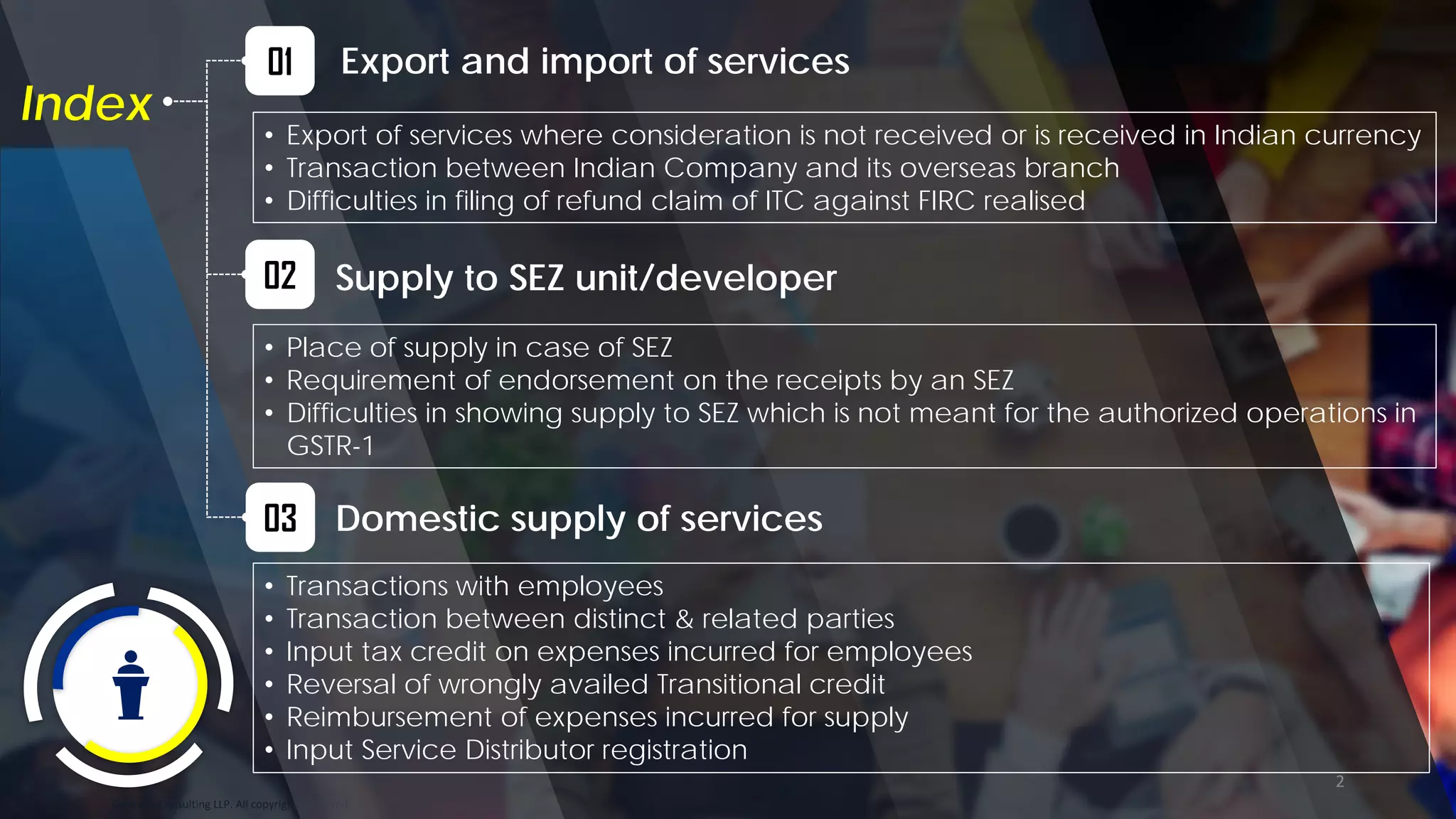

The document summarizes several hot button topics under the Goods and Services Tax (GST) in India, including:

