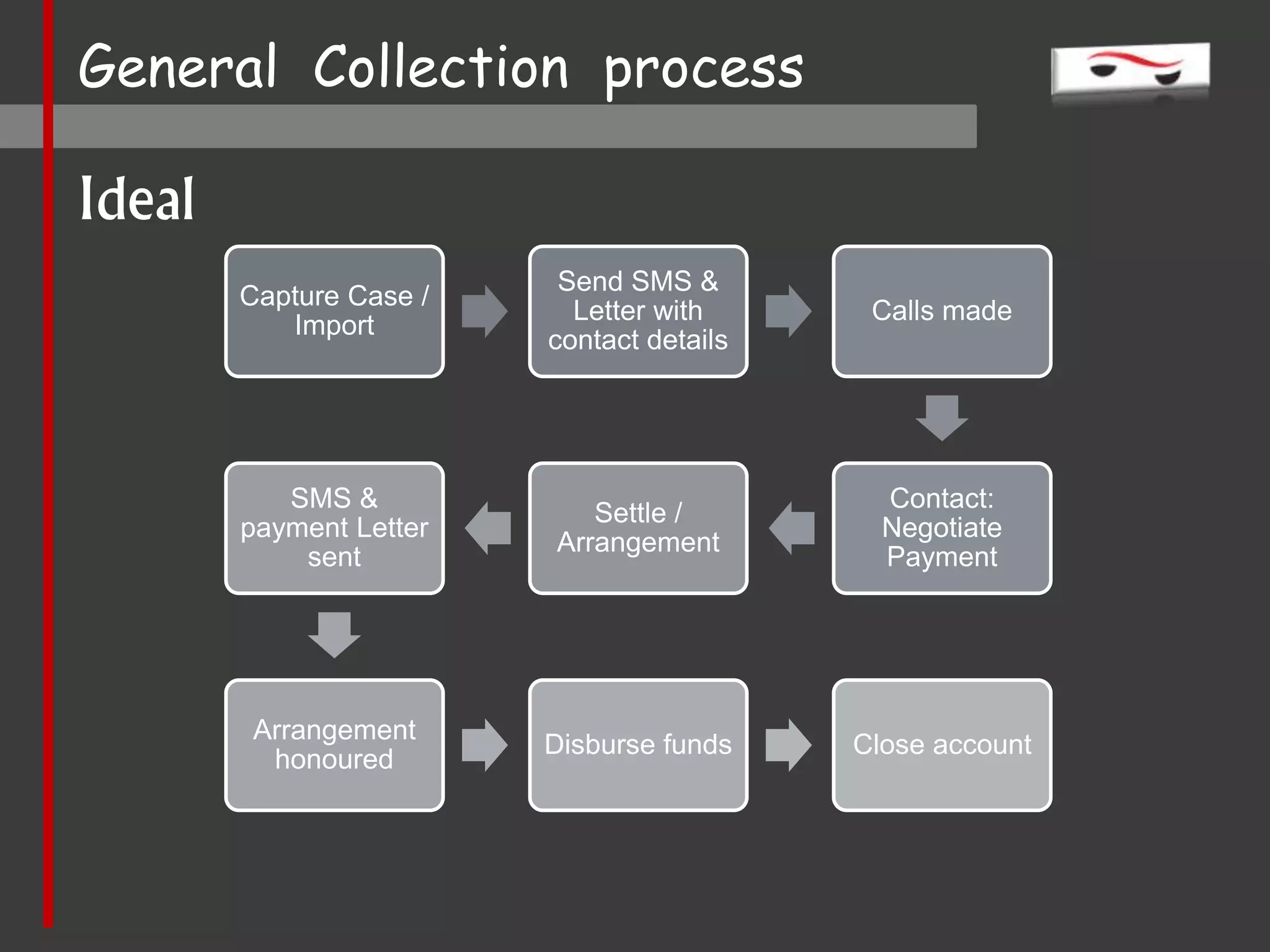

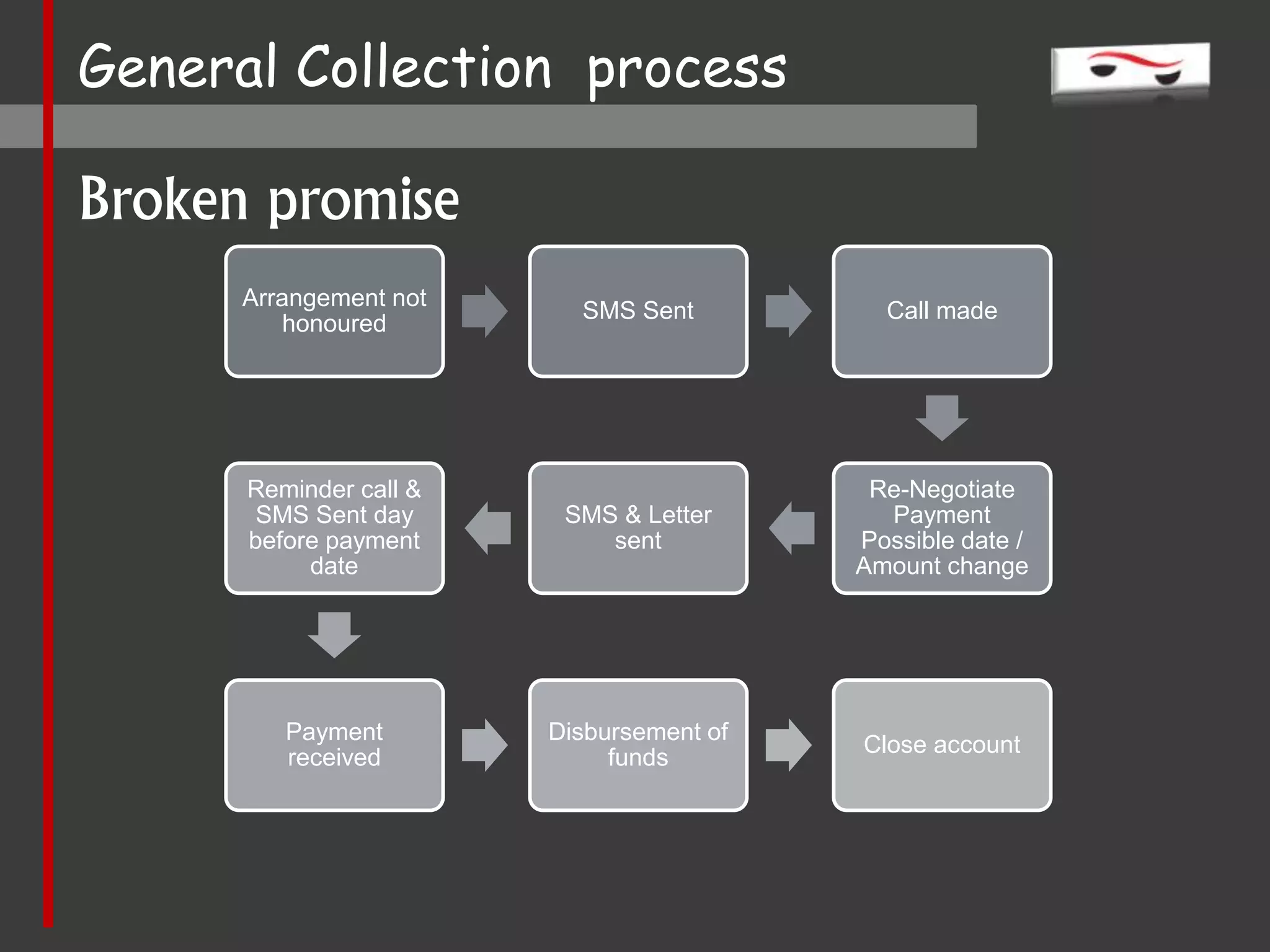

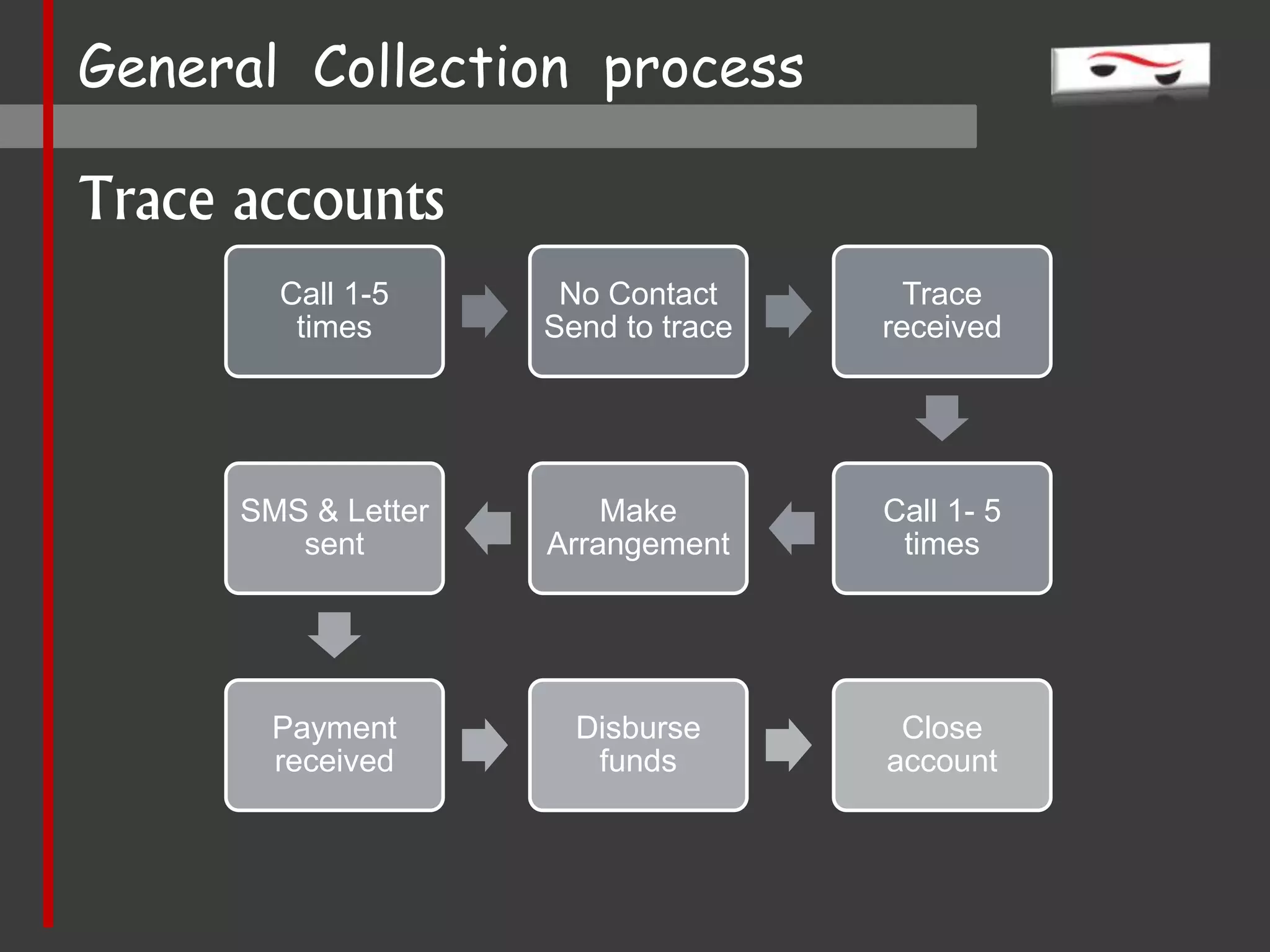

