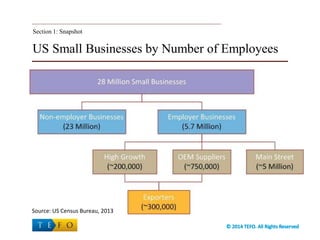

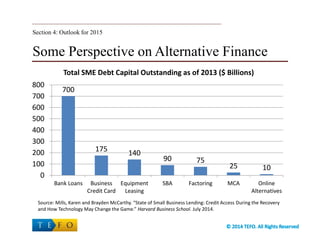

This document summarizes the current state of small and medium enterprise (SME) access to capital and emerging alternatives. It finds that while bank lending to SMEs has improved since the financial crisis, it remains below pre-crisis levels due to ongoing regulatory pressures and risk aversion. To fill the resulting credit gap, online alternative finance platforms like marketplace lenders, peer-to-peer lending, and crowdfunding have grown rapidly in recent years and are expected to continue strong growth in 2015. These alternatives provide lower-cost capital options for SMEs and attractive returns for investors.