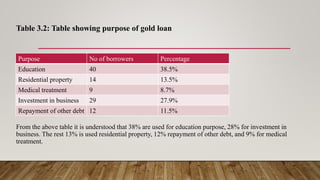

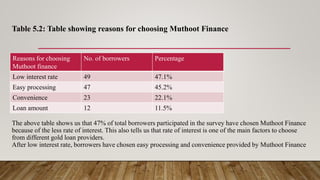

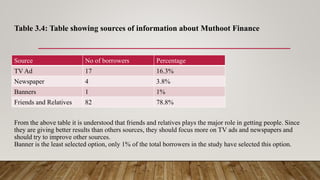

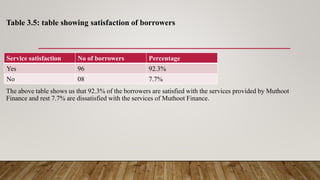

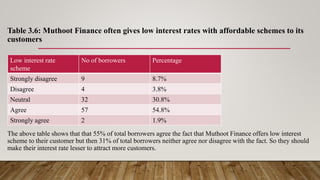

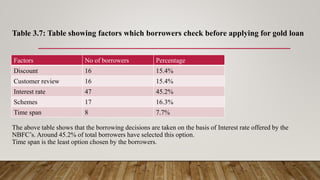

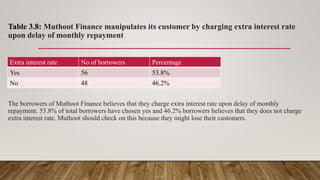

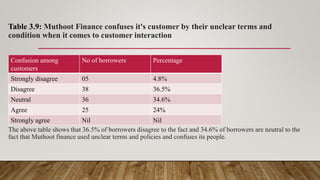

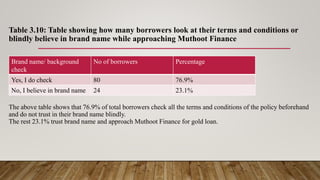

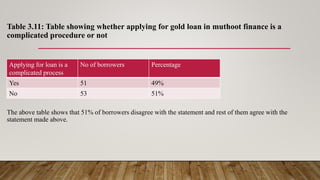

Muthoot Finance is the largest gold loan NBFC in India, founded in 1997 and headquartered in Kochi. It provides personal and business loans secured by gold as well as other services. The study surveyed 104 Muthoot Finance customers in Karnataka to understand factors influencing their choice of Muthoot. It found that customers chose Muthoot due to low interest rates and easy processing. Most borrowers used loans for education or business investment. Friends and relatives were the main source of information about Muthoot and customers reported overall satisfaction with Muthoot's services.