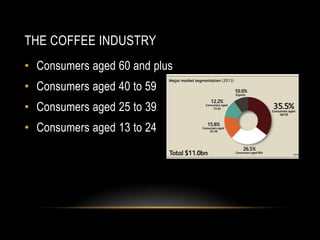

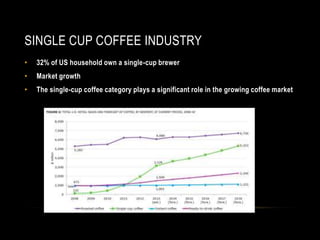

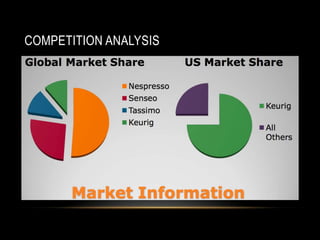

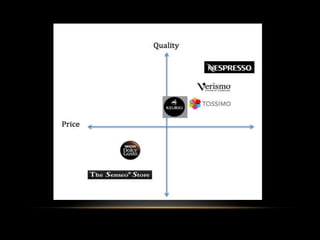

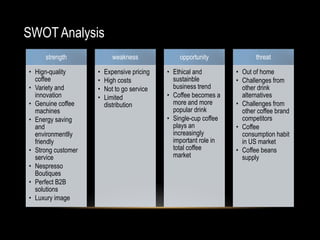

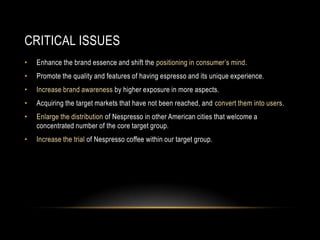

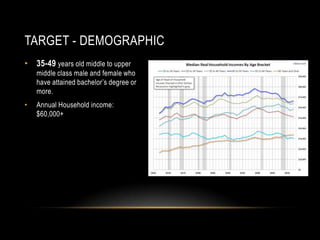

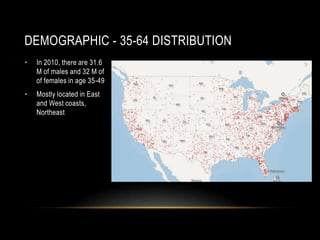

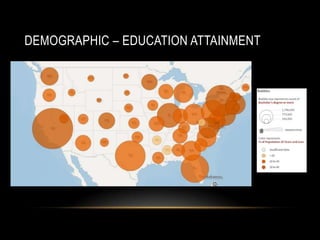

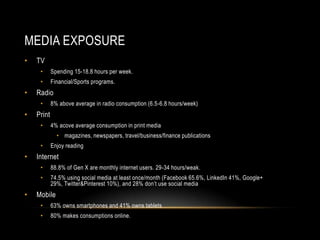

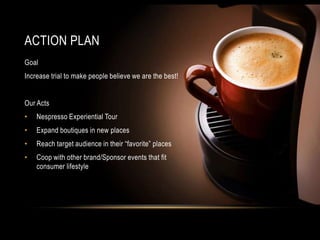

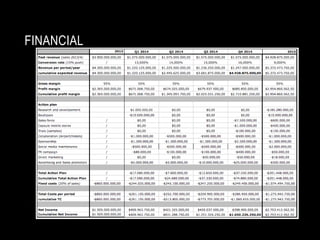

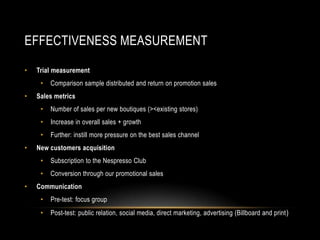

The document provides a comprehensive analysis of Nespresso's business strategy, market trends, and competitive landscape in the coffee industry. It highlights key demographics, marketing objectives, and critical issues the company faces, including brand positioning and consumer awareness. The action plan includes initiatives to increase product trials and expand market share from 7% to 12% by 2016 through targeted marketing efforts and new geographic market entries.