Works contract provisions in maharashtra and MVAT Act

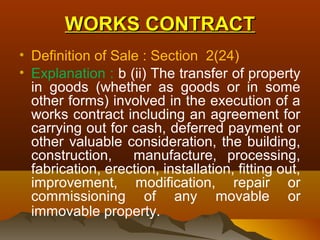

- 1. WORKS CONTRACT • Definition of Sale : Section 2(24) • Explanation : b (ii) The transfer of property in goods (whether as goods or in some other forms) involved in the execution of a works contract including an agreement for carrying out for cash, deferred payment or other valuable consideration, the building, construction, manufacture, processing, fabrication, erection, installation, fitting out, improvement, modification, repair or commissioning of any movable or immovable property.

- 2. EXAMPLES OF WORKS CONTRACTS • Composite contract for maintenance & service, repairs, improvements , alteration , amendment , mixing , blending, processing , servicing of any immoveable or moveable property. • Construction work like Building, road, dam, canals, jetty, treatment plants , etc.

- 3. METHODS OF COMPUTATION OF TAX • There are two methods for computation of tax liability in respect of Works Contract transaction. 1. Determination of sale price of goods (u/r 58): a) Actual Expenses b) Fixed Percentage (Table) 2. Composition u/s 42(3) & (3A): a) Construction or Non-construction contract b) Builder / Developer.

- 4. SALE PRICE OF GOODS USED IN W.C. u/r 58(1) ENTIRE VALUE OF CONTRACT LESS:- a)Labour & Service charges for the execution of works; b)Amounts paid by way of price for sub-contract, if any to sub- contractors; c) Charges for planning, designing, & architect`s fees;

- 5. d) Charges for obtaining on hire or otherwise, machinery & tools for the execution of the works contract; e) Cost of consumables such as water, electricity, fuel used in the execution of the contract, the property in which is not transferred in the course of execution of the works contract; f) Cost of establishment of the contractor to the extent to which it is relatable to supply of the said labour & services;

- 6. • g) other similar expenses relatable to the said supply of labour & services, where the labour and services are subsequent to the said transfer of property; • h) Profit earned by the contractor to the extent it is relatable to the supply of labour & services:

- 7. SALE PRICE OF GOODS: FIXED PERCENTAGE (Table U/R 58) • Where proper evaluation of such expenses [a to h of Rule 58(1)] is not possible, fixed percentage of deduction is prescribed from 15% to 40% • various activities enlisted in the table, e.g.Installation of Plant & Machinery – 15%, Painting – 20%, Pipeline – 20%, other works contracts-25%. • Either dealer or department may chose lump-sum deductions if books are not intelligible. • Construction contracts of flats: cost of land is also allowed as deduction. Ready reckoner rates on 1st Jan of the year in which the agreement to sell the flat is signed.

- 8. COMPOSITION METHOD U/S 42(3) & (3A) • 8% for all contracts up-to 20.06.2006. • 8% for All contracts except Construction contract. ( w.e.f. 21.06.2006) • 5% for notified construction contracts w.e.f. 21.6.2006, (Notifi- dt.- 30.11.2006), • 1% for construction of flats / buildings, etc. w.e.f. 01.04.2010. (Notifi dt.- 09.07.2010)

- 9. • Construction contracts are notified by Government vide notification no. VAT-1505/CR- 134/Taxation-1 DT.30.11.2006, • e.g. Buildings, Roads, Dams, Swimming Pool, Canals, Drainage, Jetty, etc.

- 10. On Going Works Contract (S -96) • Provisions of old Works Contract Act are applicable if works started prior to 1.4.2005 and continued thereafter. • Works Contracts started prior to VAT Act – If tax was paid under composition scheme under old Act before 01.04.2005 , then tax is payable at the same rate under VAT, if contract continues. • No set off is allowable for such ongoing contract.

- 11. SET OFF (ONLY FOR - RD) • Normal Method: U/R 58(1) = Full set off Subject to conditions U/R 55, 54, 53 & 52 • Composition : Tax @ 8% = 64% of set off [Rule – 53(4)] Tax @ 5% = 4% Reduction [Rule – 53(4)] Tax @ 1% = no set off (As per notification) • On Going Contracts : No set off is allowed for RD purchases.

