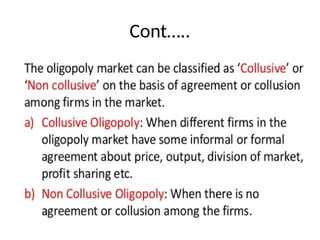

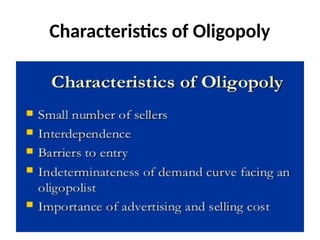

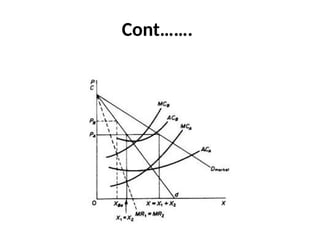

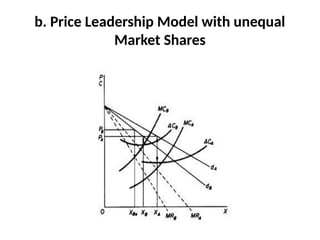

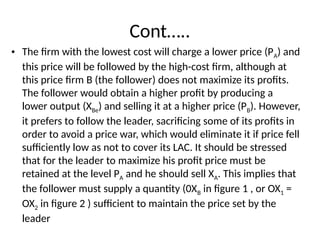

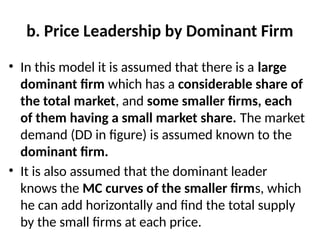

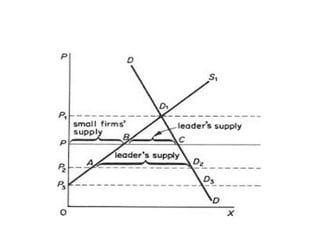

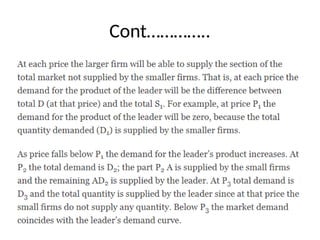

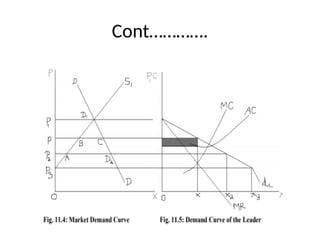

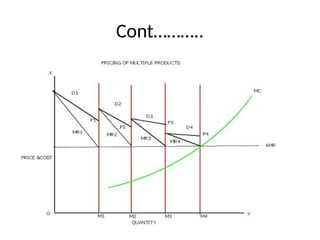

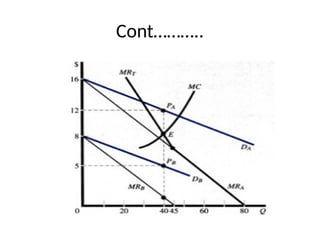

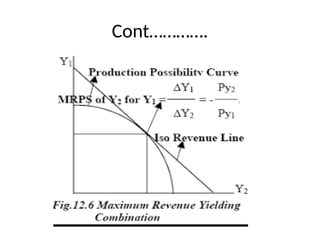

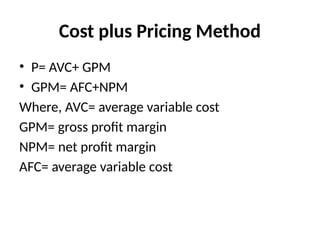

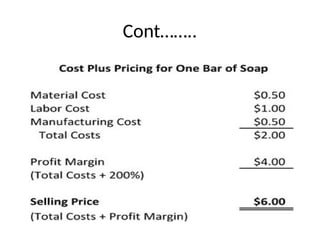

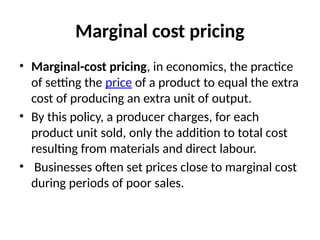

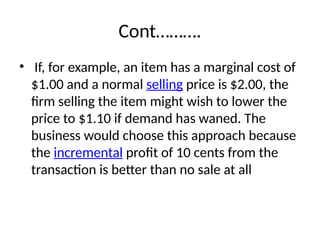

The document discusses the characteristics and dynamics of oligopoly markets, highlighting key features such as few sellers, barriers to entry, interdependence among firms, and price rigidity. It also elaborates on price leadership models, including those by low-cost and dominant firms, as well as multiple product pricing and joint product pricing strategies. Additionally, concepts like cost-plus pricing and marginal cost pricing are summarized, outlining how firms strategically set prices based on costs and market conditions.