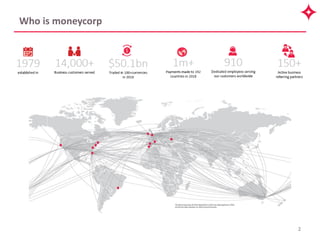

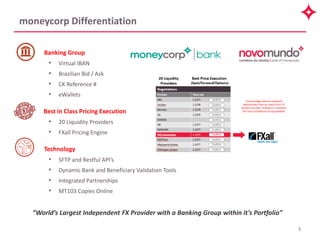

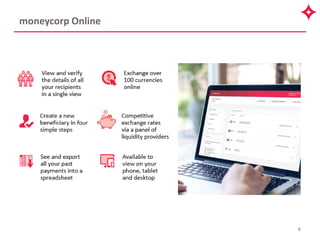

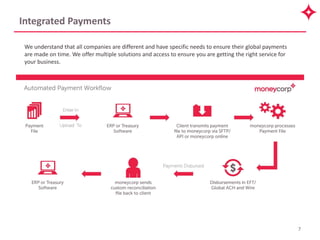

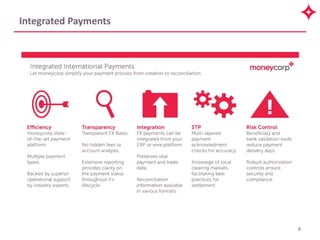

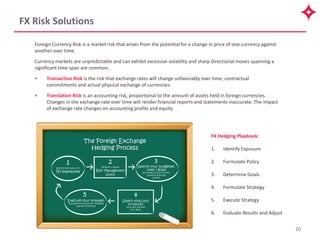

Moneycorp offers customizable foreign exchange services, positioning itself as the world's largest independent FX provider, catering to over 14,000 businesses with tailored global payment solutions. The document highlights the importance of FX risk management, outlining potential risks such as transaction and translation risks, and provides a hedging playbook for businesses to mitigate these risks. Various hedging instruments including forwards and options are discussed to help companies manage foreign currency exposure effectively.