New base 1036 special 30 may 2017 energy news

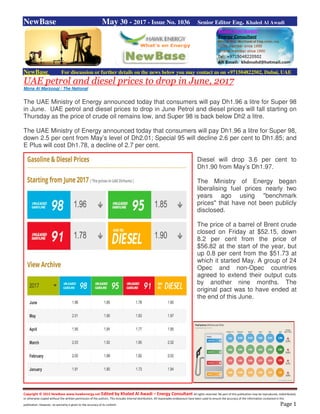

- 1. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 1 NewBase May 30 - 2017 - Issue No. 1036 Senior Editor Eng. Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE UAE petrol and diesel prices to drop in June, 2017 Mona Al Marzooqi / The National The UAE Ministry of Energy announced today that consumers will pay Dh1.96 a litre for Super 98 in June. UAE petrol and diesel prices to drop in June Petrol and diesel prices will fall starting on Thursday as the price of crude oil remains low, and Super 98 is back below Dh2 a litre. The UAE Ministry of Energy announced today that consumers will pay Dh1.96 a litre for Super 98, down 2.5 per cent from May’s level of Dh2.01; Special 95 will decline 2.6 per cent to Dh1.85; and E Plus will cost Dh1.78, a decline of 2.7 per cent. Diesel will drop 3.6 per cent to Dh1.90 from May’s Dh1.97. The Ministry of Energy began liberalising fuel prices nearly two years ago using "benchmark prices" that have not been publicly disclosed. The price of a barrel of Brent crude closed on Friday at $52.15, down 8.2 per cent from the price of $56.82 at the start of the year, but up 0.8 per cent from the $51.73 at which it started May. A group of 24 Opec and non-Opec countries agreed to extend their output cuts by another nine months. The original pact was to have ended at the end of this June.

- 2. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 2 Oman :OPWP plans “Request for Proposals” (RfP) this year of its first private power project, Manah, IPP power station. Oman Observer - Conrad Prabhu A competitive process for the sale of the Manah Independent Power Project (IPP) — the first-ever privately procured power plant in the Sultanate, and indeed in the wider Middle East — is expected to commence before the end of this year, according to state-owned power procurement utility Oman Power and Water Procurement Company (OPWP). The 264-megawatt (MW) plant in Al Dakhiliyah Governorate, owned and operated by United Power Co, transfers to government ownership in April 2020 upon the conclusion of the current Power Purchase Agreement. Unlike all of the Independent Power Projects (IPPs) that followed in the wake of Manah — a trailblazer at the time in private-led power sector investment — Manah IPP was developed under the ‘Build-Own-Operate-Transfer (BOOT)’ model. Ownership of the asset reverts to the government in less than three years — a transfer that is also a first for the national power industry. “OPWP is currently evaluating the options available toward continuing operations at the Manah IPP after asset ownership transfers to the government in April 2020. OPWP expects to issue a tender in 2017 for sale of the asset, supported by a Power Purchase Agreement (PPA) with OPWP,” the utility said in its newly published 7-Year Outlook Statement. As a first step in the sale of the asset, OPWP plans to issue a Request for Proposals (RfP) in the fourth quarter of this year, it noted. A new PPA will allow for the continued operation of Manah IPP well beyond the expiry of the current contract with OPWP in April 2020. Significantly, contracts governing the operation of at least two other privately procured power plants are up for extensions. Al Kamil IPP, a 280 MW power plant in Sharqiyah South Governorate, will receive a three-year contract extension to December 2021 pending final approval by the government. Likewise, OPWP has finalised negotiations with the Barka Independent Power and Water Project (IWPP) for an extension of the contract covering the power generation component of the plant. Under the new agreement, around 388 MW of generation capacity will be available in combined cycle generation mode beyond the expiry of the current contract in April 2018 to December 2021. However, the plant’s water desalination capacity, which is based on old-style multi-stage flash (MSF) technology, will not be tapped as part of the deal. Peak power demand in the Main Interconnected System (MIS), covering much of the northern half of the Sultanate, is projected to grow at an average rate of about six per cent annually to 8,960 MW in 2023, up from 5,920 MW in 2016. “This growth rate, lower than previous forecasts, reflects economic trends and the introduction of cost reflective tariffs to large consumers. Energy consumption is expected to grow at 7 per cent per year,” says OPWP. In 2016, average demand grew by a modest 3.9 per cent compared to previous years.

