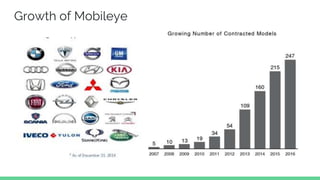

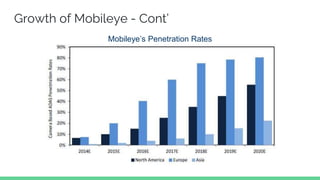

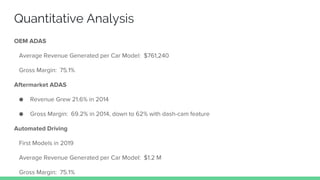

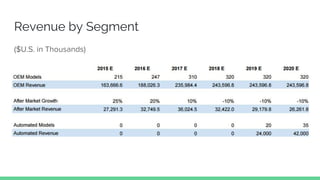

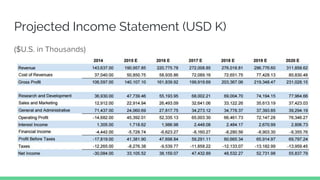

Mobileye is facing pressure from automakers to reduce prices for its advanced driver assistance systems technology. It must decide whether to lower prices and reduce margins or keep prices constant and risk losing market share. Mobileye is also choosing a partner to solidify its position in automated driving between companies like Google and automakers. The document recommends Mobileye partner with an automaker for branding, automated driving development, and aftermarket incentives to maintain market leadership through awareness campaigns and dashcam features while pursuing strategic partnerships. Financial projections estimate growing revenue and profits through the 2020s from ongoing OEM sales and new automated driving models.