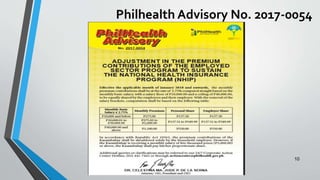

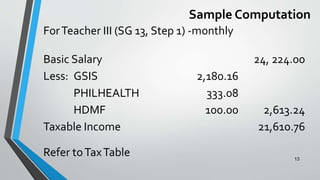

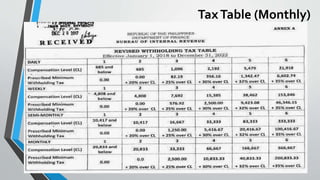

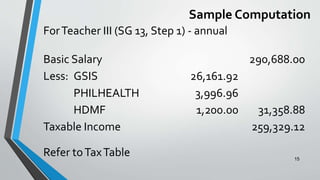

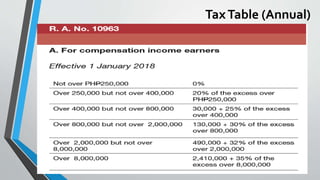

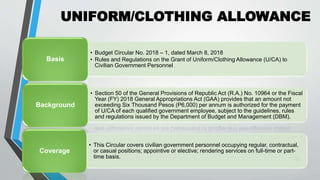

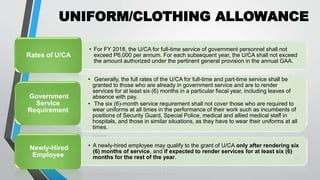

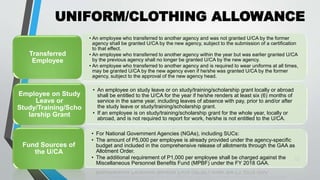

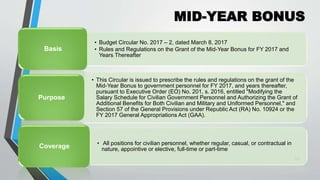

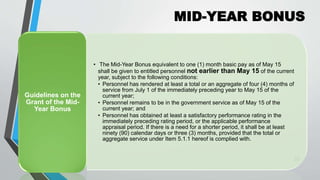

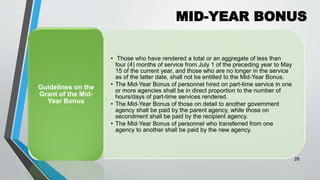

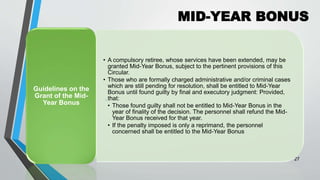

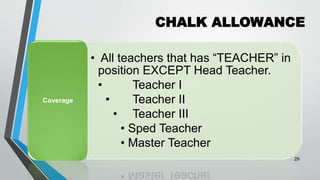

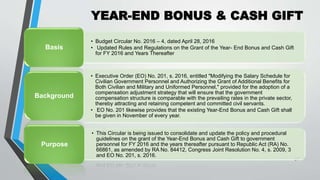

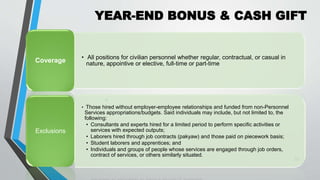

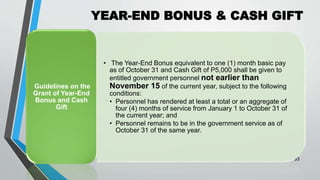

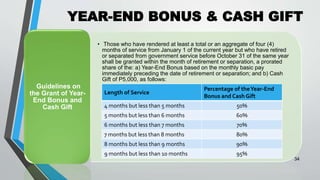

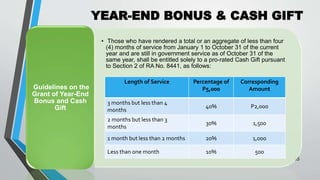

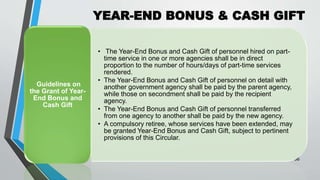

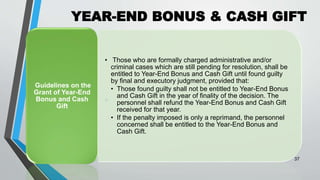

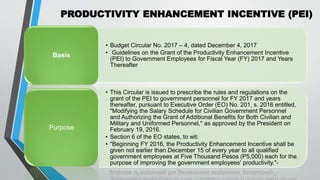

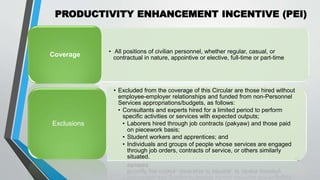

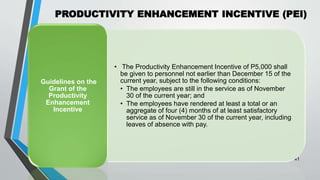

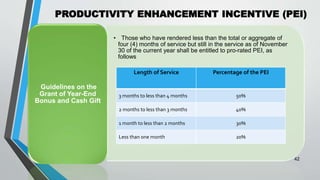

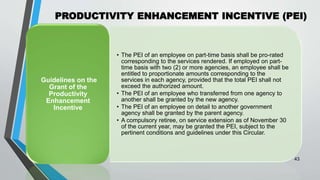

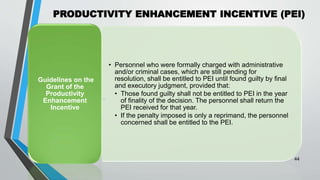

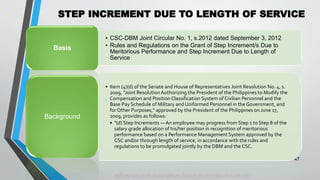

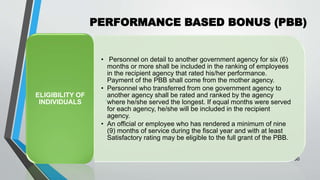

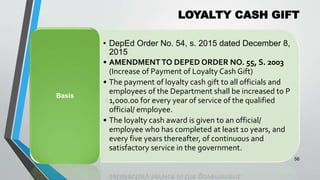

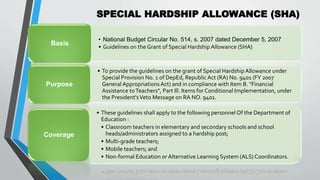

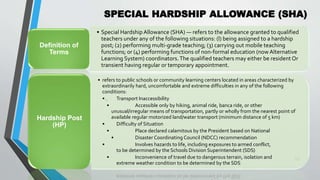

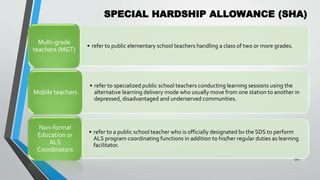

This document provides information about salary deductions and monetary benefits for public school teachers in the Philippines. It discusses mandatory salary deductions including GSIS, HDMF, PhilHealth, and tax withholdings. It also outlines several monetary benefits teachers receive such as uniforms/clothing allowance, mid-year bonus, year-end bonus and cash gift, and productivity incentive. Sample computations are provided to demonstrate how deductions are calculated from a teacher's monthly and annual salary.