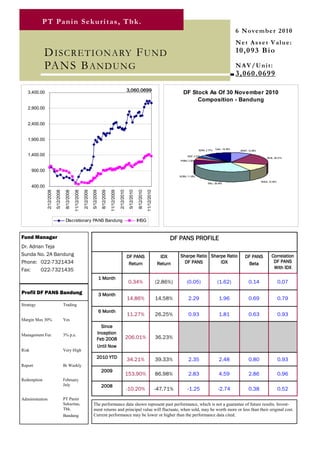

This document provides information on the Discretionary PANS Bandung fund as of November 30, 2010. It shows that the fund had a net asset value of Rp10,093 billion and NAV per unit of Rp3,060.0699. The largest holdings were in BNLI (38.49%), BKSL (26.01%), and BNGA (16.45%). The fund has outperformed the IDX stock market index since inception in February 2008, with a return of 206.01% compared to 36.23% for the IDX. The fund manager is Dr. Adrian Teja and it is administered by PT Panin Sekuritas, Tbk. in Bandung.