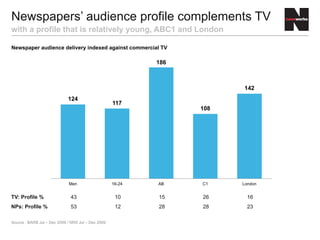

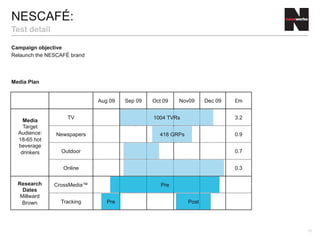

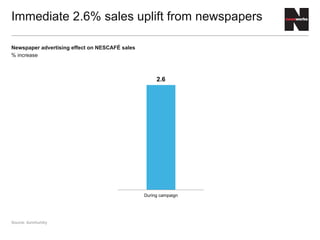

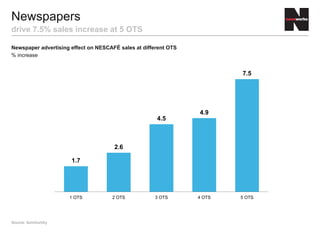

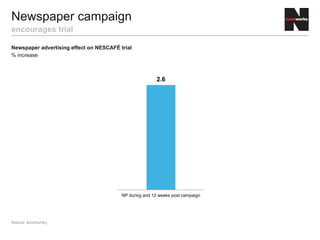

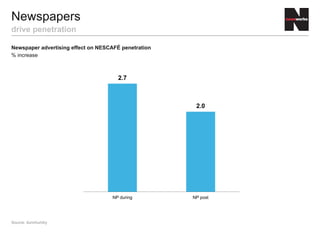

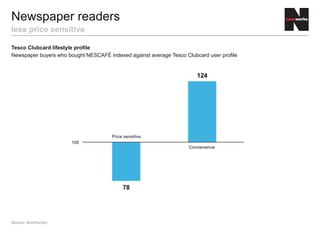

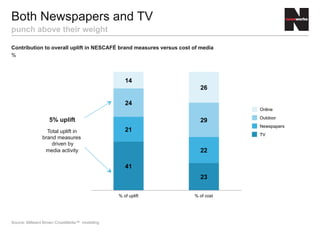

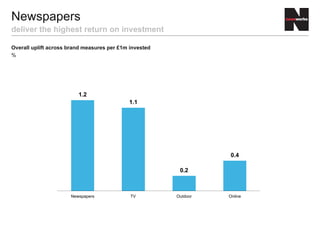

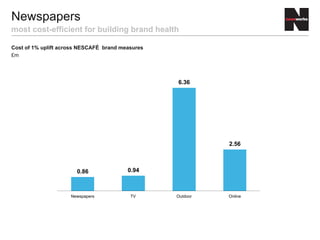

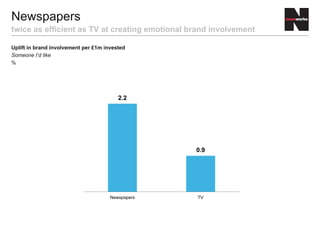

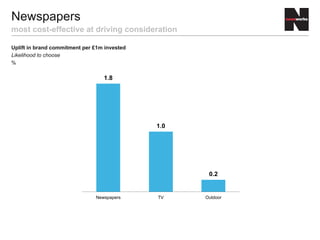

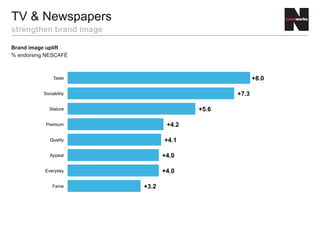

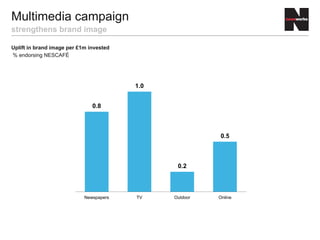

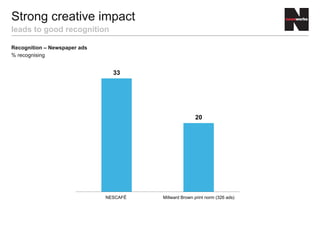

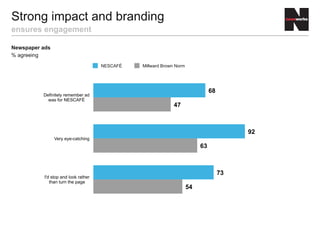

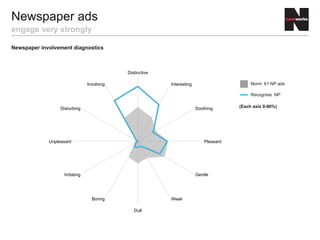

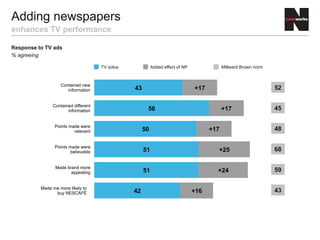

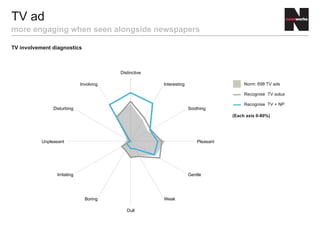

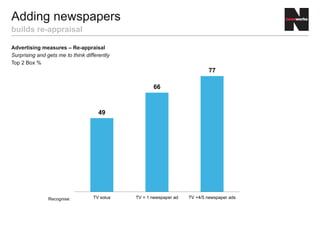

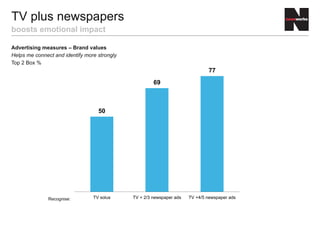

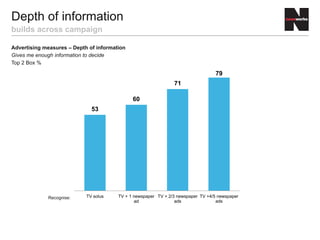

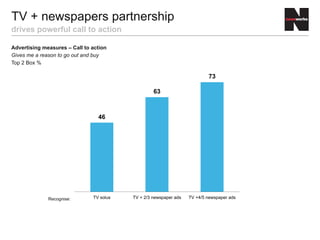

The document analyzes the effectiveness of newspaper advertising in Nescafé's multimedia campaign, highlighting its significant contribution to sales increases, brand engagement, and emotional involvement compared to TV advertising. It reveals that newspapers generated a sales uplift of 2.6%, rising to 7.5% with increased ad exposure, and were more cost-effective in enhancing brand metrics. The synergistic effect of combining newspaper ads with TV campaigns further strengthened Nescafé's brand image and resonance with consumers.