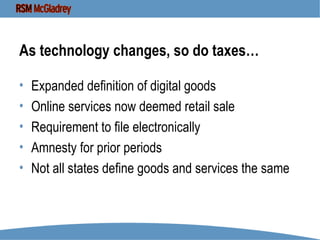

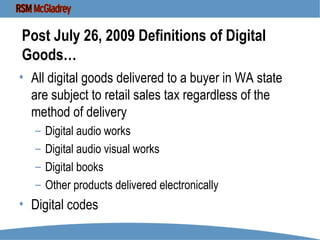

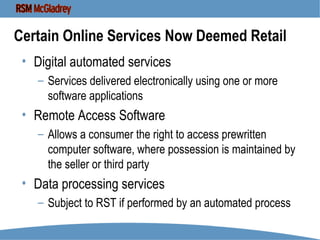

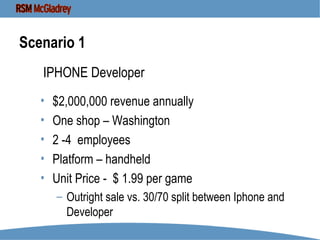

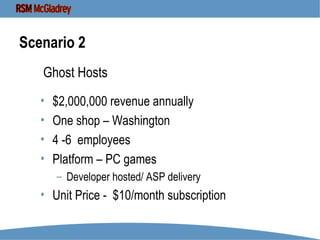

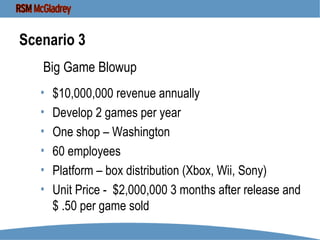

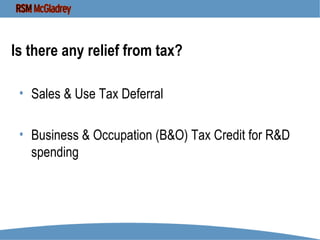

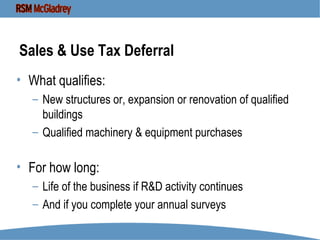

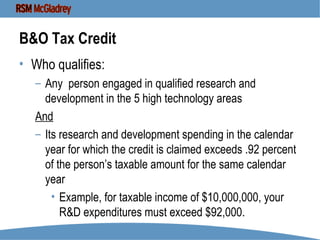

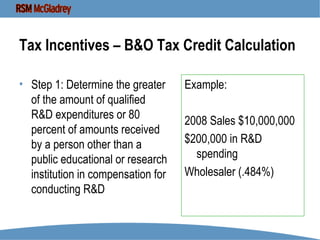

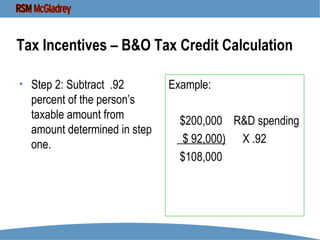

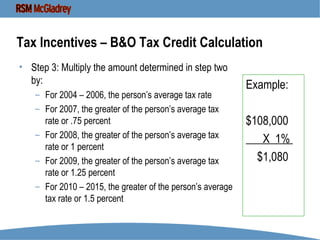

The document presents a tax help seminar for startups by Dan Wright and Nicole Wilson, covering Washington state business and occupation tax changes, and tax relief options. Key topics include founder and investor arrangements, documentation management, and tax implications of the digital goods economy. It also outlines tax incentives for research and development spending and provides illustrative revenue scenarios with tax relief options.