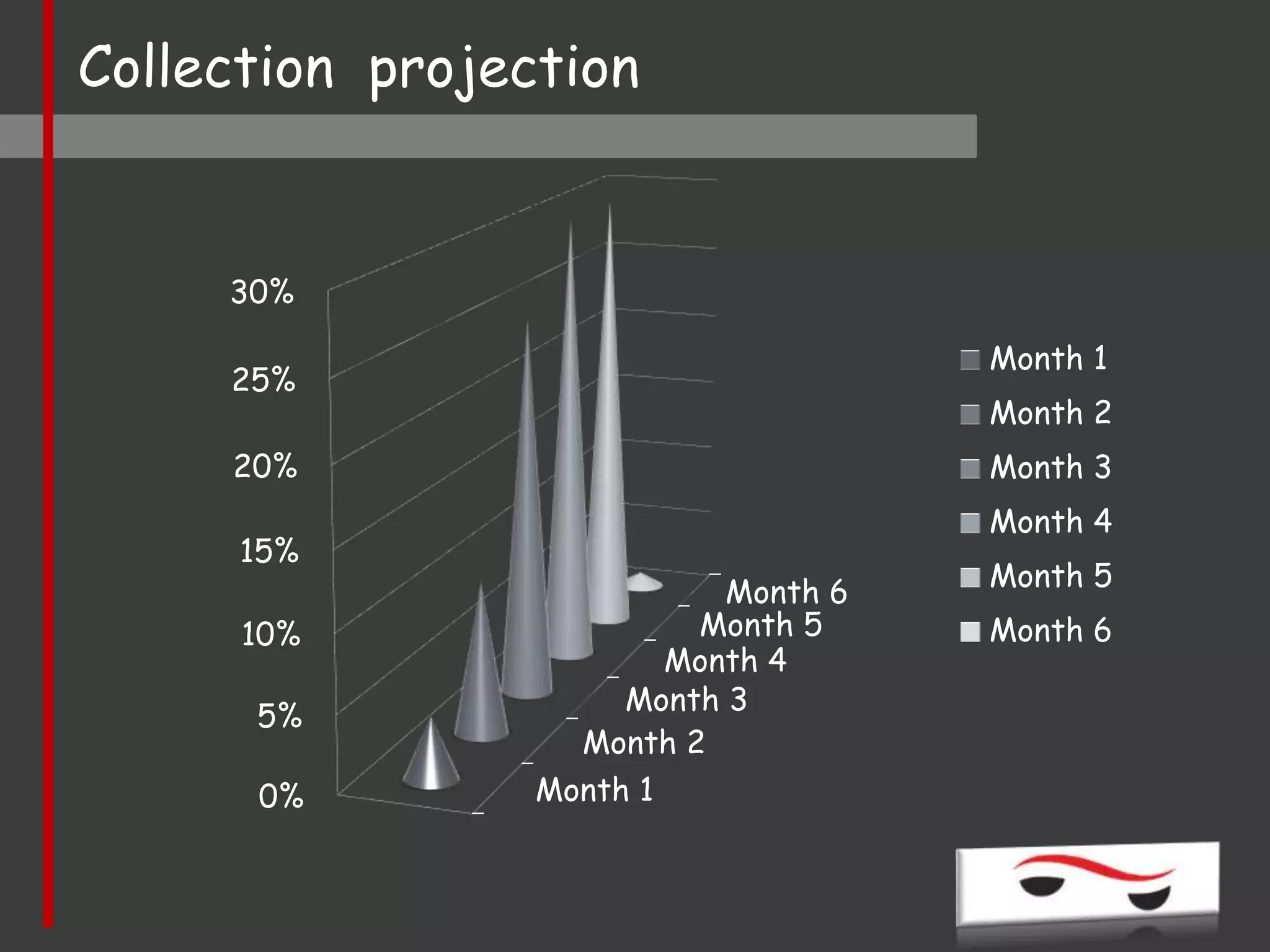

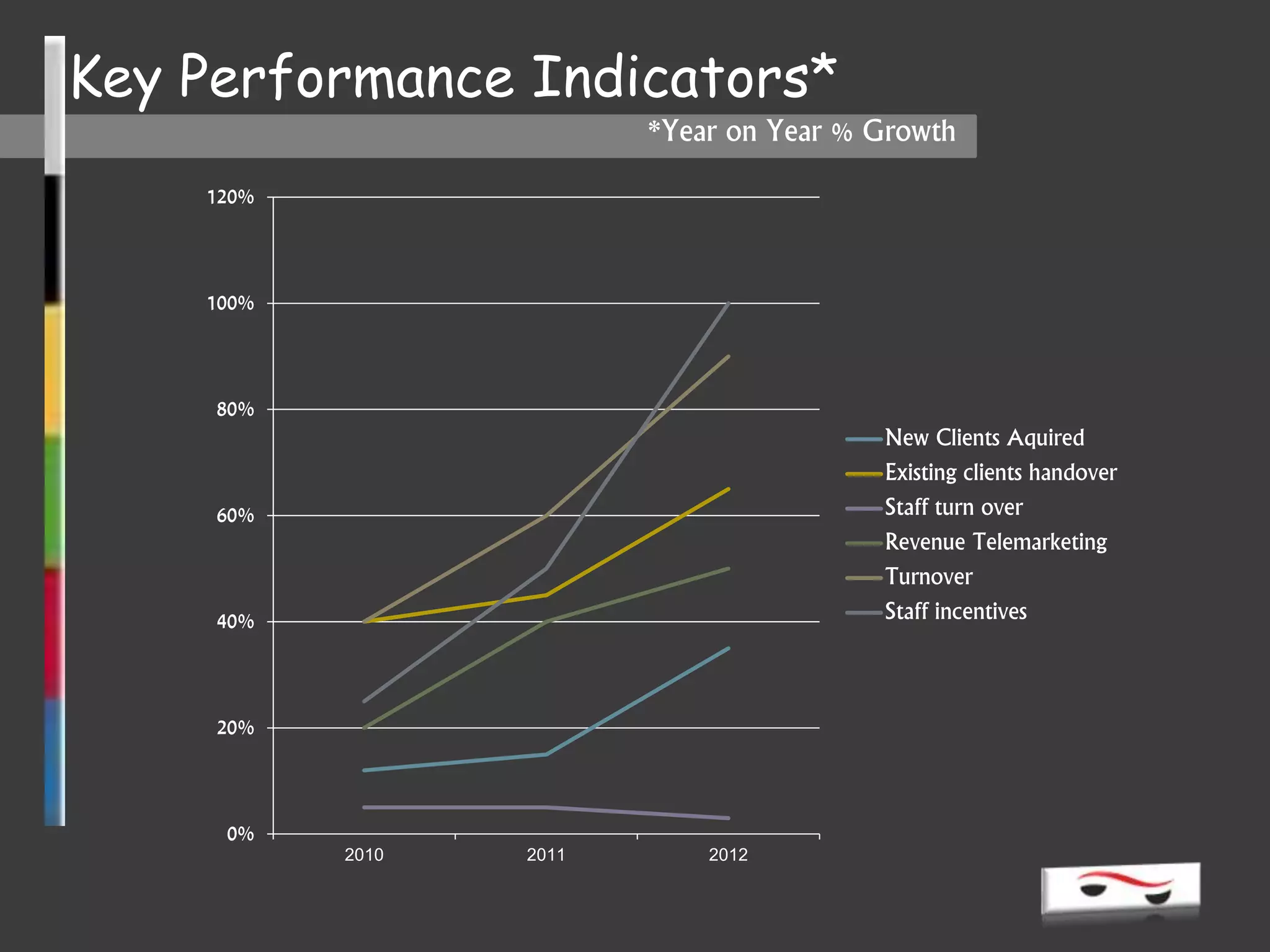

