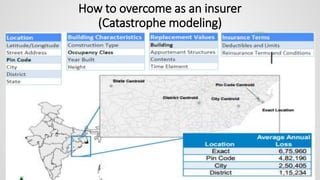

The document discusses the significant impact of natural catastrophes on insurance markets, particularly highlighting the substantial losses from disasters like hurricanes and earthquakes. It outlines challenges insurers face, such as inadequate resources to cover catastrophic losses, and emphasizes the role of reinsurance and catastrophe modeling in effective risk management. Moreover, it suggests collaborative efforts among governments, the industry, and society to create simpler insurance products and processes for improved future outcomes.