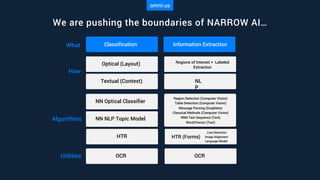

The document discusses the impact of AI on the insurance industry within the context of Industry 4.0, emphasizing the transformation towards data-driven processes and cognitive claims handling. It highlights the unique advantages of the omni:us team in developing AI solutions for insurance, supported by extensive document access and collaborations with leading research centers. The presentation concludes with a call for partnerships to embrace AI and drive digital transformation in insurance, aiming for improved speed, transparency, and personalization.

![Why we can bet confidentially.

Unfair Advantage

We have unique access to millions of highly variable documents & types to train our AI modules.

Scalable Approach

§ Our production grade tech

platform can run, train, predict,

validate and re-train workflows

for any AI task.

§ Closed & fast feedback loops

§ Easy deployment into existing

system landscape without

interfering with daily operations

§ Small training sets required for

deployment

+[

Pre-trained AI Modules

§ Document Classification, Page

Classification, Entity Recognition,

Template Alignment &

Handwritten Text Recognition

§ High variety of different insurance

document classes: car & health

invoices, policies, e-mails, forms,..

(details see appendix)

§ Transfer learning capabilities

§ Advanced ground truthing,

validation & model versioning

system

+ ]

World-Class AI

Ecosystem

§ Decades of internal team

Machine Learning expertise

§ Exclusive collaboration with leading

research center for Computer Vision

(CVC Barcelona)

§ MIT Media lab collaboration

§ 250+ publications & papers

x](https://image.slidesharecdn.com/omniusnoah19ber-200419114015/85/Omni-us-NOAH19-Berlin-19-320.jpg)