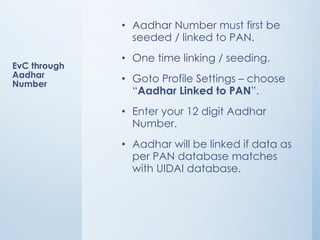

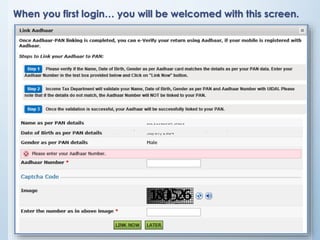

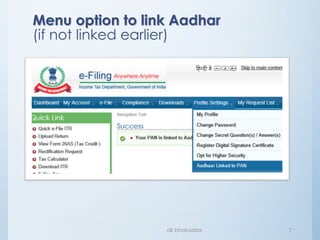

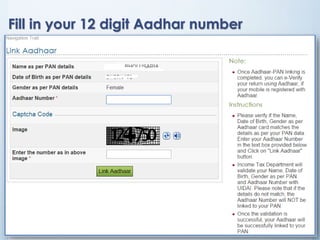

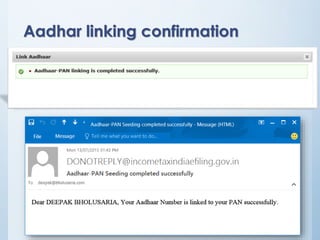

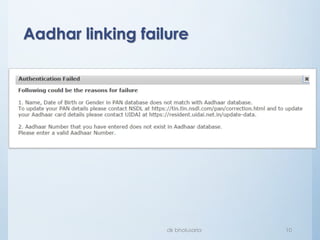

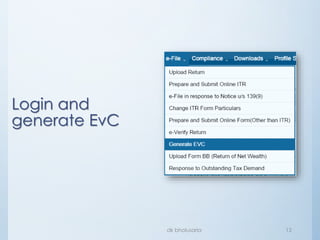

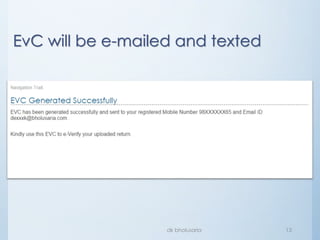

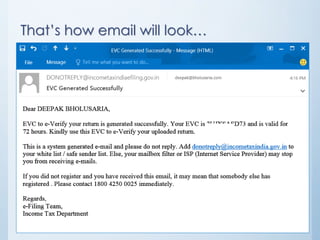

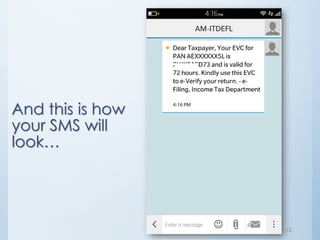

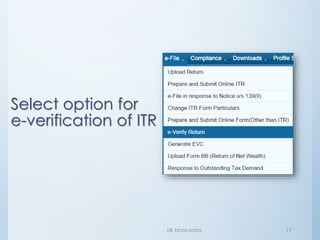

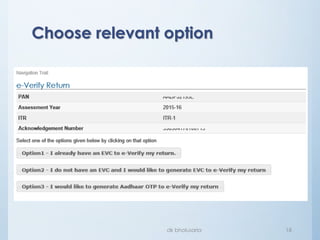

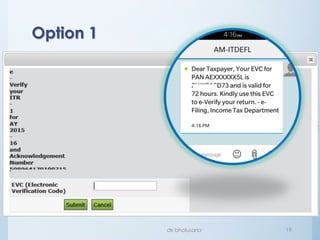

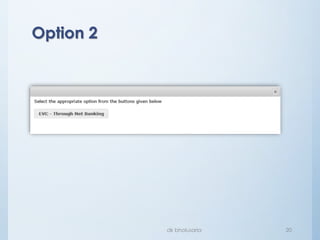

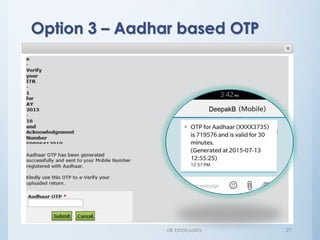

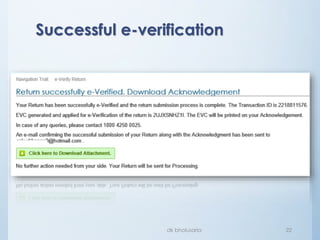

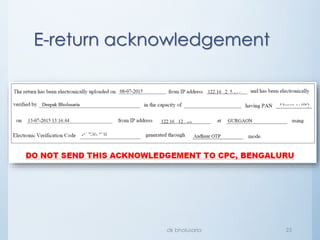

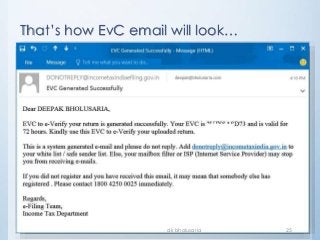

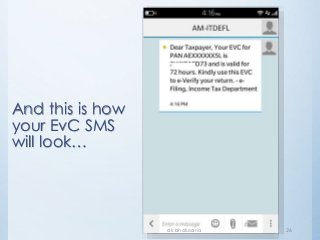

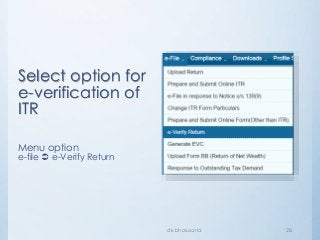

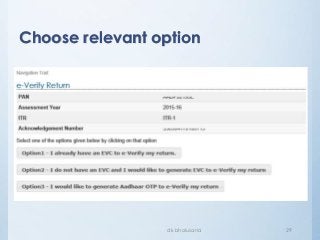

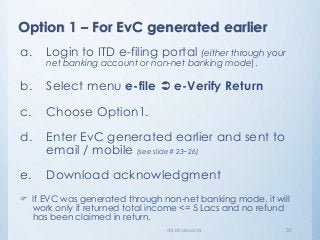

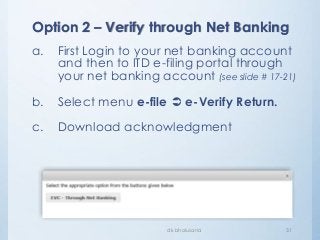

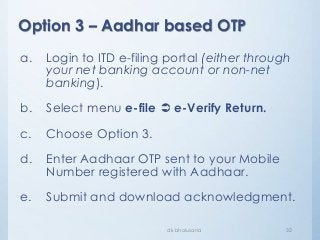

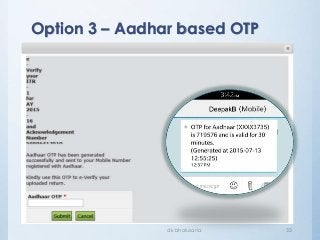

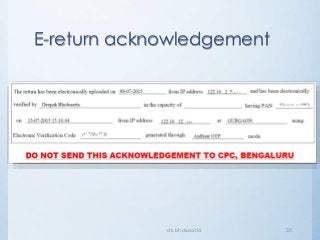

This document provides an overview of electronic verification codes (EVC) for e-verifying income tax returns in India. It discusses that EVC is a unique code linked to a person's PAN that is generated for e-verifying their income tax return. The document outlines different methods for generating EVC, including through Aadhaar number, net banking, or directly from the income tax portal. It also explains how to link a PAN to Aadhaar and use the various EVC methods to e-verify a filed income tax return within 72 hours of EVC generation.