- 12. ISSUE OF TAX INVOICE • The contractor who opts for Composition scheme can issue Tax invoice & recover tax @ 5% or 8% in the Tax invoice. • Composition Amount is included in the definition of Tax [2(29)]. • Subcontractor can issue Tax Invoice, collect tax, but no set off is allowed to the contractor in case of immovable property.

- 13. Interstate Works Contract • As per section 2(g)(ii) of CST Act, Interstate Works Contract is treated as sale. • Hon`ble Supreme Court decision, M/S Mahim Patram Private Ltd vs Union Of India & Others (6 VST 248) (sc) • Provisions of the State Act can be used for assessment under CST Act [Section 9(2)].

- 14. TDS • Deduction is to be made on the date of Payment or Credit. • Amount of TDS not to exceed amount of Tax Payable. • TDS is not applicable on amount of Tax. • NO TDS on subcontracts. • Payment of TDS - within 21 days from the expiry of the month of deduction • Interest @1.25% p.m. for late payment of TDS.

- 15. Rates of TDS • 2% TDS - Registered dealers / contractors. • 4% TDS – Unregistered Contractor (up to 30.04.2012) • 5% TDS – Unregistered Contractor (w.e.f. 01.05.2012)

- 16. EXEMPTION FROM TDS • If the aggregate amount payable to a dealer is less than Rs.5 lakh in a financial year, no tax at source is to be deducted. • If pure labour contract then no Tax is to be deducted. • JC (Adm) may issue a certificate in response to application of the dealer that the contract is not a Works contract then TDS is not required.

- 17. FORMS TO BE ISSUED BY PRINICIPAL CONTRACTOR • Certificate regarding payment by the principal Contractor -Form 406. • Declaration by Principal Contractor- Form - 409.

- 18. FORMS TO BE ISSUED BY SUB- CONTRACTOR • Certificate regarding payment by the subcontractor - Form 407. • Declaration by registered Sub- Contractor - Form 408.

- 19. Works Contract - Builders • The taxable event – Agreement to sale the flat before completion of the Building. • Period - 20.06.2006 to 31.03.2010 • Tax can be paid by way of : a. Composition (u/r 42 (3) @ 5%) b. Actual expense method [u/r 58(1) and 1A] c. Standard deduction method [u/r 58(1)]

- 20. Works Contract - Builders • Period : w.e.f. 01.04.2010 • Tax can be paid by way of : • a. composition (u/r 42 (3A) @ 1% • b. Actual expense method [u/r 58(1) / (1A)] • c. Standard deduction method (u/r 58) • d. composition u/s 42(3) • No set off is allowed if composition is opted u/s 42(3A).

- 21. IMPORTANT JUDGEMENTS • Builder’s Association (73 STC 370). States can not levy WCT on entire consideration, but only on valuable consideration received in respect of goods transferred. • Gannon Dunkerly (88 STC 204). Formula for calculating the value of the goods by deducting the various charges towards labour and services, etc . • N M Goel (72 STC 370). • Goods supplied by employer to contractor for valuable consideration is treated as transaction of sale.

- 22. IMPORTANT JUDGEMENTS • K. Raheja Case (141 STC 298) • works contracts include any type of agreement wherein the construction of a building took place for valuable consideration. • Mycon Construction (111 STC 322) • Validity of composition scheme is upheld. • Larsen & Tourbo Ltd. (17 VST 1) (SC) • There is only one sale, i.e. from subcontractor to employer and not multiple transactions.

- 23. IMPORTANT JUDGEMENTS • Silpi Construction (Kerala HC 2009) • Timber and plywood are not used in the same form but in other form . • Kone Elevators (140 STC 22) • Contract of erection and installation of lift is a contract of sale and not works contract. • Matushree Textile (132 STC 539) • Property in goods (colour shade) transferred while the process of dyeing of textiles. • L & T Limited V/s State of Karnataka (2009), Depreciation and other expenses are allowed as deduction.

- 24. IMPORTANT JUDGEMENTS • NCC SMS Unity JV (MSTT , SA No.-127 of 2010, dated 04/02/2012) • Composition method , once opted , can not be changed by revised return and pure profit of contractor is taxable under composition, if subcontractor opts for composition. • Nikhil Comforts (MSTT , SA No. 3 of 2010, dated 31/03/2012) • The amount of Service tax is treated as a part of sale price in case of composition. • DDQ- M/s. Sujata Painters, Dt. 20.01.2012 - Service Tax forms part of sale price and taxed accordingly.