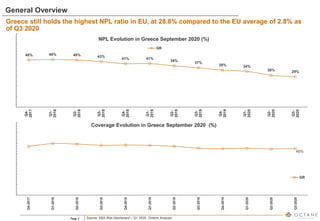

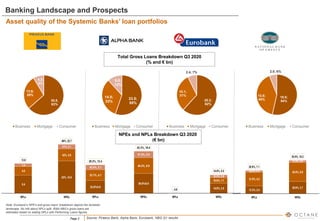

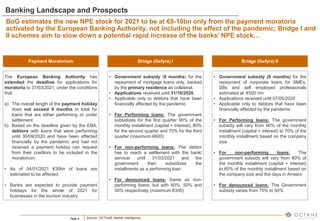

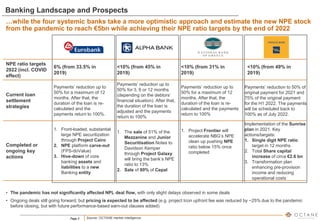

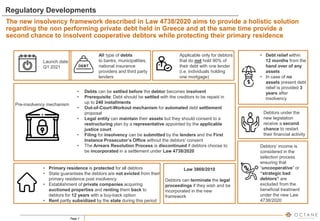

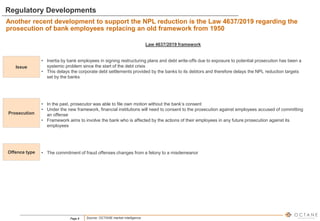

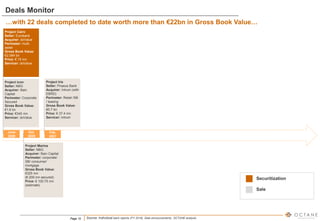

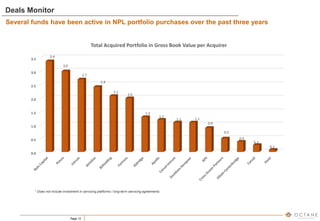

Greece has the highest non-performing loan (NPL) ratio in the EU at 28.8% as of Q3 2020, compared to the EU average of 2.8%. The four largest Greek banks aim to reduce their NPL ratios to under 10% by 2022. New laws have been introduced to facilitate the resolution of private debt and protect debtors' primary residences, while providing debt relief and a fresh start. Several large NPL portfolio sale and securitization deals have taken place in recent years to help banks accelerate the reduction of their NPLs.