- 3. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 3 Oman: Exploration focus on low unit technical cost opportunities Oman Observer - Conrad Prabhu Majority government-owned oil and gas producer Petroleum Development Oman (PDO) is harnessing cutting-edge seismic data acquisition technology to explore and build a portfolio of oil and gas assets designed to help sustain production over the long-term. In its sights are “low unit technical cost opportunities” that will help the company meet its production targets over the coming 10 years, PDO said in its 2016 Sustainability Report. The strategy, spearheaded by the Exploration Directorate, helped uncover a total of 86.4 million barrels of oil, 0.45 trillion cubic feet (Tcf) of non-associated gas (NAG) and 24.3 million barrels of condensate in Commercial Contingent Resources (CCR) in 2016. A notable highlight of PDO’s oil maturation programme was a project targeting the Shammar play in the north of its Block 6 licence. It helped unlock 40 million barrels of CCR volumes from the shallow reservoir in the Lekhwair field. A development plan due to commence this year calls for the drilling of four wells in the area. Also significant was the Qarn Alam- Raba discovery that was appraised last year, according to PDO. “Exploration wells drilled showed initial production flow rates of up to 560 barrels per day (bpd) and a total volume of 27 million barrels of CCR was booked,” it noted in its Sustainability Report. On the gas maturation front, the accent is on “balancing short-term demand with long-term growth”. Key to this goal has been the use of high quality 3D Wide Azimuth (WAz) seismic data to explore various plays and thereby support the creation of a diversified portfolio, says PDO. Noteworthy was the Tayseer-Ara discovery leading to 0.45 Tcf of non-associated gas and 24.3 million barrels of booked condensate CCR reserves. “The opportunity was unlocked on the basis of newly acquired seismic data that targeted the South Oman Salt Basin as part of the portfolio diversification efforts,” said PDO.

- 4. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 4 Production is planned via the implementation of an Early Development Facility (EDF) involving an additional well with a capacity of one million m3/day of gas, due to come on stream in 2019. A key factor in the success of PDO’s oil and gas maturation efforts has been the deployment of superior seismic data gathering technology in the exploration of new resources, as well as development of production assets. Leading the effort is the Exploration Directorate which has been operating a ‘mega’ seismic crew complement of around 700 staff and more than 200 vehicles to gather seismic data using high- end 3D Wide Azimuth seismic gathering technology. “The quality of the seismic data has also made possible quantitative interpretation of the data. All these factors facilitated the mapping of opportunities, some of which have not been seen before,” said the report. This year, the main focus for the Exploration Directorate will be to “deliver more for less”. “Early monetisation will continue to be pursued where possible along with any value creation opportunities. Efforts will mainly target rebuilding the portfolio to generate attractive drill-worthy segments that could support PDO’s growth and stability,” the report added.

- 5. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 5 Greece to open up onshore oil and gas prospects in 2018 licensing authority - By Karolina Tagaris | ATHENS Greece will begin the process of opening up new onshore oil and gas prospects to exploration next year, the chief executive of the country's oil and gas resources management company said on Monday. Among the first will be the Greek region of Grevena, close to where the Trans Adriatic Pipeline (TAP) will cross, Yannis Bassias, head of the Hellenic Hydrocarbons Resources Management (HHRM), told Reuters in an interview. TAP, which will bring new gas supplies from Azerbaijan to Italy, runs across northern Greek territory. "As of next year, and perhaps earlier, we will begin announcing that we are opening the door to whoever is interested in onshore sites, " Bassias told Reuters. HHRM, an independent body, would start compiling data packages for Grevena and central regions too, he said. Greece has launched an ambitious program to discover more oil and gas, encouraged by the recent big large gas finds offshore Israel and Cyprus and spurred on by its protracted financial crisis. Last week it granted a concession to Greece's Hellenic Petroleum for onshore exploration at two sites in the west of the country, and to privately-held Energean for another block. Energean is currently the country's only offshore oil producer, in northeastern Greece, with an average production of 3,500 barrels per day last year. Bassias said he expected the first new offshore and onshore drillings to begin in two years, provided bureaucratic hurdles were overcome. He was also confident that firmer crude prices and a more stable political climate in Greece would attract prospectors to the remaining 17 of 20 blocks in the Ionian Sea and south of Crete which were unsuccessfully offered in 2014. "We've seen all the big companies, and medium-sized ones too. Its inconceivable to not have companies express interest in the coming months in sites which were not leased during the previous bid round in 2014," Bassias said. HHRM, tasked with finding investors, overseeing licences and monitoring the implementation of exploration and exploitation agreements, would not be launching new license bidding rounds for those blocks, Bassias said. Instead, it was in talks with firms for so-called "investors' initiatives." "We are optimistic because these are high risk, high reward regions," he said.

