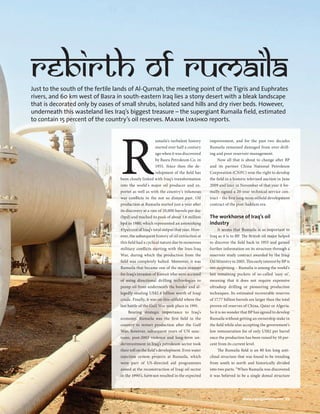

The document outlines BP's significant role in developing Iraq's Rumaila oil field, which is one of the largest in the world and crucial to Iraq's economy. Following a historic contract signed in 2009, BP and its partners plan to increase production from 1 million to 2.85 million barrels per day within six years, involving an investment of $15 billion. Despite various challenges, the development of Rumaila is seen as a key factor in Iraq's post-war reconstruction and potential rise as a major oil producer.