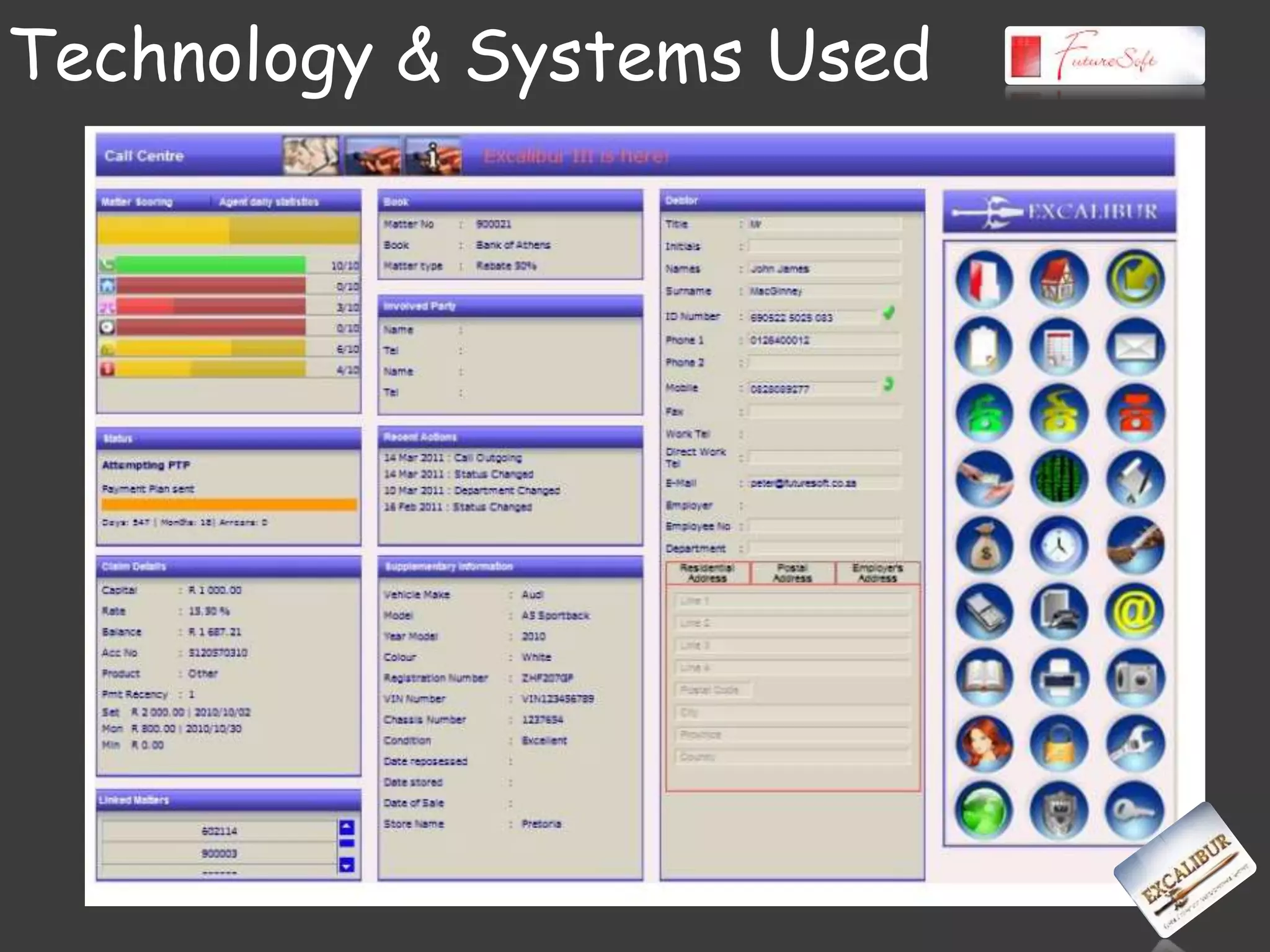

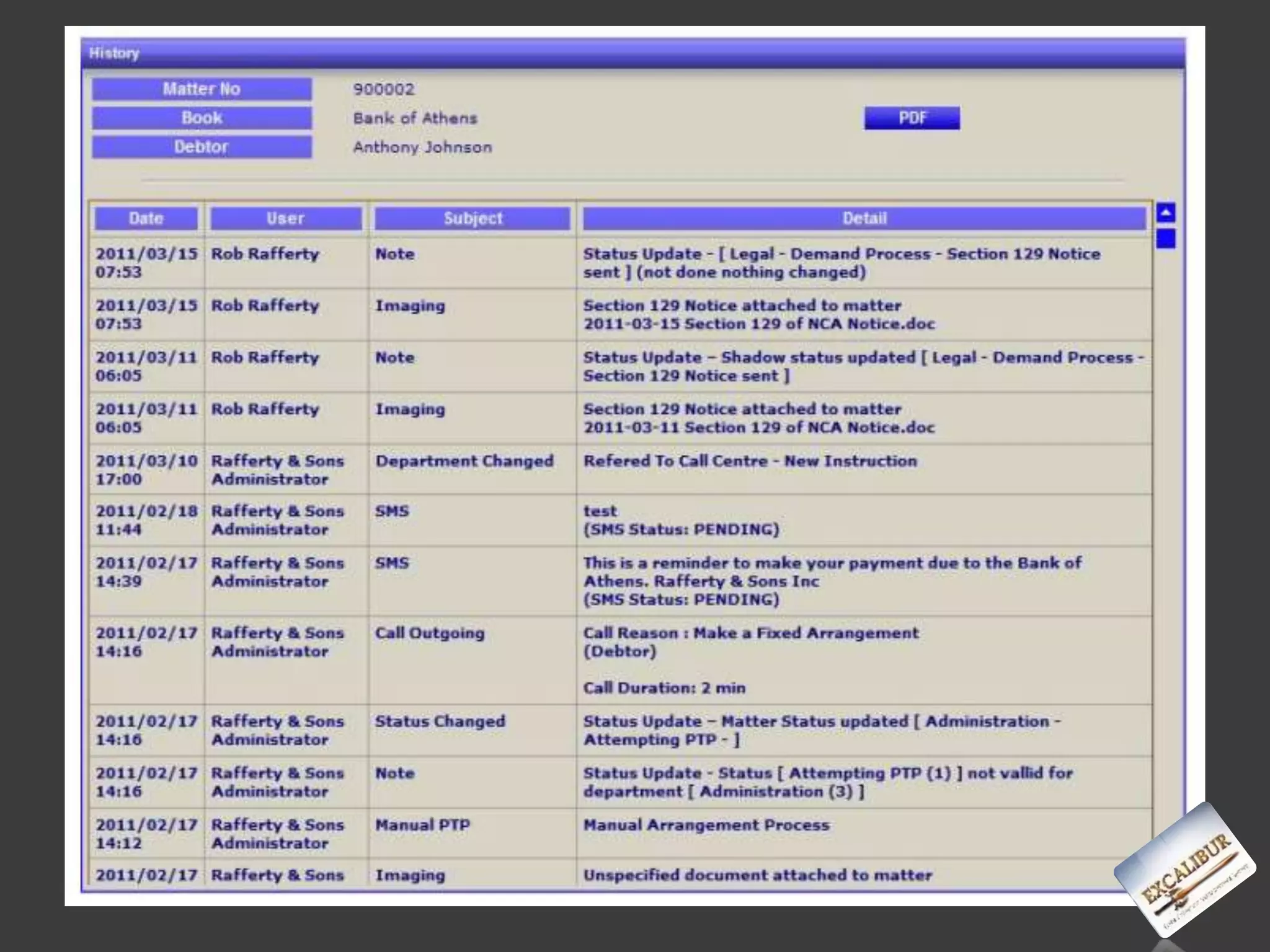

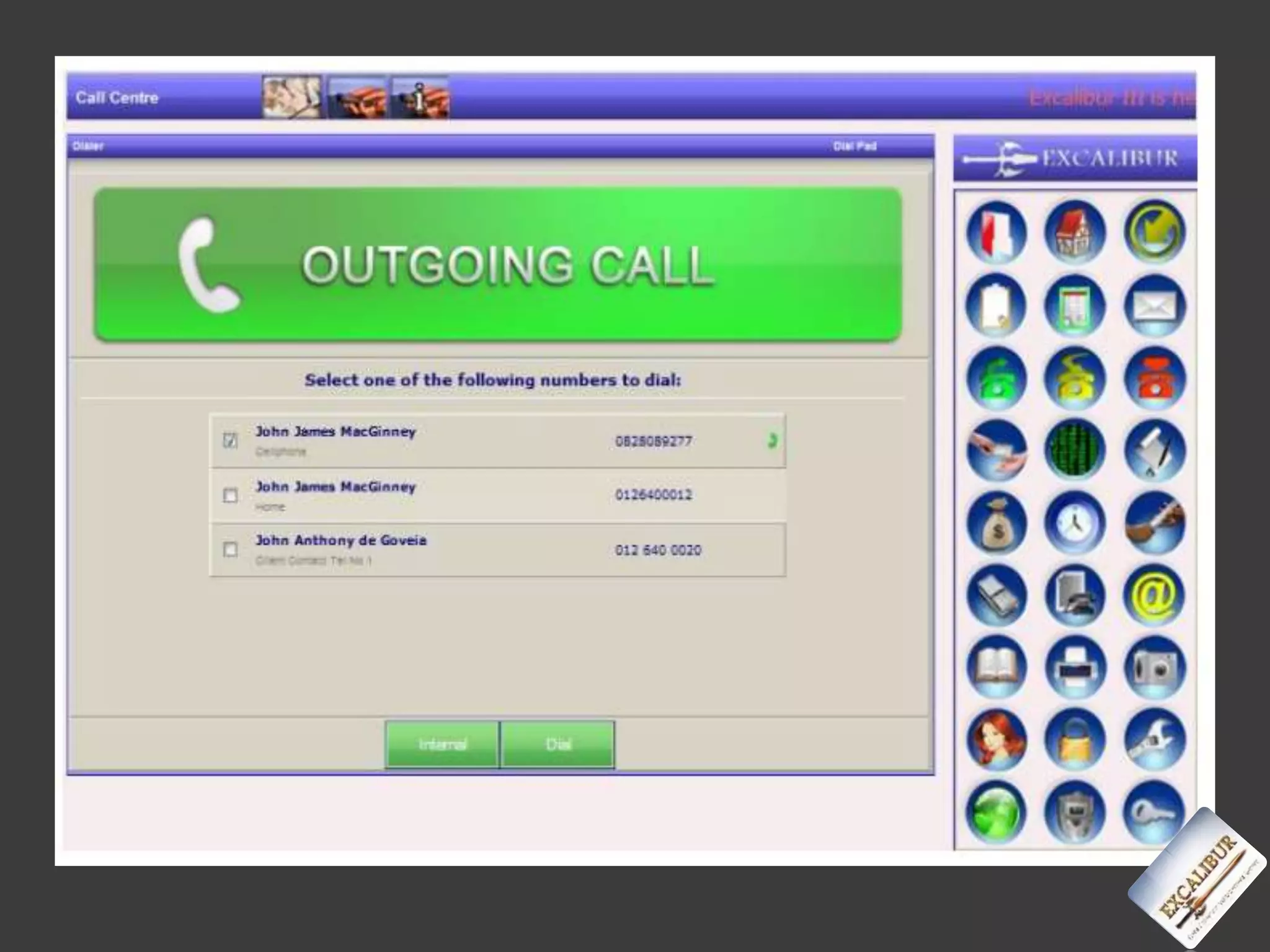