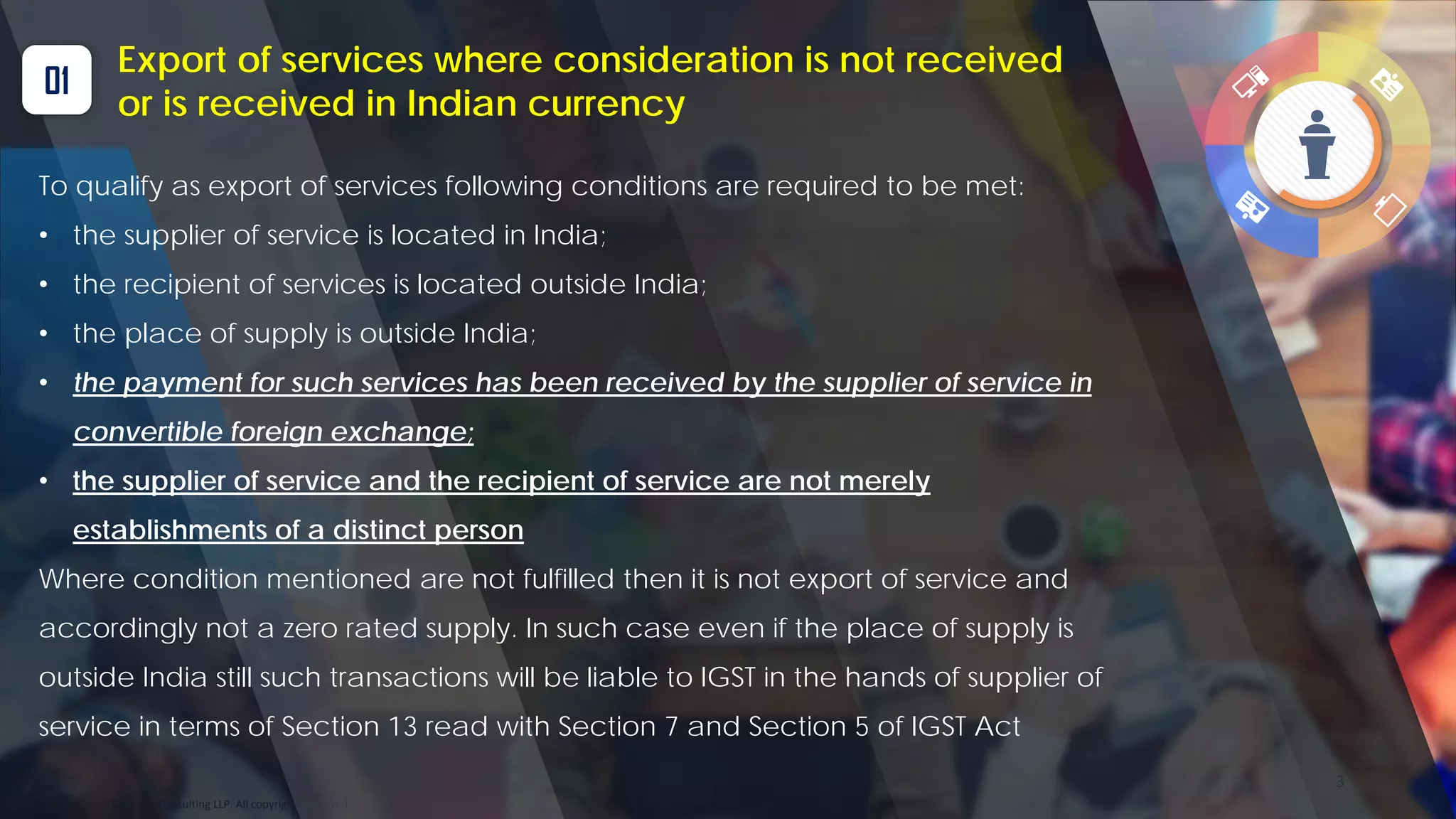

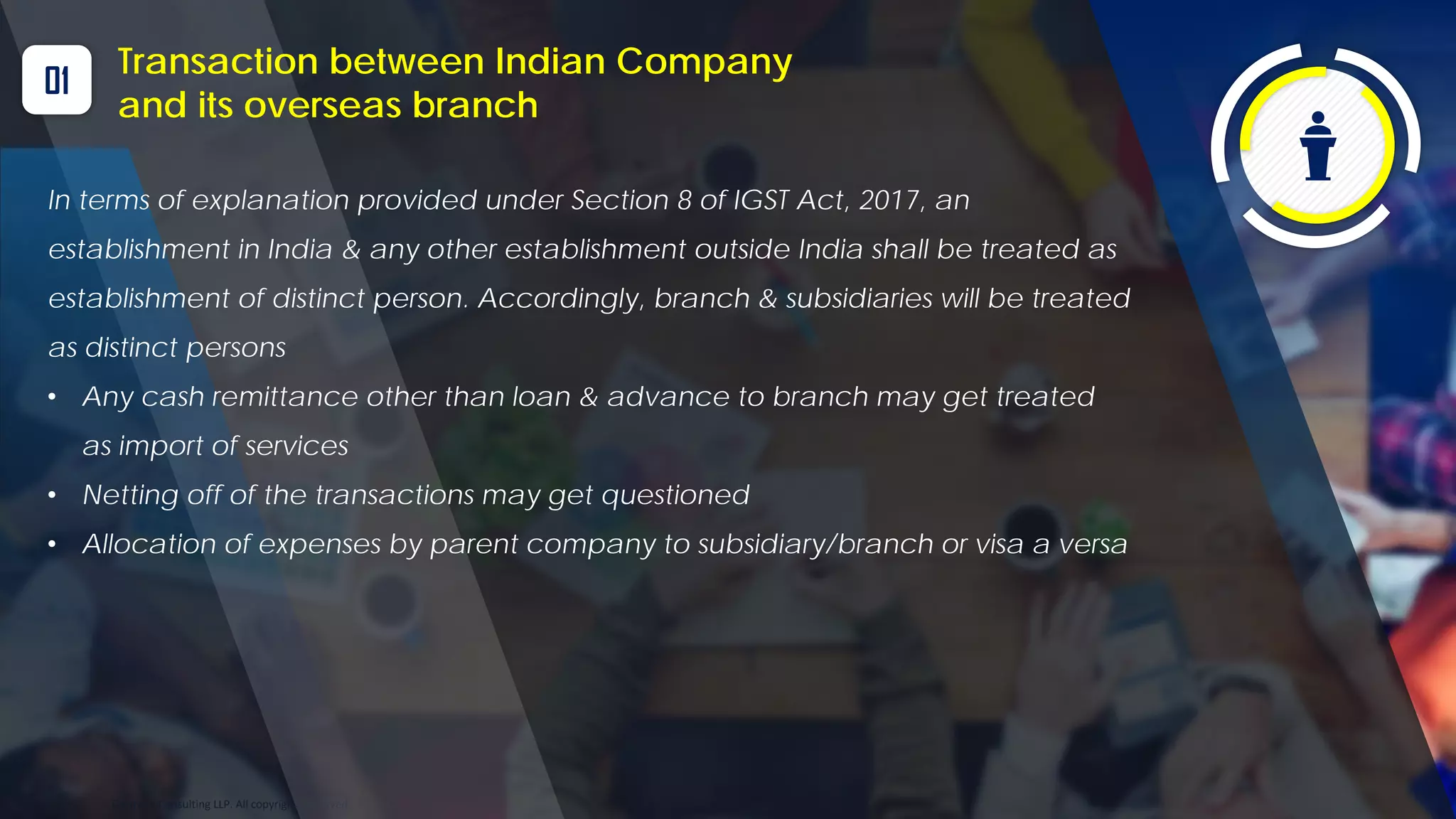

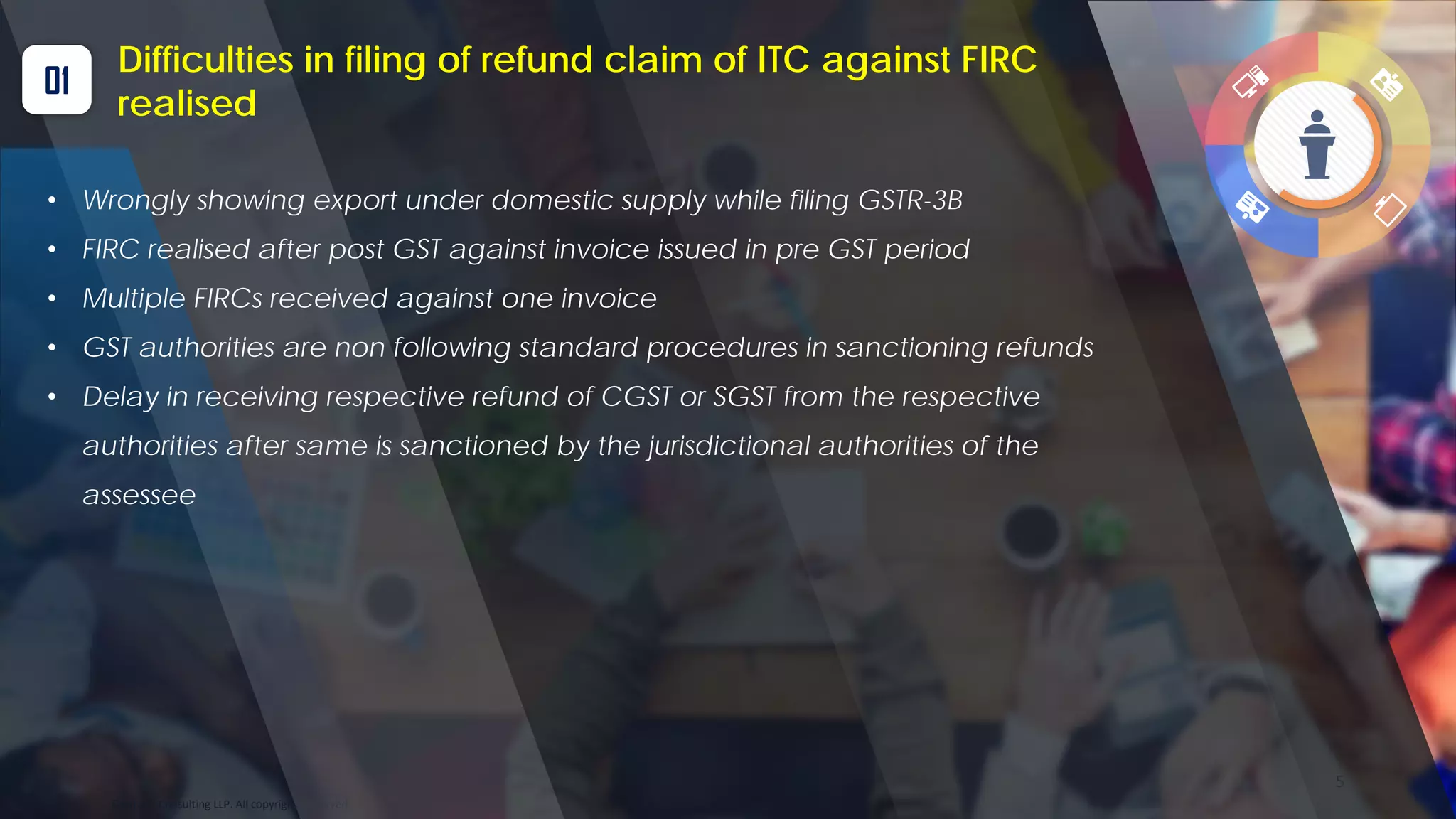

1) Export and import of services, and difficulties with claiming refunds of input tax credits against foreign inward remittances realized.

2) Supply of services to Special Economic Zones, and issues with determining place of supply and obtaining required endorsements on receipts.

3) Transactions with employees, between distinct and related parties, and claiming input tax credits on employee-related expenses.