- 6. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 6 NewBase 30 May 2017 Khaled Al Awadi NewBase For discussion or further details on the news below you may contact us on +971504822502 , Dubai , UAE Strong start to summer driving season pushes US oil towards $50 Reuters + NewBase U.S. crude oil prices rose towards $50 per barrel on Tuesday as a strong start to the summer driving season in the United States suggested strong fuel demand in months ahead. U.S. demand for transport fuels such as gasoline used in cars and diesel in buses tends to rise significantly as families visit friends and relatives or go on vacation during the summer months, with the so-called summer driving season officially kicking off on the Memorial Day holiday at the start of this week. U.S. West Texas Intermediate (WTI) crude futures climbed above $50 per barrel in early trading on Tuesday, and were at $494.97 per barrel at 0032 GMT, still up 17 cents from their last settlement. The American Automobile Association (AAA) said ahead of Memorial Day that it expected 39.3 million Americans to travel 50 miles (80 km) or more away from home over the Memorial Day weekend. "That is 1 million more travelers than last year taking to the roads, skies, rails and water, creating the highest Memorial Day travel volume since 2005," the AAA said. With no such driving taking place in Asia or Europe at this stage, international benchmark Brent crude futures prices were not pushed up as strongly. The main price factor for Brent is whether a decision led by the Organization of the Petroleum Exporting Countries (OPEC) to extend a pledge to cut production by around 1.8 million barrels per day (bpd) until the end of the first quarter of 2018 will have the desired effect of significantly tightening the market to end years of oversupply. Oil price special coverage

- 7. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 7 An initial agreement, which has been in place since January, would have expired in June this year, and the production cutback has so far not had the desired effect of substantially drawing down excess inventories. Oil Rises Second Day as OPEC Cuts Seen Bringing Stockpiles Lower Oil rose on expectations OPEC will succeed in bringing down inventories as the summer driving season kicks off in the U.S. Futures climbed for a second session in New York after an OPEC-led deal to extend output limits through March was initially met with a selloff last week as deeper cuts or a plan for the rest of 2018 weren’t proposed. But Saudi Arabia’s Energy Minister Khalid Al-Falih said the strategy is working and stockpiles will drop faster in the third quarter. Many expect the driving season that’s starting with the Memorial Day holiday to help ease the glut. The cuts “will continue to help inventories draw through the summer,” said Craig Bethune, a fund manager at Manulife Asset Management Ltd. in Toronto who focuses on energy and natural resources investments. There is “modest recovery from the OPEC selloff the other day.” U.S. inventories have dropped seven weeks in a row in a sign Al-Falih may be right, though they still remain above the five-year average. To speed up that decline, Saudi Arabia plans to reduce exports to the world’s biggest consumer. The shale expansion that many fear will offset the Organization of Petroleum Exporting Countries’ efforts showed the first signs of slowing down last week, with the fewest rigs added this year, Baker Hughes Inc. data show. West Texas Intermediate for July delivery rose 19 cents, or 0.4 percent, to $49.99 a barrel as trading halted on the New York Mercantile Exchange around 1 p.m. Earlier, it touched $50.28.

- 8. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 8 There will be no settlement on Monday because of the holiday. Total volume was about 78 percent below the 100-day average. Prices fell 1.1 percent last week. Brent for July settlement rose 14 cents, or 0.3 percent, to $52.29 a barrel on the London-based ICE Futures Europe exchange, trading at a premium of $2.30 to WTI. The global benchmark crude fell 2.7 percent last week. “We believe the next big move for prices is up as oil inventories fall at an even faster pace in the coming weeks,” Giovanni Staunovo, a Zurich-based commodity analyst at UBS Group AG, said by email. While U.S. shale output is set for “robust growth” in the second half of the year, “we see the oil market tightening further in the coming quarters,” he said. Rigs targeting crude in the U.S. increased for a 19th straight week in the longest streak of gains since August 2011, the Baker Hughes data show. But while the number has more than doubled from last year’s low, to 722, the total rose by a meager two rigs last week. Drillers in Colorado led the growth. The nation’s busiest oil patch, the Permian Basin of west Texas and New Mexico, added just one, its smallest gain in more than a month.