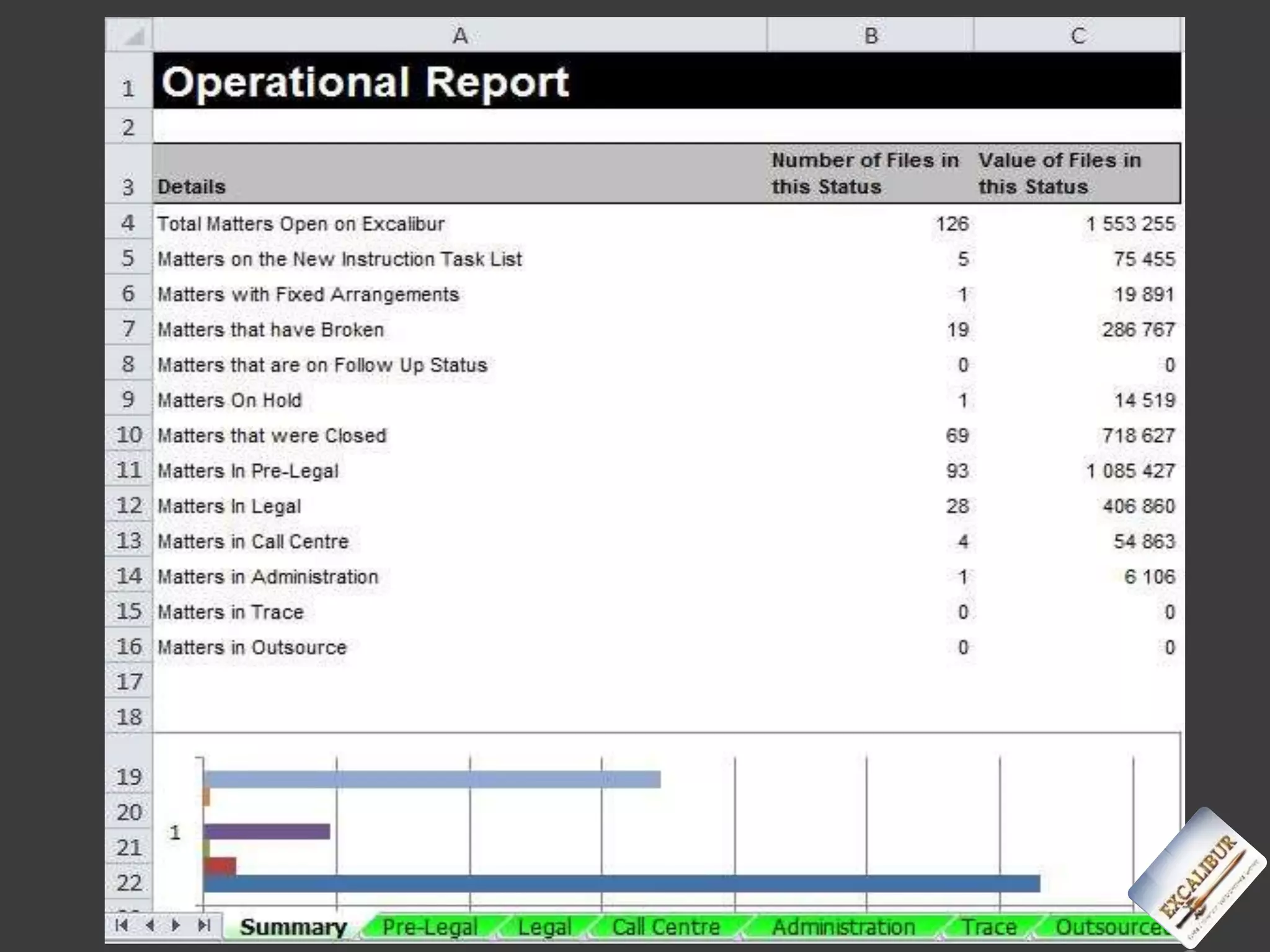

This document is a proposal from Phakamani Debt Collection Services that offers a 25% contingency commission on successful debt recoveries. It details Phakamani's experience in debt collection across various industries, capacity to handle accounts, legislative compliance, performance indicators, understanding of client needs, and technology/systems used. The proposal aims to retain clients by ensuring debtors receive excellent service and payment options while meeting all collection requirements.