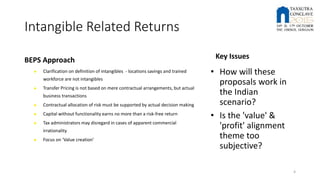

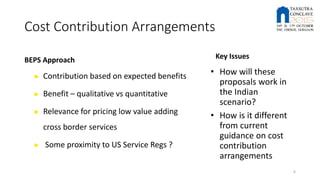

This document summarizes a panel discussion on managing transfer pricing risks. The panel included representatives from the OECD, India tax authorities, and multinational companies. Key topics discussed include the BEPS final reports, intangible-related returns, returns for assuming risks, cost contribution arrangements, country-by-country reporting requirements, India's unilateral and bilateral APAs, Indian transfer pricing controversies, and India's amendments to its transfer pricing laws regarding deemed international transactions. Issues around implementing OECD guidelines in India and managing compliance burdens were also addressed.