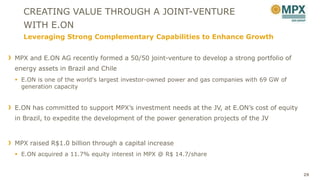

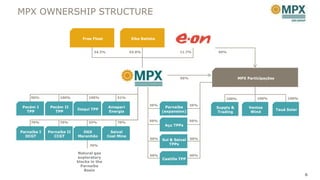

The document provides an overview of MPX Energia S.A. and its subsidiaries as a diversified energy company with exposure to Brazil's growing energy demand through its portfolio of tax-advantaged thermal power plants coming online in 2012 and attractive natural gas resources. MPX also has a joint venture with E.ON to develop its portfolio of energy assets and accelerate growth through E.ON's support. The presentation highlights MPX's proven track record and investment opportunities across its power generation, natural gas exploration and production, and renewable energy businesses.

![BRAZIL NEEDS NEW THERMAL CAPACITY TO

INCREASE SUPPLY RELIABILITY

Water storage capacity has stagnated, leading to decreased system autonomy

Storage Capacity (Southeast) Autonomy = [Storage Capacity / (Load – Thermal Generation)]

Actual

Reservoir

Autonomy:

~ 5 months

Storage

capacity

stagnation

2001: Energy

Deficit

(load reduction)

Storage Capacity (SIN):

Southeast = 69% Northeast = 19% New thermal plants are necessary to guarantee

South = 7% North = 5% a reliable power supply.

Source: ONS 11](https://image.slidesharecdn.com/mpxcorporatepresentationdezembro-121210074202-phpapp02/85/MPX-Corporate-Presentation-December-2012-11-320.jpg)