- 9. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 9 NewBase Special Coverage News Agencies News Release 30 May 2017 Why nuclear could become the next ‘fossil’ fuel and Nuclear nations AFP + By Iain Wilson A gray dinosaur statue outside south Florida’s largest power plant is meant to symbolise two decommissioned fossil fuel reactors, but it also could be seen to represent a nuclear industry crumpling under mounting costs. Almost a decade ago, Turkey Point was aiming to become one of the country’s largest nuclear plants. Florida Power and Light had argued that such expansion was needed to maintain diverse energy sources and to supply Florida’s booming population for years to come, while touting nuclear as a clean form of energy. But now, just three reactors are in operation — one natural gas and two nuclear reactors, built in the 1970s. And plans to build two more nuclear reactors — first announced in 2009 — are essentially on hold for at least four years, according to filings with the state’s Public Service Commission. “Right now our only focus is on getting all the approvals we need,” company spokesman Peter Robbins told AFP. “We are not buying construction materials.” Earlier this year, the bankruptcy of Westinghouse, builder of the AP1000 reactor — the model scheduled for use at plants in South Carolina and Georgia as well as Turkey Point — rattled the industry. Both projects are now years behind schedule and billions of dollars over budget. “We are very closely monitoring the two new nuclear projects going on,” Robbins said. The Southern Alliance for Clean Energy estimates that construction on Turkey Point has been delayed until 2028 at the earliest, with costs expected to balloon to over $20bn. FPL has refused to publicly revise its projections at Turkey Point, for now. “We don’t think there is value in coming up with a new cost or schedule until those reactors are closer to completion,” Robbins said. The project has been controversial from the start, and casts the spotlight on wider concerns about nuclear power.

- 10. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 10 Critics have pointed to the rising seas from climate change, risks of storm surge, radioactive waste and threats to drinking water and wildlife at the site, nestled near Everglades National Park, as reasons to stop nuclear expansion. Complaints have also centred on the difficulty of evacuating the densely populated area around the plant in case of emergency. Miami-Dade County is home to 2.6mn people. “Investing tens of billions of dollars on a power plant that will be underwater one day, along with the highly radioactive waste it will produce, makes no sense,” said fishing captain Dan Kipnis, one of the activists who is fighting to stop the project. Legal challenges to the plant’s planned expansion began in 2010, and continued this month with a hearing before the Atomic Safety Board. Over the course of the two-day hearing, environmental scientists and lawyers wrangled over whether the porous limestone in Florida could really contain wastewater injected underground, without allowing toxic chemicals to seep upward into drinking water. Currently, Turkey’s Point’s two nuclear reactors use a series of cooling canals to treat wastewater. These canals were confirmed last year to be leaking into a nearby national park, after a radioactive isotope, tritium, was found at up to 215 times the normal levels in the waters of Biscayne Bay. The three-judge safety board panel is expected to rule by year’s end on whether an operating license should be granted by the Nuclear Regulatory Commission (NRC). Throughout Florida, FPL is expanding its solar installations, and is shuttering coal plants. Its energy mix is 70% natural gas, 17% nuclear, with the rest divided between solar, oil and coal. Meanwhile, the ever-dropping cost of natural gas is making nuclear less attractive every day, analysts say. “Most people think Turkey Point will never get built,” said Mark Cooper, senior research fellow at the Institute for Energy and the Environment, Vermont Law School, referring to FPL’s proposed two new nuclear reactors. “It turns out it was not the environmentalists, it was not the lawsuits,” Cooper told AFP. “They could not deliver a safe, economically viable product. They couldn’t do it in the ‘80s and they can’t do it today,” said Cooper. “Nuclear power is a technology whose time never came.”

- 11. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 11 The Nuclear nations Half the world seems to think the planet needs nuclear power more than ever. The other half seems just as sure that now’s the time to get rid of it forever. There’s never been a time when nuclear power wasn’t controversial, but the discussion has perhaps never been so polarized. It’s a collision between long-term concerns over global warming — which gives nuclear power appeal as a practical form of carbon-free energy — and anxieties heightened by three reactor meltdowns at the Fukushima plant in northern Japan in March 2011. Nowhere are the conflicts more evident than within Japan. Despite considerable public opposition, Japan began restarting nuclear facilities in 2015 after a hiatus of almost two years. As of mid-August 2016, three reactor units were online. The Situation The world’s 446 operating nuclear reactors produce about 11% of its electricity. Sixty-three more are under construction. In the UK, where almost a fifth of the electricity comes from nuclear power, the government has ambitious expansion plans, including a joint venture with China to construct the world’s most expensive atomic station.

