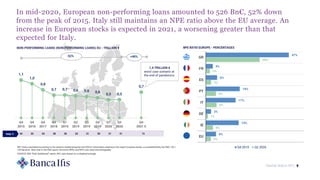

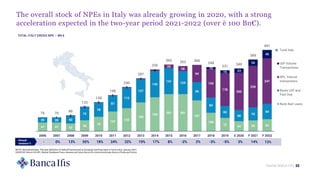

1) The document analyzes the Italian NPL market and servicing industry, providing forecasts for 2021-2022. It finds that government support measures, the Next Generation EU plan, the duration of the pandemic and vaccination rollout will impact the economic scenario.

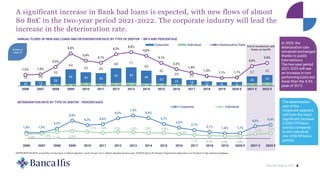

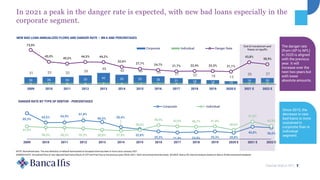

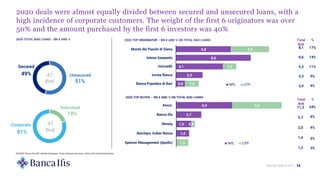

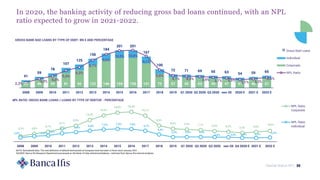

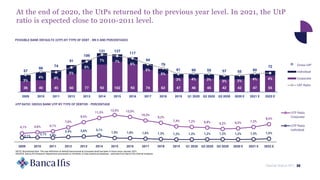

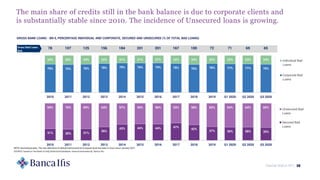

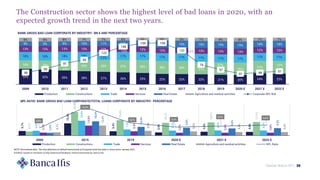

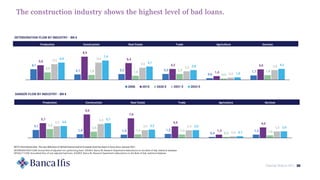

2) The stock of bank bad loans is expected to increase significantly over 2021-2022, with new flows of around €80 billion. The corporate sector will lead the rise in default rates.

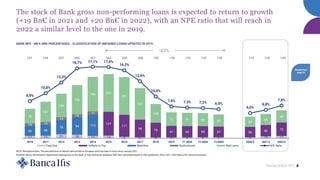

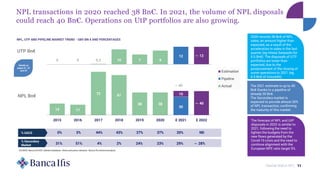

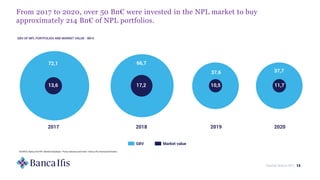

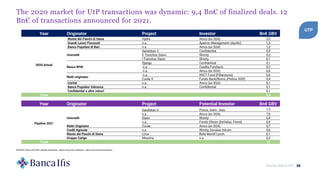

3) The NPE ratio for banks is forecasted to reach 7.8% in 2022, bringing the stock of gross NPLs back to growth levels, though still below peaks seen in earlier crises. Transaction volumes in the NPL market are also expected