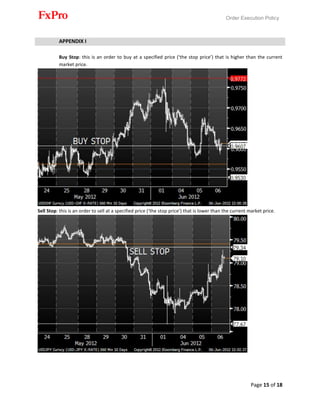

This document outlines FxPro UK Ltd's Order Execution Policy. It details FxPro's best execution obligations and how it executes different order types for its clients on the MetaTrader 4, MetaTrader 5 and cTrader platforms. The policy covers factors like price, costs, speed and likelihood of execution that FxPro considers when obtaining best execution. It also lists the execution venues and third party liquidity providers that FxPro uses to execute client orders.