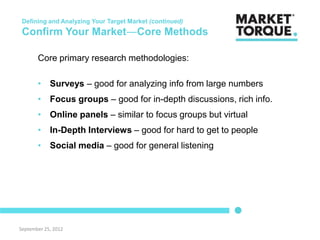

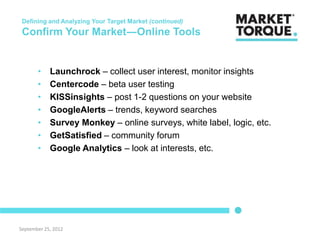

Emily Summers gave a presentation on market research in a data rich world. She discussed the importance of understanding competitors, analyzing the target market size and segments, and confirming customer interest through primary research methods like surveys and interviews. She provided tips on leveraging different research models and online tools to validate a product-market fit. Investors emphasized the importance of understanding market size and pain points. Conducting effective market research may require budgets of $5,000-20,000 depending on the scope and organization conducting the work.