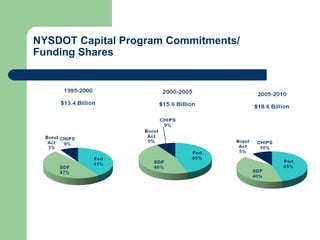

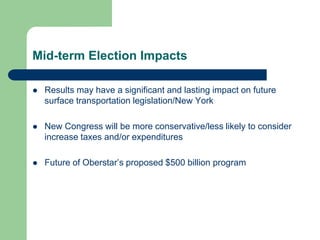

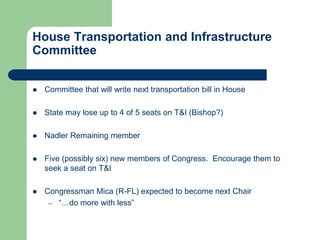

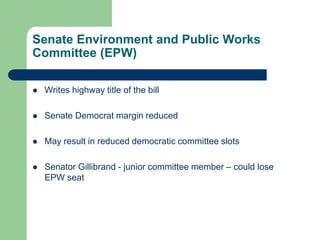

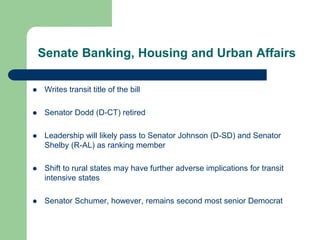

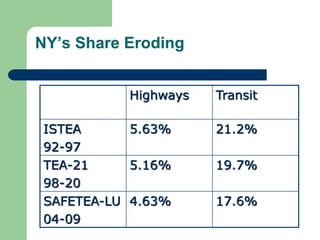

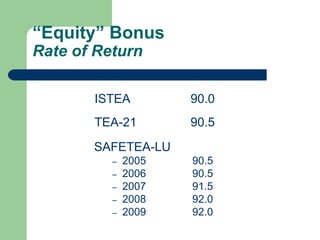

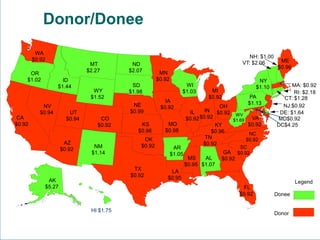

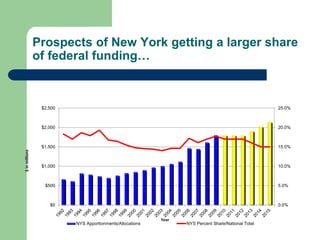

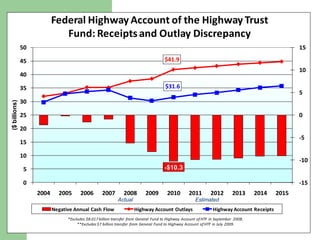

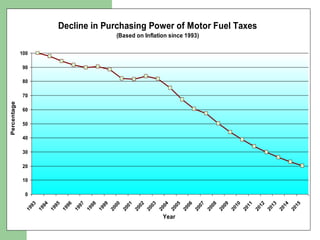

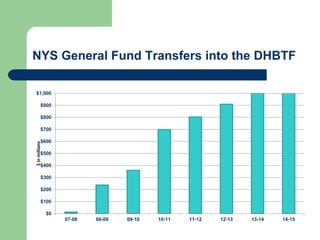

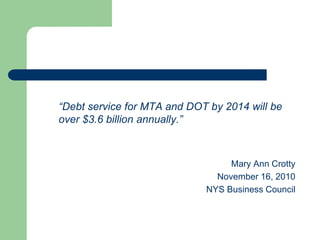

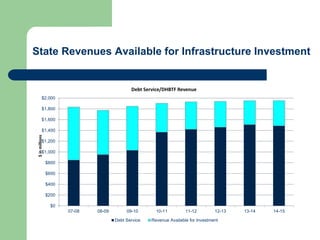

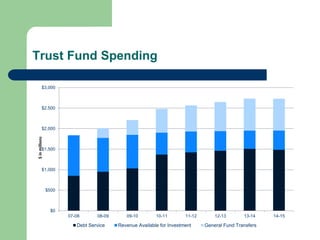

The document discusses the uncertain fiscal future for transportation infrastructure in New York State. It notes that the state currently lacks sufficient revenue to maintain its transportation system and has no credible strategy for meeting future needs. The session then discusses topics such as the current federal and state budget climates, the role of the federal government, and how best to generate required revenue for investment. It provides details on funding sources and commitments, declining federal shares for New York, increasing debt burdens, and the broken financial backbone of current transportation funding models. Overall, the document outlines serious challenges and uncertainties facing transportation infrastructure finance in New York.