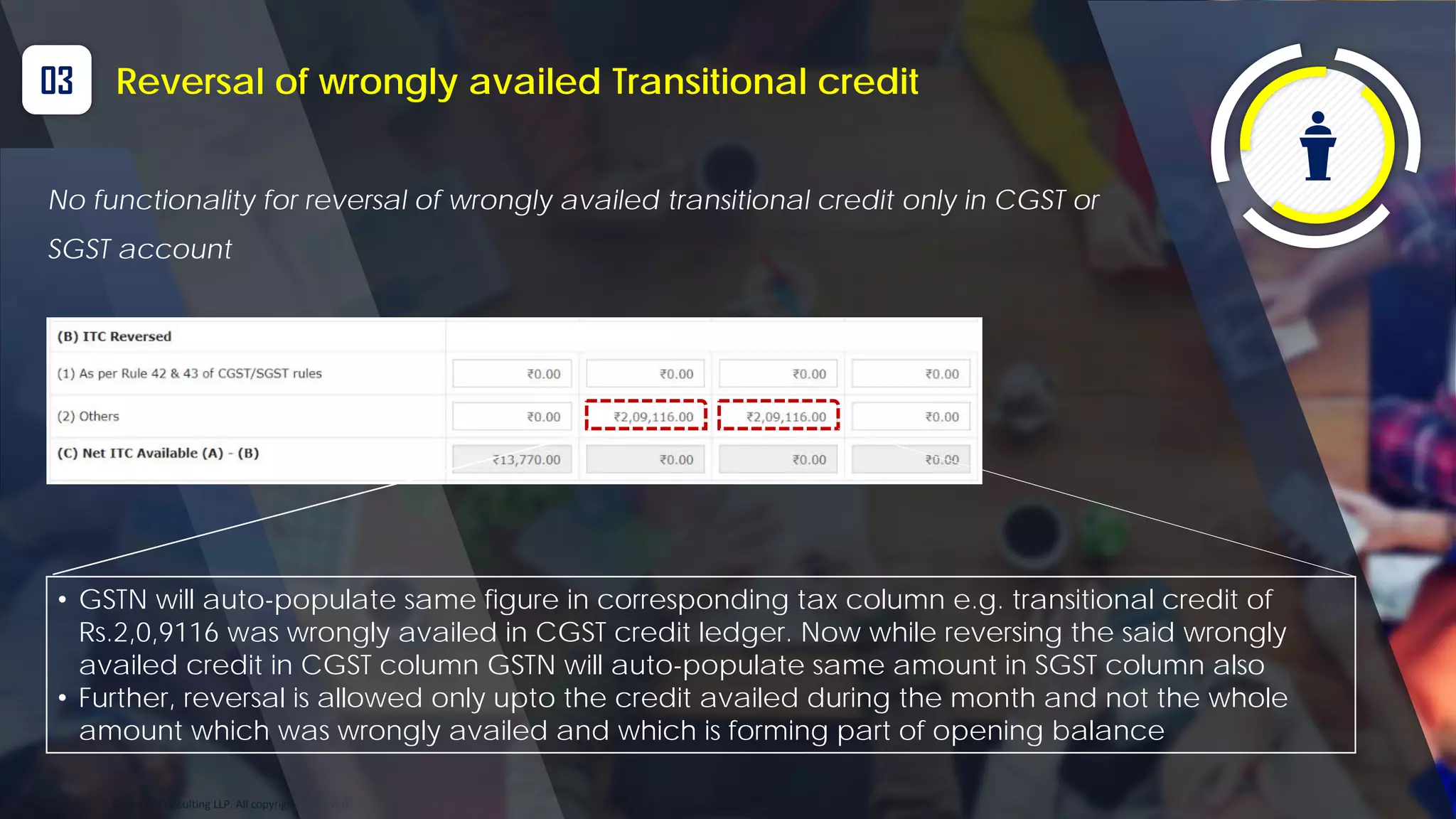

4) Reversal of wrongly availed transitional input tax credits under GST.