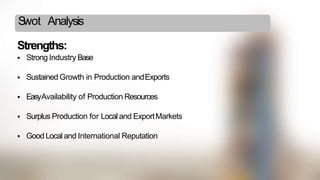

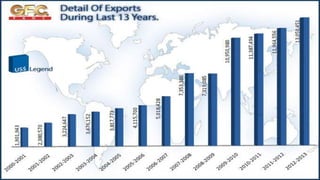

The document analyzes Pakistan's cement industry. It states that Pakistan has unlimited reserves of limestone and clay to support the cement industry for 50-60 more years. Pakistan is among the world's fastest growing construction markets and cement demand is predicted to grow 12% annually over the next five years due to CPEC projects. The cement sector aims to further increase capacity to capitalize on Chinese-financed infrastructure projects across Pakistan. Statistics are provided on production capacity, local dispatches, exports, capacity utilization, and surplus capacity for Pakistan's cement industry from 2008-2009 to the first half of 2017-2018.