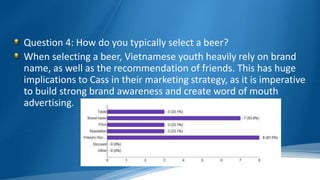

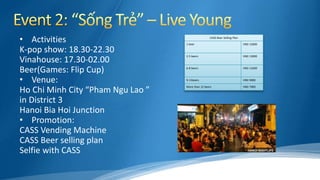

This document provides a marketing plan to introduce the Cass beer brand from Oriental Brewery to Vietnamese youth. It begins with an overview of Oriental Brewery and the Cass product line. Market research on Vietnam identifies Hanoi and Ho Chi Minh City as prime targets due to consumer demographics and trends. A survey of Vietnamese youth reveals social media and events as key areas for branding. The plan proposes launching sampling activities at universities and malls, sponsoring concerts and games, and utilizing guerilla marketing tactics like mobile stalls. The goal is to increase Cass awareness and trial among young Vietnamese.