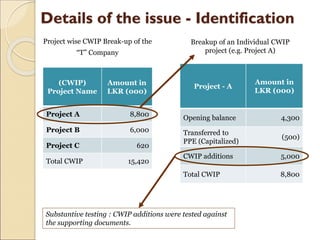

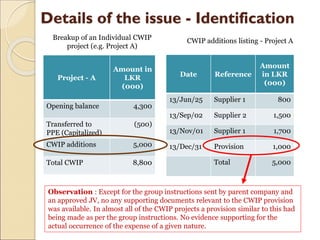

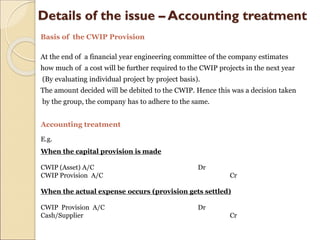

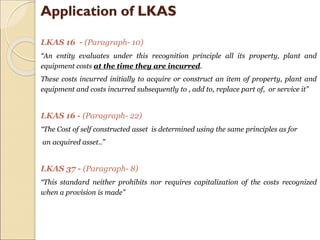

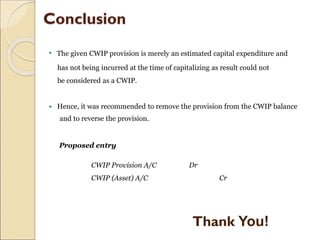

The document discusses an issue regarding the capitalization of provisions for capital work-in-progress (CWIP) by a client company. It provides background on the client and identifies capitalization of CWIP provisions as a key audit risk. It then details the client's practice of creating provisions in CWIP projects for estimated future costs based on engineering estimates, without supporting documentation for actual expenses. Application of relevant accounting standards suggests this is not in compliance as the costs have not actually been incurred. The conclusion recommends removing such provisions from the CWIP balance by reversing the provision entries.