- Parle Agro started operations in 1959 as Baroda Bottling Co. for carbonated beverages and has since launched several fruit-based drinks and other beverages and snacks.

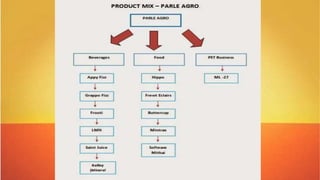

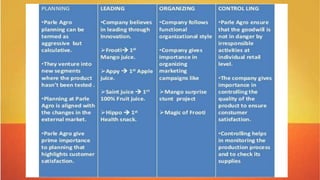

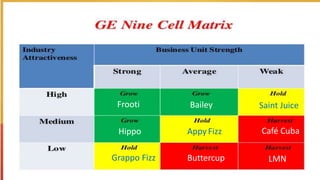

- Some of their major brands include Frooti, India's largest selling mango drink launched in 1985, Appy fruit nectar launched in 1986, Cafe Cuba carbonated coffee launched in 2013, and Hippo snacks launched in 2009.

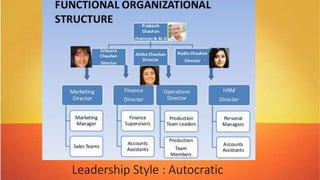

- Their three major growth strategies are focusing on their core business of nectars and juices, backward integration to manufacture PET bottles, and related diversification into the food business. Their challenges include being wholly family-owned without professional expertise and facing pressure from competition.