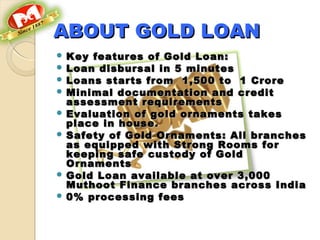

Muthoot Finance is an Indian NBFC that specializes in gold loans. It has over 3,000 branches across India. Some key services include:

- Gold loans with disbursal in 5 minutes and loans from ₹1,500 to ₹1 Crore

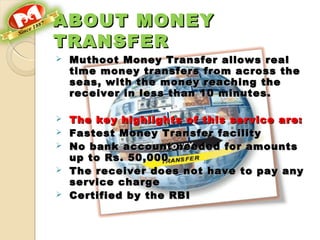

- Money transfer services allowing real-time money transfers within 10 minutes

- Foreign exchange services like buying/selling traveller's cheques and currency exchange

- Other financial services like insurance, share trading, and gold coins

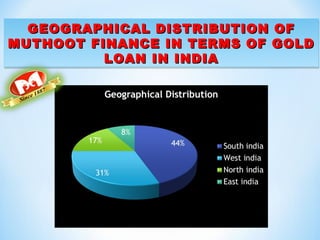

Muthoot Finance focuses primarily on gold loans, which constituted 98.5% of its revenues. It has had significant success in South India, where over 70% of its branches are located and gold