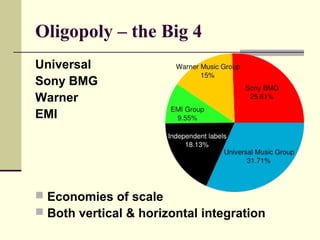

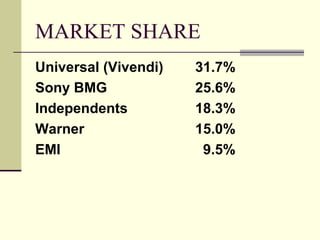

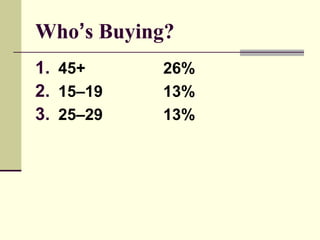

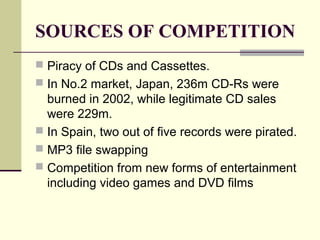

The music industry is dominated by four major record labels: Universal, Sony BMG, Warner, and EMI. These labels have significant market share and benefit from economies of scale and vertical/horizontal integration. Music sales have been declining steadily since 1999 as CD sales fall but digital track sales rise. Piracy and CD burning cost the industry an estimated $4 billion annually in lost revenue. The industry focuses heavily on promotion to influence charts and radio play. Record labels are tied to other conglomerate businesses like film studios to promote artists across different media.