- 12. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 12 Germany is headed in the opposite direction: Chancellor Angela Merkel wants to close all its nuclear plants by 2022. China, choked by air pollution, plans to expand nuclear operations and construction fourfold by 2020; India aims to supply 25% of its electricity from nuclear power by 2050. In late 2014, the Vermont Yankee Nuclear Power Station was shut down, the fourth US nuclear facility to close in two years. And PG&E Corp is proposing to shutter California’s only operating nuclear power plant in the next decade when licenses for its two units expire. Yet five new reactors may come on line in the US by 2020, according to the World Nuclear Association. Japan went nuclear-free in September 2013 — temporarily, and not entirely by choice. Within a year of the Fukushima disaster, all but two of Japan’s 42 commercial nuclear reactors had been shut down either because of damage from the 2011 earthquake and tsunami, or for maintenance or safety checks. The two remaining plants went offline in September 2013. While Japanese leaders pledged to promote renewable energy sources, its policy statements call nuclear power an important source of reliable energy for a nation that relies on imported fuels for 96% of its electricity-generating needs. The Background Nuclear pioneers after World War II envisioned an abundance of clean energy at low cost. Before reactor accidents released radiation at Three Mile Island in the US in 1979 and Chernobyl in the Soviet Union seven years later, the benefits seemed to outweigh the dangers. In recent years, nuclear power, which produces no greenhouse-gas emissions, seemed poised for a renaissance based on worries about climate change. The economic and environmental risk-reward ratios are moving targets. Horizontal drilling and hydraulic fracturing are squeezing torrents of oil and gas from shale rock, pushing down prices. That reduces nuclear power’s economic value but not its appeal to opponents of the new oil- production techniques. Renewables are a small though growing part of the energy picture. Germany’s government plans to get 80% of its electricity from sources like solar and wind by 2050, up from about a third in 2015. The Argument Proponents of nuclear energy say accidents like the Fukushima meltdown are rare, that reactors are getting safer, and that fossil fuels are responsible for more deaths, through mine accidents and pollution. Opponents say Fukushima shows that reactors can’t be made to withstand catastrophes. They also cite the cost and environmental risks involved in disposing of nuclear waste. Better, they say, to develop cleaner sources of energy such as solar and wind power. The question is whether renewables will be enough to head off extreme global warming or whether nuclear energy is no longer an option — but a necessity.

- 13. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 13 Tracking Progress: Nuclear power ( iea ) https://www.iea.org/etp/tracking2017/nuclearpower/ Nuclear power~ In 2016, nuclear power saw the highest capacity additions since 1990 (10 GW gross). New construction continued to fluctuate, with 3.2 GW commencing in 2016, down from 8.8 GW during the previous year, and averaging 8.5 GW over the past ten years. Capacity additions of 20 GW per year are needed to meet the 2DS targets. Recent trends Nuclear power accounts for approximately 11% of total electricity production and one-third of electricity from low-carbon sources. While the Paris Agreement is not technology specific, out of the 163 Intended Nationally Determined Contributions (INDCs) submitted by the end of 2016, only ten countries explicitly mentioned nuclear energy in their national strategies. These include countries with ambitious nuclear development programmes (China and India, for example). Premature closure of operational nuclear power plants (NPPs)1 remains a major threat to meeting 2DS targets. A number of reactors in the United States are in jeopardy of shutting down in liberalised markets dominated by low natural gas prices, with nuclear largely excluded from financial incentives to other low-carbon generation technologies. In 2016, a considerable part of French nuclear capacity was offline owing to safety reviews.2 Projected nuclear growth remains strongest in Asia, as China released a new five year plan to more than double its 2015 capacity to 58 GW (net) by 2020, with an additional 30 GW (net) under construction at that time. However, with 31.4 GW (net) in operation at the end of 2016 and 21.5 GW (net) under construction, China will likely miss that target by a year or two. Korea also projects considerable growth – from 23 GW in 2016 to 38 GW by 2029. The Russian Federation (Russia) reduced its projections during 2016, noting that the reductions were to better

