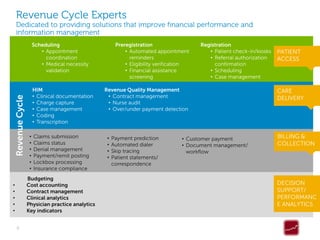

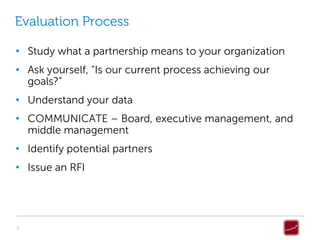

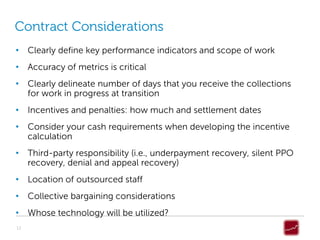

This document discusses when hospitals and physicians should consider outsourcing their revenue cycle management. It provides reasons why organizations outsource such as inability to attract qualified staff, high costs, and changing regulations. It addresses common myths around outsourcing and provides examples of outsourcing solutions. The document outlines an evaluation process for selecting a partner and discusses important considerations for the contract including performance indicators and incentives. Overall it aims to provide guidance on the revenue cycle outsourcing decision-making process.