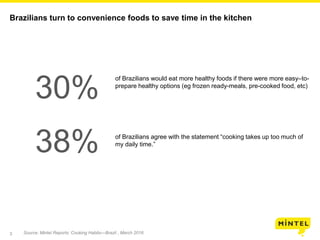

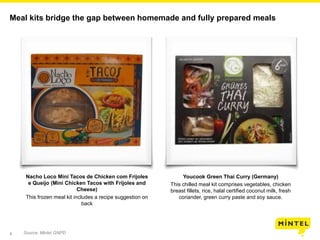

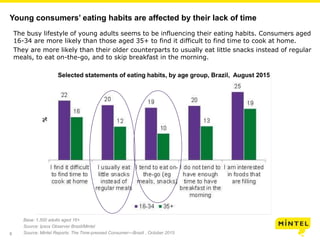

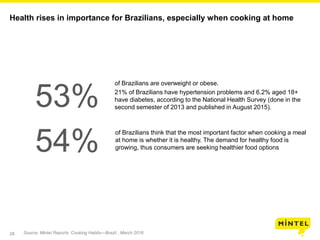

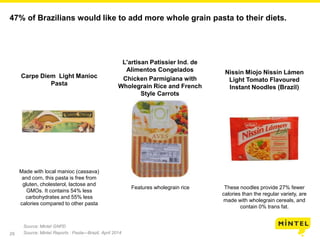

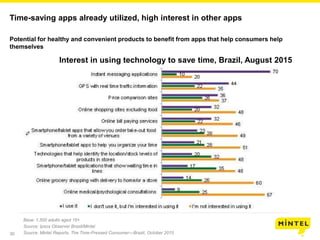

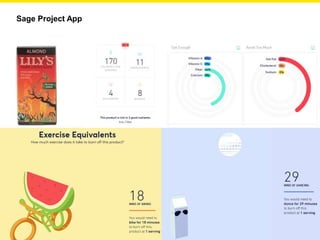

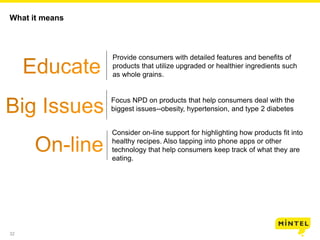

Brazilians are increasingly looking for convenient foods that save time in cooking while also being healthy options. Many consumers find that they have little time to cook at home due to busy lifestyles. There is demand for products that make cooking easier through streamlined preparation, ready-made meals, or meal kits. Snacking is also on the rise as traditional meal times decline. Many consumers are also trying to add more whole grains and proteins to their diets for health reasons like obesity, hypertension, and diabetes. Technologies like apps have potential to help consumers make healthier choices and track their eating.