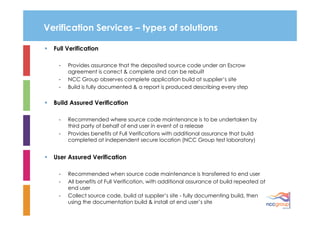

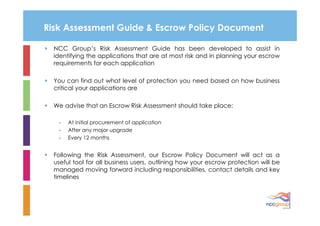

NCC Group is a leading independent IT assurance provider with over 30 years of experience providing escrow services. They protect over 5,000 software suppliers and have over 2,000 multi-licensee escrow agreements in place. Escrow provides a simple and effective way to minimize the risk of depending on third parties for business critical software and services by holding important materials like source code in escrow to ensure continued access and support. NCC Group offers various escrow and verification solutions tailored to different software licensing models and business needs.