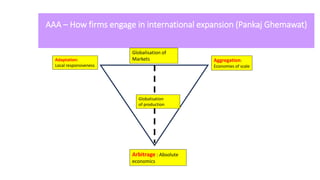

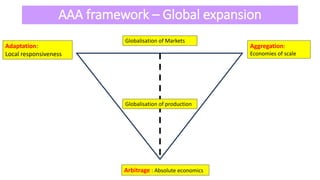

This document discusses strategies for managing differences in global expansion using the AAA framework of adaptation, aggregation, and arbitrage.

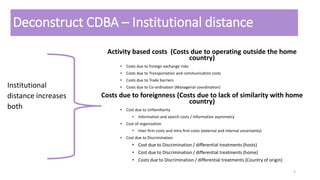

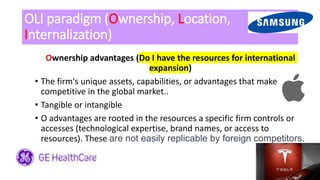

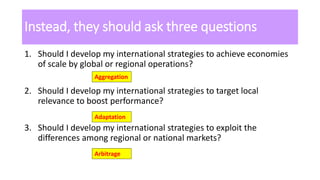

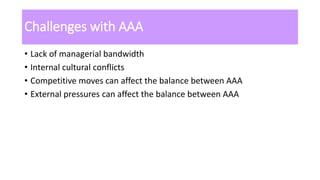

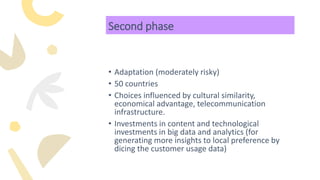

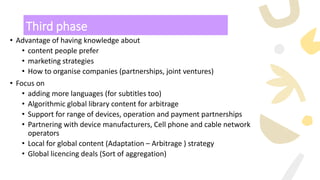

It explains that the central challenge for global managers is balancing local responsiveness through adaptation with global integration through aggregation. Firms must consider whether to pursue economies of scale through global or regional operations or boost local performance through adaptation. Managing differences across borders involves exploiting differences through arbitrage opportunities.

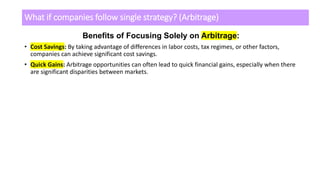

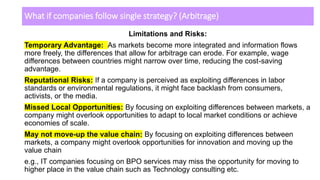

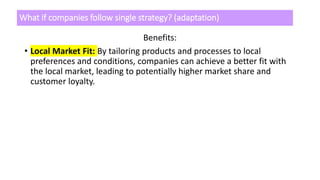

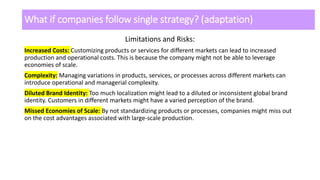

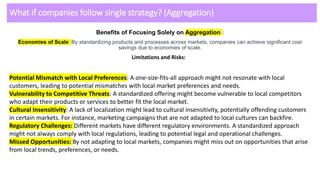

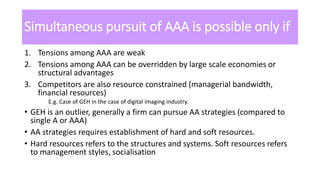

The document cautions against solely pursuing any single AAA strategy. Adaptation increases costs but improves local fit, while aggregation achieves scale but risks mismatches. Arbitrage provides quick gains but differences can erode over time. An effective strategy balances these factors based on the tensions between them in a given industry and competitive environment