Embed presentation

Download to read offline

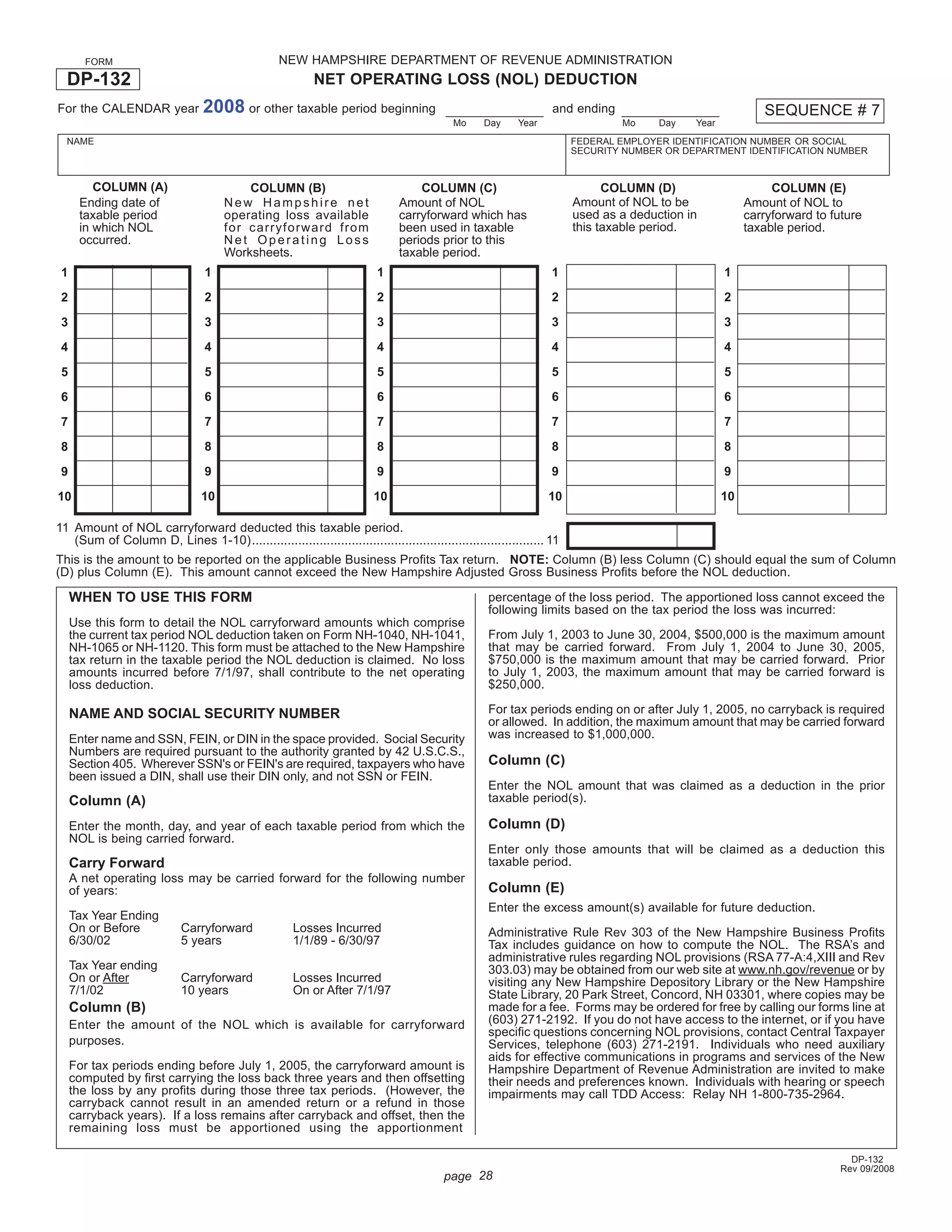

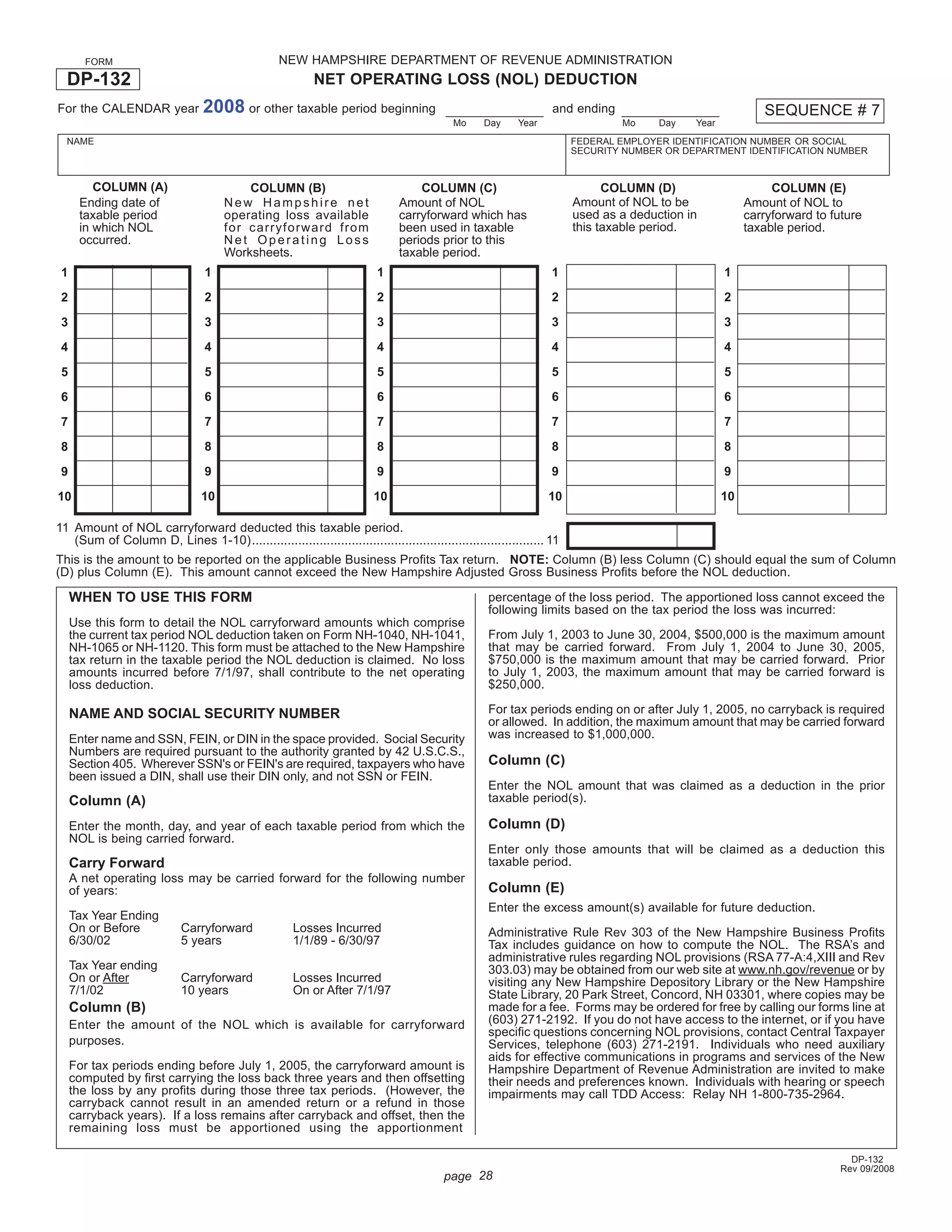

This document is a form from the New Hampshire Department of Revenue Administration for claiming a net operating loss (NOL) deduction. It provides instructions for taxpayers to detail NOL carryforward amounts being claimed as a deduction for the current tax period. The form has columns to enter the tax period the loss was incurred, the NOL available to carryforward, amounts already used in prior periods, amounts being used in the current period, and remaining amounts to carryforward to future periods.