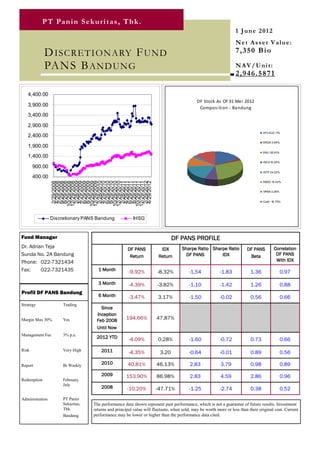

This document is a fund report from PT Panin Sekuritas Tbk that provides information on the Discretionary PANS Bandung fund as of June 1, 2012. The key details include:

- The fund's net asset value is Rp7,350 billion with a NAV per unit of Rp2,946.587.

- The top 5 holdings as of May 31, 2012 were Bank Lippo Tbk. (38.91%), Astra Agro Lestari Tbk. (22.11%), Indocement Tunggal Prakarsa Tbk. (10.20%), and Bank Negara Indonesia Tbk. (3.64%).

- The fund