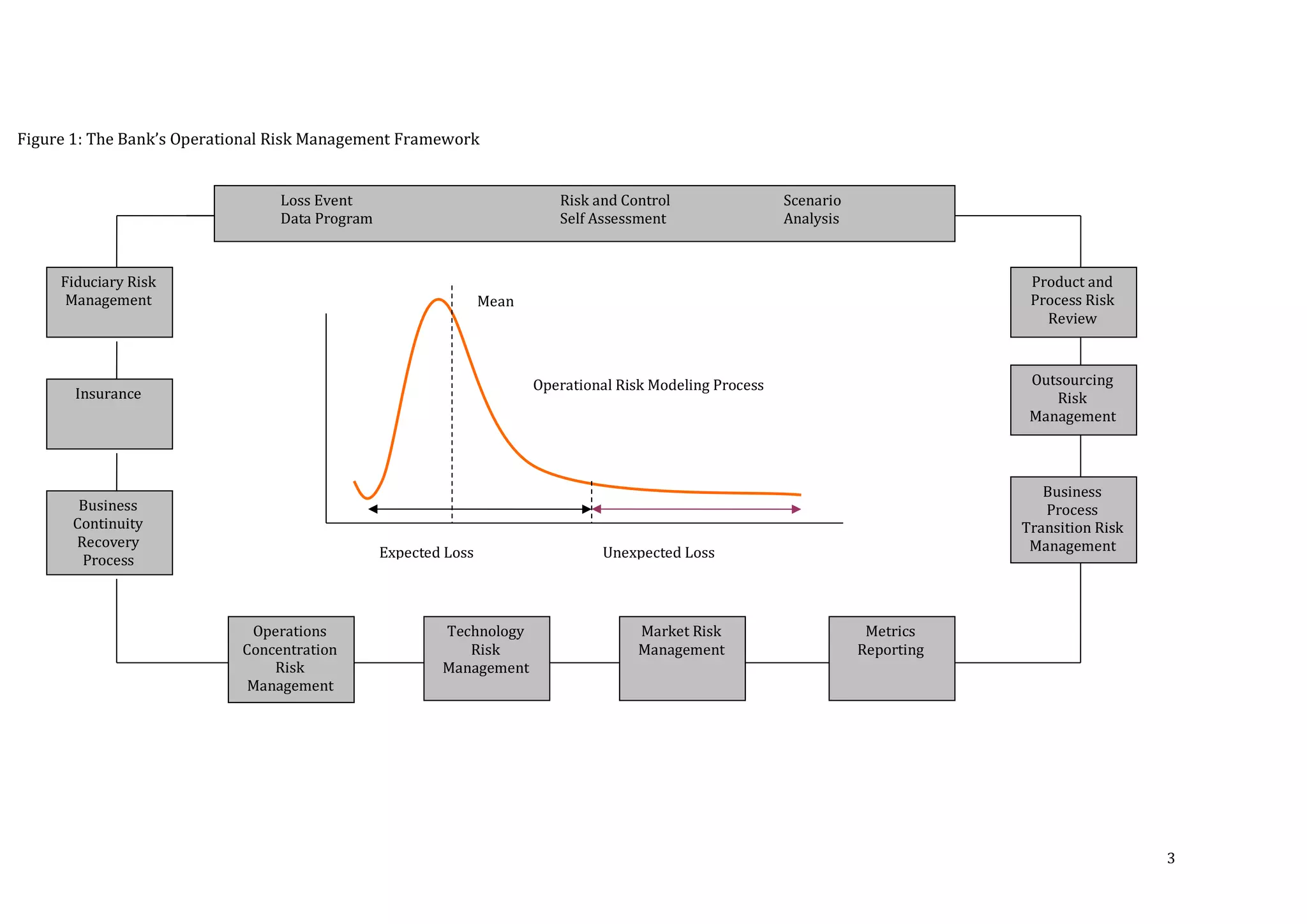

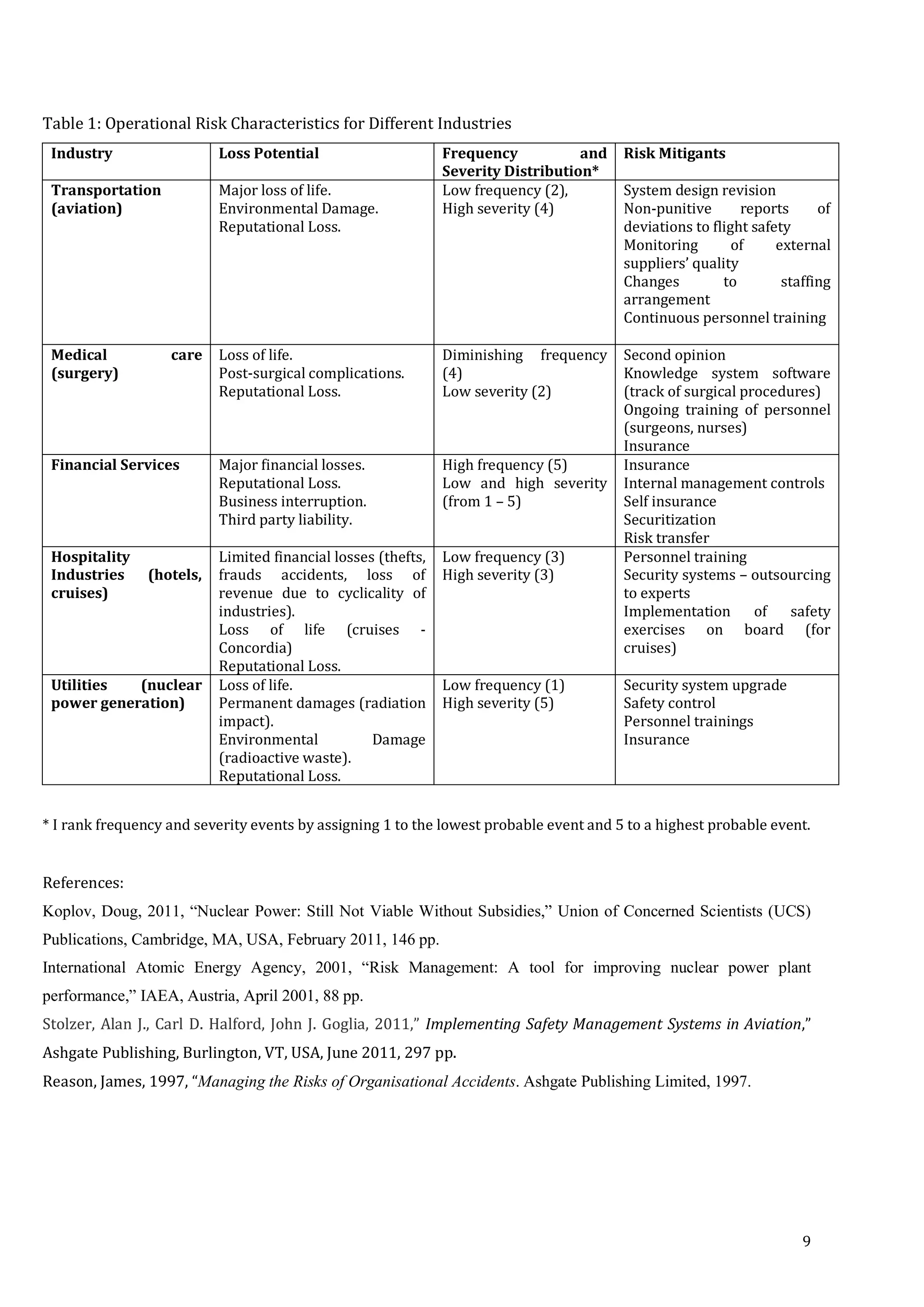

The document discusses operational risk within the financial services industry and the Bank's operational risk management framework. It describes how the Bank identifies and manages operational risks through processes like risk control self-assessments and collecting operational loss event data. It provides an influence diagram showing factors that could lead to human errors in the Bank's risk management department. It also briefly compares sources of operational risk across different industries like transportation, focusing on factors like reputational, financial, and legal losses.