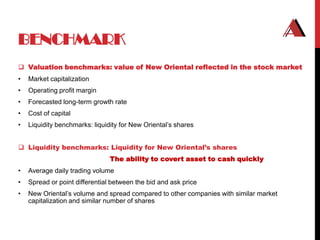

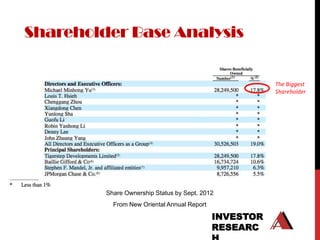

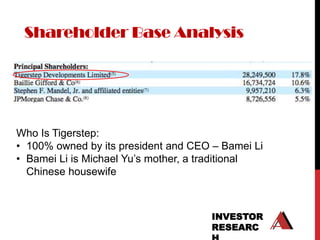

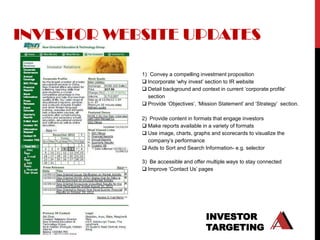

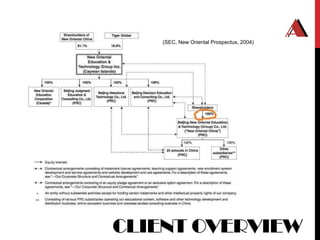

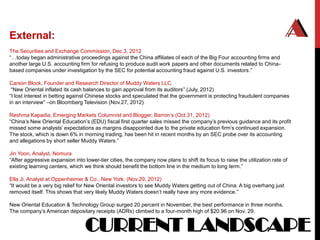

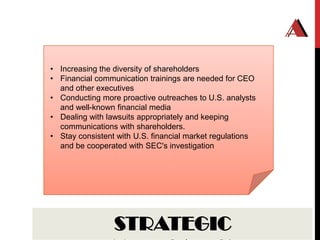

New Oriental Education & Technology Group Inc. is China’s largest private educational services provider, founded in 1993, focusing on language training and test preparations. The company faces challenges including SEC investigations and allegations of inflated cash balances, leading to stock price volatility despite strong growth in its lower-tier cities. The investor relations plan aims to improve market perception and transparency while enhancing engagement with diverse stakeholders and analysts.

![New Oriental Educational & Technology Group Inc.

[“New Oriental”]

• Founded: 1993 by Michael Yu,who is also current CEO

• Largest provider of private educational services in China

• Primarily of English and other foreign language trainings, test

preparations and primary & secondary school educations.

• 2.4 Million enrollments in fiscal year 2012

• IPO: September 7th, 2006

• NYSE: EDU

• IPO Price: $15

CLIENT OVERVIEW](https://image.slidesharecdn.com/jour599-neworientalirplan-130325022245-phpapp02/85/New-Oriental-Investor-Relations-Plan-3-320.jpg)

![GOALS

Create Fair Market Value For New Oriental To Make Sure Its

Current Stock Price Accurately Reflect The True Value Of

The Company.

[Stock Price]= [Performance] + [Perception]

Performance Variables: Perception Variables:

• Revenue growth • Management credibility

• Earnings growth • Corporate reputation

• Return on investment • Customer loyalty

• Cash flow • Brand image

• Balance sheet strength • Employee commitment

• Dividend yield

• Liquidity](https://image.slidesharecdn.com/jour599-neworientalirplan-130325022245-phpapp02/85/New-Oriental-Investor-Relations-Plan-11-320.jpg)