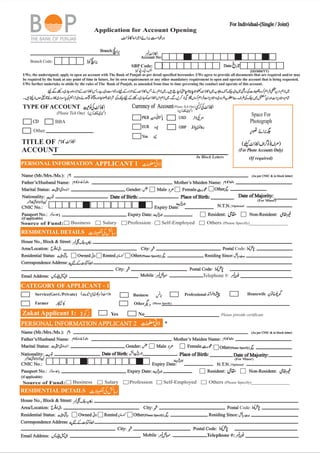

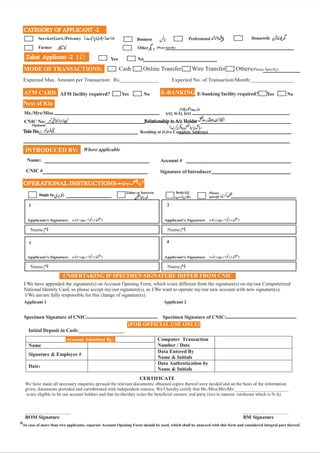

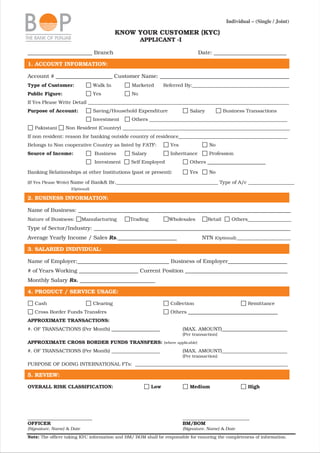

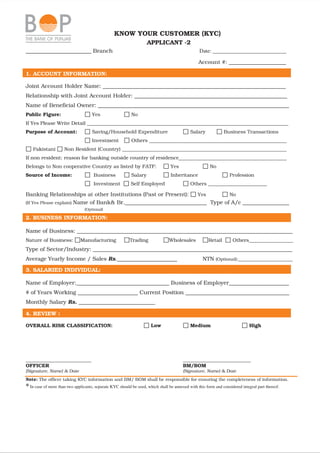

1. The document is an account opening form for individuals to open single or joint accounts at The Bank of Punjab. It collects personal information and requires signatures to agree to the terms and conditions.

2. The terms specify requirements for opening and operating the account such as submitting required documents and maintaining a minimum balance. It also outlines operational instructions regarding deposits, withdrawals, statements, and more.

3. The form provides for optional services like ATM cards and e-banking and collects information about expected transactions for account monitoring purposes.