- 14. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 14 align with reduced projections of electricity demand. In the United Kingdom, final approvals were given for the Hinkley Point C Contract for Difference after a government review of the entire project, and EDF Energy made the final investment decision in July 2016. Poland delayed a decision on its nuclear programme until mid-2017, citing the need to find a suitable financing model for the country, and Viet Nam abandoned plans to build two reactors due to lower electricity demand and the cost of nuclear technology compared with coal. In terms of technology, the majority of reactors under construction today are Generation III/III+ designs. The first APR1400 and VVER1200 (Novovoronezh 2 in Russia) were connected to the grid in 2016. Efforts to develop and deploy small modular reactor (SMR) designs continued, with Argentina’s CAREM reactor and Russia’s and China’s floating NPPs. In the United States, NuScale Power submitted the first-ever design certification application for an SMR to the US Nuclear Regulatory Commission. All of these SMRs are 100 megawatts electrical (MWe) or smaller. Tracking progress According to the most recent Red Book (NEA and IAEA, 2016), gross installed capacity is projected to be 402 GW to 535 GW by 2025; in the 2DS, global nuclear capacity would need to reach 529 GW by that time. Considering currently installed capacity of 413 GW and new capacity under construction of 66 GW, progress towards near-term targets has been positive. With another 20 GW of planned construction in the next three to four years, the remaining gap to the 2025 2DS target would be approximately 30 GW, which could be met if construction starts were sustained at the levels of 2009-10. However, retirements due to phase-out policies in some countries, long-term operation limitations in others or loss of competitiveness against other technologies could offset these gains. Up to 50 GW could be lost by 2025. Without action to address these reductions due to non-technical factors, the capacity will more likely be 70 GW to 90 GW short of the 2025 2DS target, unless annual grid connections double compared with the 2016 rate. Recommended actions Increasing nuclear capacity deployment could help bridge the 2DS gap and fulfil the recognised potential of nuclear energy to contribute significantly to global decarbonisation. This requires clear and consistent policy support for existing and new capacity, including clean energy incentive schemes for development of nuclear alongside other clean forms of energy. In addition, efforts are needed to reduce the investment risk due to uncertainties, such as licensing and siting processes that have clear requirements and that do not require significant capital expenditure prior to receiving a final approval or decision. Industry must take all actions possible to reduce construction and financing costs in order to maintain economic competitiveness.

- 15. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 15 NewBase For discussion or further details on the news below you may contact us on +971504822502, Dubai, UAE Your partner in Energy Services NewBase energy news is produced daily (Sunday to Thursday) and sponsored by Hawk Energy Service – Dubai, UAE. For additional free subscription emails please contact Hawk Energy Khaled Malallah Al Awadi, Energy Consultant MS & BS Mechanical Engineering (HON), USA Emarat member since 1990 ASME member since 1995 Hawk Energy member 2010 Mobile: +97150-4822502 khdmohd@hawkenergy.net khdmohd@hotmail.com Khaled Al Awadi is a UAE National with a total of 25 years of experience in the Oil & Gas sector. Currently working as Technical Affairs Specialist for Emirates General Petroleum Corp. “Emarat“ with external voluntary Energy consultation for the GCC area via Hawk Energy Service as a UAE operations base , Most of the experience were spent as the Gas Operations Manager in Emarat , responsible for Emarat Gas Pipeline Network Facility & gas compressor stations . Through the years, he has developed great experiences in the designing & constructing of gas pipelines, gas metering & regulating stations and in the engineering of supply routes. Many years were spent drafting, & compiling gas transportation, operation & maintenance agreements along with many MOUs for the local authorities. He has become a reference for many of the Oil & Gas Conferences held in the UAE and Energy program broadcasted internationally, via GCC leading satellite Channels. NewBase : For discussion or further details on the news above you may contact us on +971504822502 , Dubai , UAE NewBase May 2017 K. Al Awadi

- 16. Copyright © 2015 NewBase www.hawkenergy.net Edited by Khaled Al Awadi – Energy Consultant All rights reserved. No part of this publication may be reproduced, redistributed, or otherwise copied without the written permission of the authors. This includes internal distribution. All reasonable endeavours have been used to ensure the accuracy of the information contained in this publication. However, no warranty is given to the accuracy of its content. Page 16 Solar power is the key to renewable development in the GCC. Installed solar capacity is expected to reach 76 GW by 2020, representing massive opportunity for suppliers in the region. Co-located with The Big 5 Dubai, The Big 5 Solar launches this November 26 - 29th 2017. 20% of The Big 5 visitors in 2016 were looking for solar technologies making The Big 5 Solar an ideal platform to meet dedicated buyers, get inspired at the Global Solar Leader's Summit and open up to new markets.