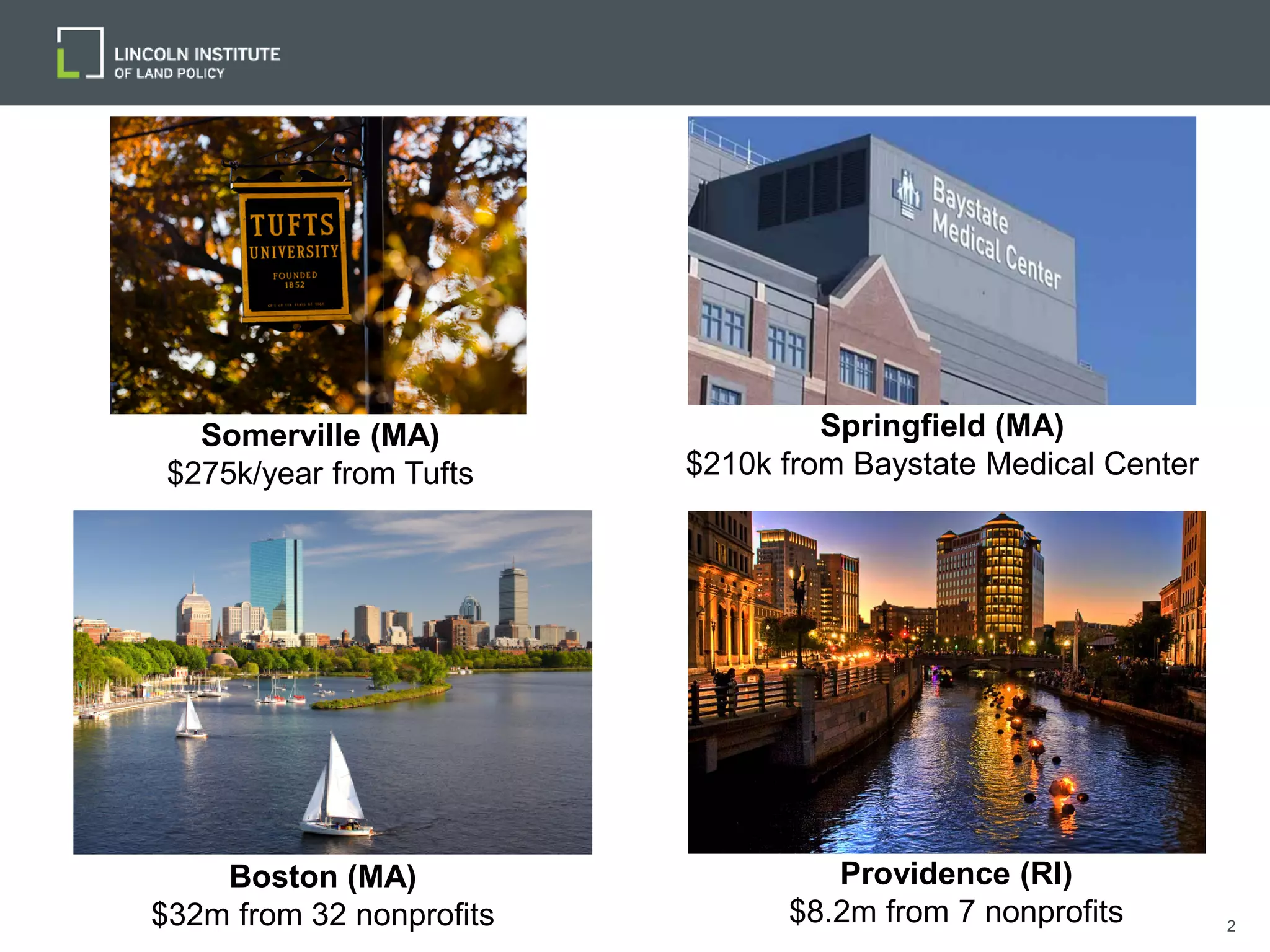

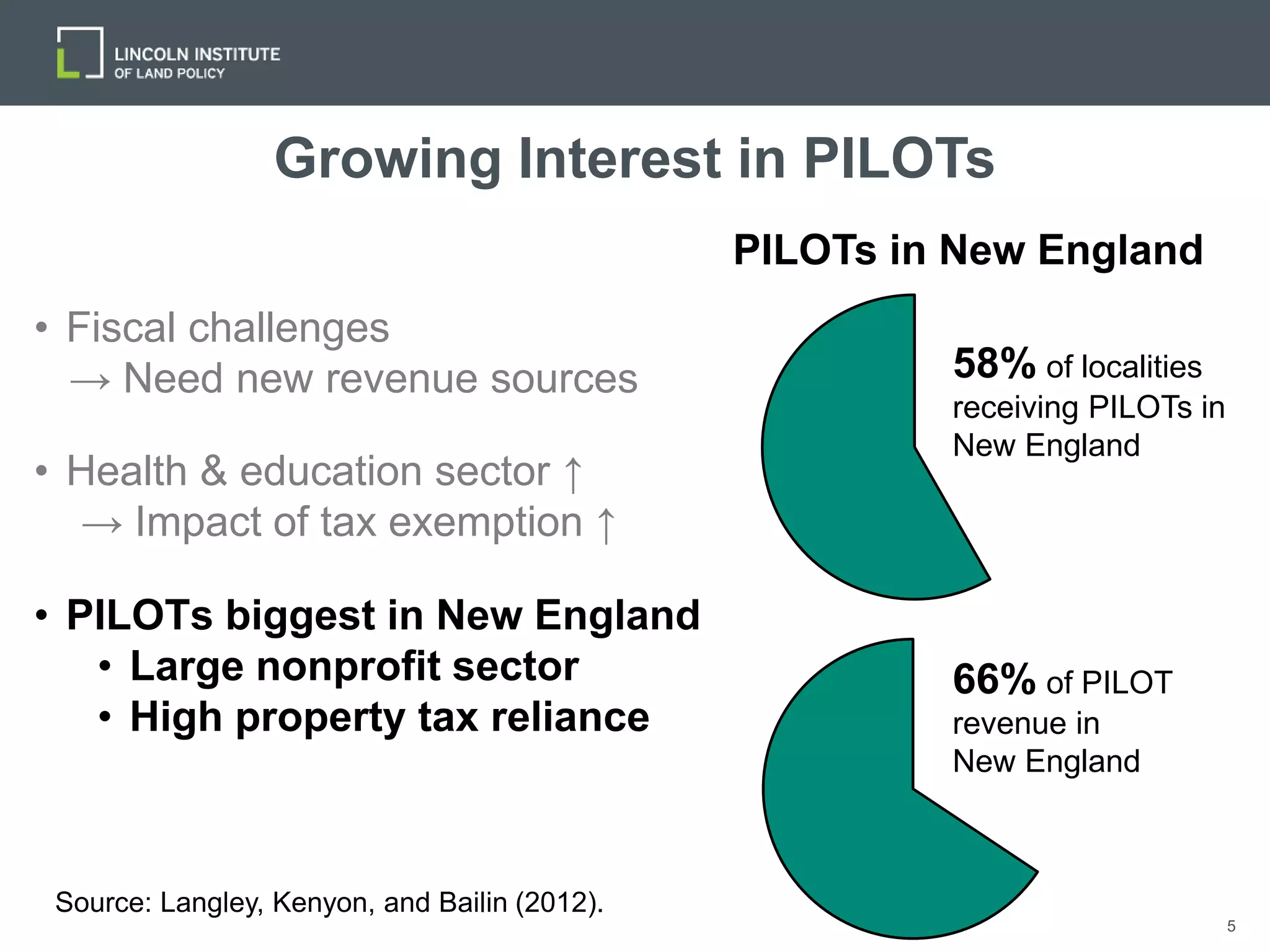

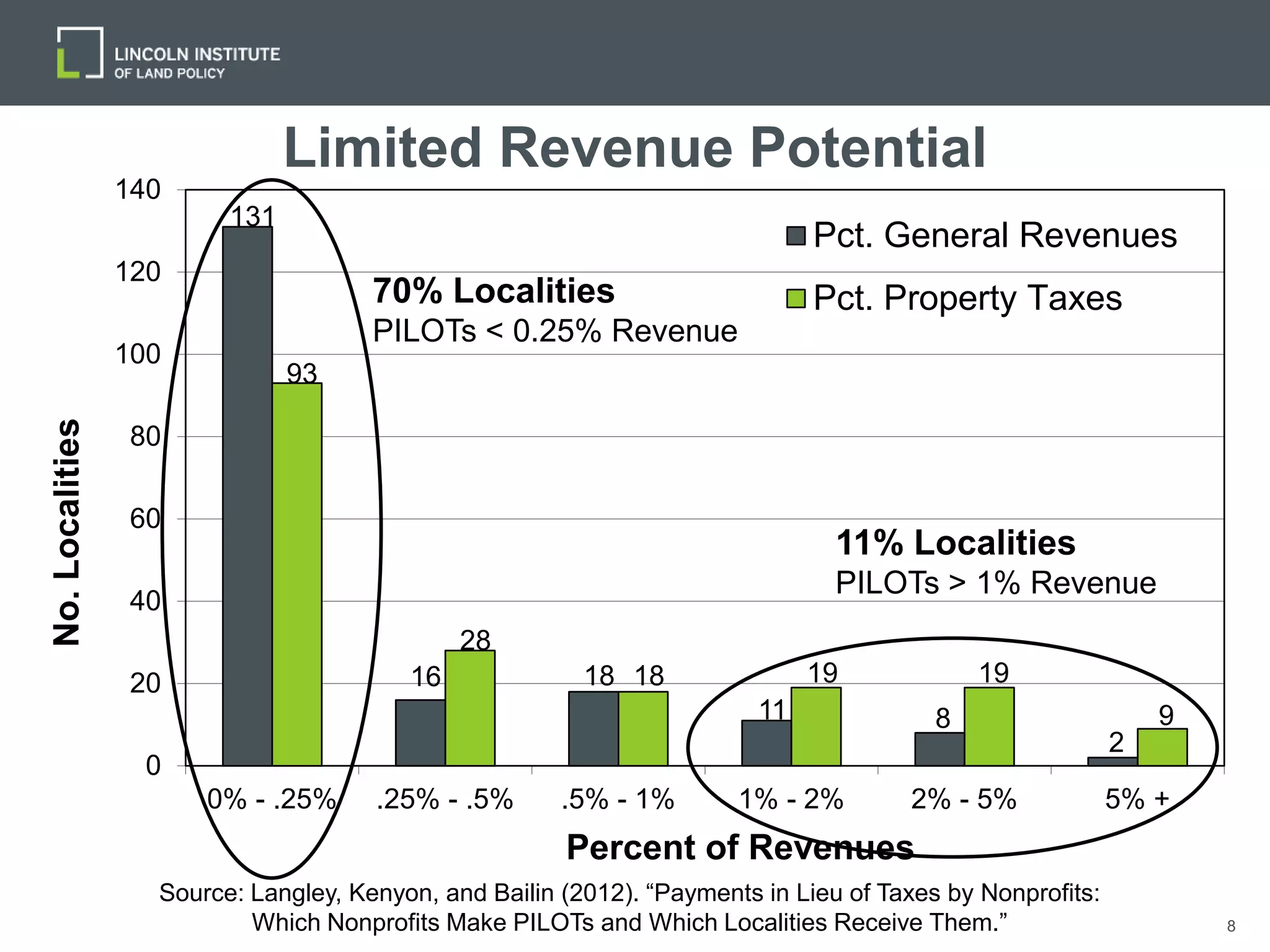

The document discusses the fiscal challenges faced by municipalities in New England regarding property taxes and the increasing interest in Payments In Lieu Of Taxes (PILOTs) from nonprofits. It presents arguments for and against PILOTs, emphasizing the need for collaborative approaches between local officials and nonprofits. Strategies for effective PILOT agreements include voluntary payments, justified amounts based on service costs, and earmarking funds for nonprofit priorities.