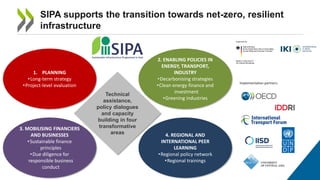

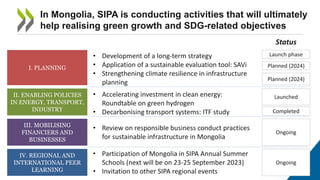

1) The document discusses a public-private roundtable on developing green hydrogen production in Mongolia for sustainable infrastructure.

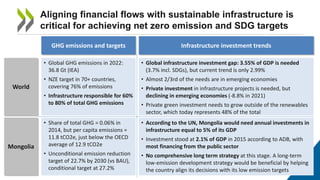

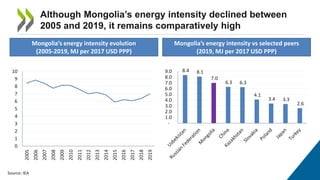

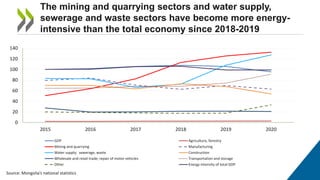

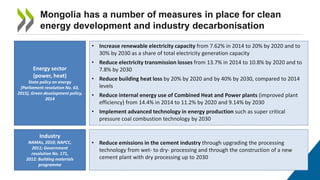

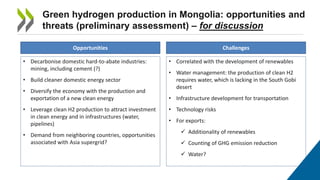

2) Mongolia has opportunities to develop green hydrogen from its renewable energy potential but faces challenges around infrastructure, technology, and ensuring additionality of emissions reductions.

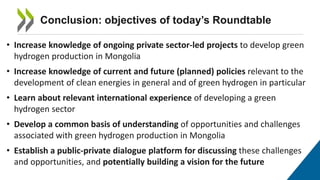

3) The roundtable aims to increase knowledge of green hydrogen projects in Mongolia, relevant policies, international experience, opportunities and challenges, and establish an ongoing public-private dialogue on developing a vision for a green hydrogen sector.